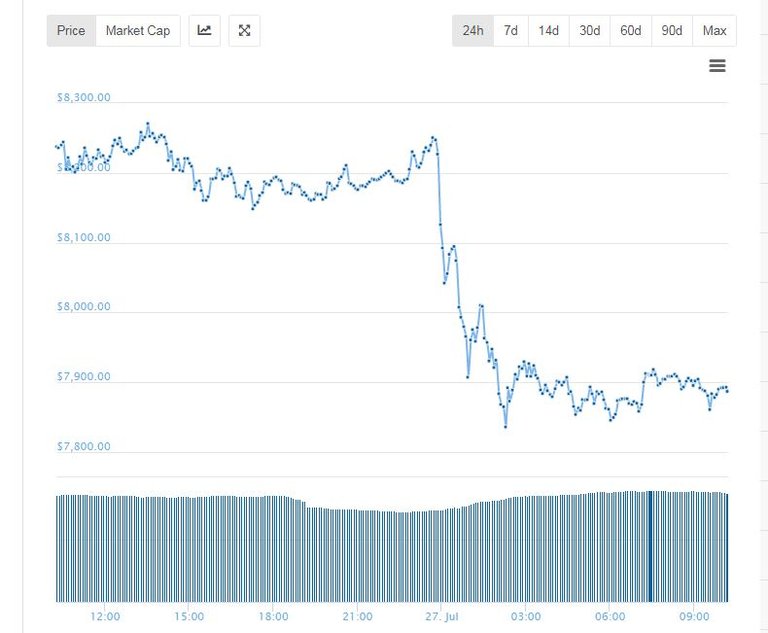

Bitcoin made a slight correction since Tuesday high of $8400 and stepped back to $8200 on Thursday afternoon. As predicted, we will most likely see a profit taking and a short retreat to a level below 8k before we try to cross the line once again (this time for good). BTC market cap is at $140b with a 24h trading volume of a little more than $3b as per information provided by Coingecko.

Majority of the market analysts agreed that last week run was mainly fueled by the East Asia investors. eToro analyst highlighted an increase in volume in both Japanese and Korean markets at the time of Bitcoin price surge above $8,000 with American trading volume staying relatively flat.

“For Clem Chambers, the CEO of ADVFN, the July 19 price BTC price surge was occasioned by wealthy Chinese scrambling to secure their money in Bitcoin in preparation for the impending currency devaluation. China’s continuing trade standoff with the United States and the decision to devalue its currency might enable the current price surge to hold.”>

Full article here: https://bitcoinist.com/bitcoin-price-surge-due-to-increased-trading-volume-in-asia-says-experts/

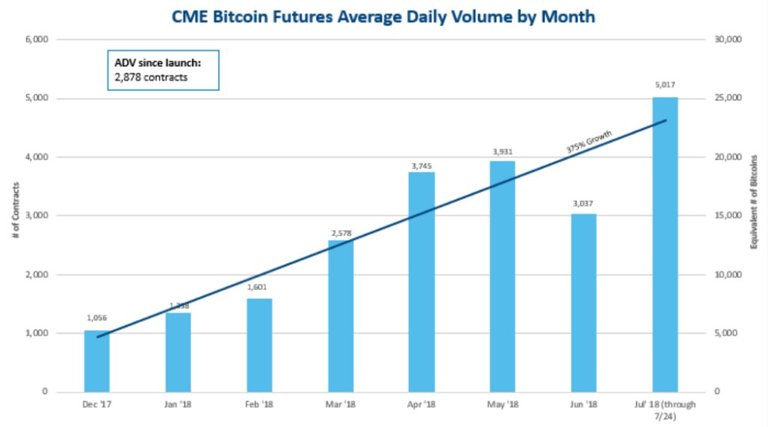

At the same time, however, Wall Street big guns did not sit on their hands. CME reported bitcoin futures hit record volume of 12,878 contracts on Tuesday, equivalent to 64,390 bitcoins with a notional value of $530M.

