Bitcoin to hit $6,000?

A number of reasons have pushed bitcoin to record highs, such as legalization of the currency in Japan for payments, boosted interest from Korea, as well as the conclusion of a debate about the future of the cryptocurrency.

Fifty-six companies around the world and 83 percent of bitcoin miners supported the "Bitcoin Scaling Agreement," according to the Digital Currency Group. The document lays out an upgrade that should increase bitcoin's transaction capacity.

Because of these factors, Aurelien Menant, CEO of Gatecoin, a regulated crytocurrency exchange, said bitcoin could hit $6,000, revising a forecast from earlier in the year of $3,000.

"There is a lot of fresh liquidity flowing into bitcoin, thanks to a surge in interest among investors in Asia, notably Japan and Korea, coupled with a resolution to the scaling debate. I would not be surprised to see the bitcoin price doubling again to around $6000 by the end of the year," Menant said.

https://www.cnbc.