What I expect is for Bitcoin to retreat, then make another short run and stabilize around mid-$8400–8500 level and stay flat for some time. In the meantime, top 10 coins will slowly start to find their way up

Now this is how the BTC chart looks like on Friday morning. The biggest cryprocurrency is down 3.6% and dropped below 8k ($7900) just as expected.

Profit taking? Correct? Futures expiration? ETF rejected by the SEC? A lot of theories, no solid answers as always.

Truth is we always see big price movements around futures expiration date or last trade days for BTC futures.

Coincidence or not today the SEC rejected Winklevoss brothers ETF proposal…the problem here is not the rejection itself, but the reason — fear of manipulation in a market that is immature. Cryptourrencies are still not ready to join the global financial markets.

The rejection will most likely have a negative impact on the market in the short-term, at least until the SEC reviews the CBOE’s ETF proposal. And I do not agree a rejection today means rejection tomorrow.

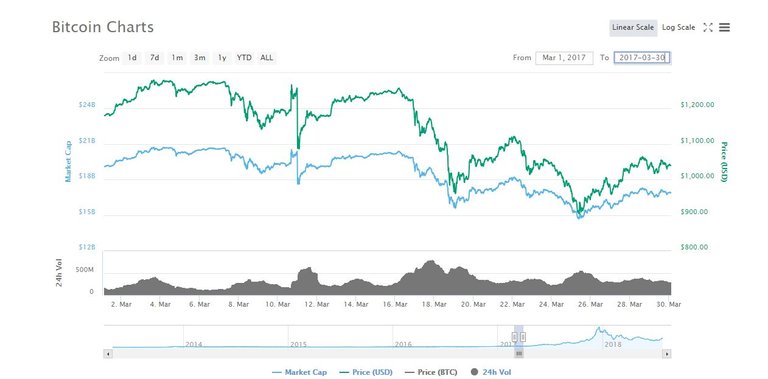

On the other hand, we had a similar situation last year when the first application for a Bitcoin ETF by the Winklevoss twins’ was rejected by the SEC in March 2017.

This graph shows BTC price during the month of March when the SEC rejected their ETF proposal on the 10th of March. Freefall started at $1249 and stopped at $909.

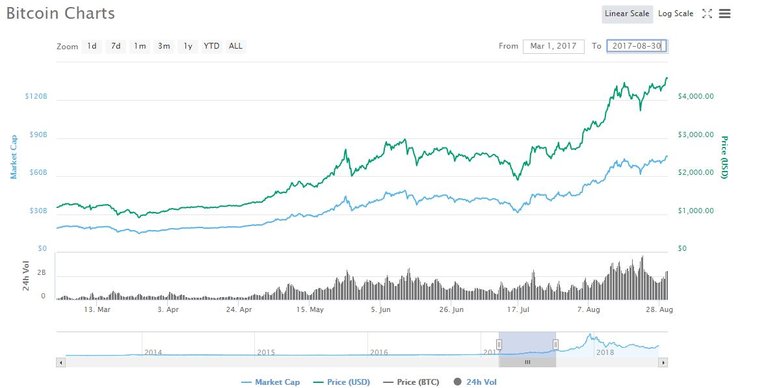

This is what happened in the next 5 months. BTC went up 500% from $909 to $4500…so let’s not be drama queens and continue with our game.

Bitcoin found its short-term bottom at $7800 on Friday before jumping back above 8k. Price is now well stabilized at $8100. I expect a drop in trading volumes and ranging for few days. The consolidation will allow the leading cryptocurrency to prepare for another attack on the $8400 line. BTC is up 11.3% for the week (there is still one day to go though), while altcoins are still struggling to find their way. Almost all of the top 10 coins (except for Dash) are green since Sunday with Stellar leading the pack.

Future Blockchain

https://medium.com/@futurebchain

Twitter: https://twitter.com/FutureBchain

Telegram: t.me/Future_blockchain

Facebook: https://www.facebook.com/cryptofuturenews/

Steemit: https://steemit.com/@tst643

You can also follow me on http://blockdelta.io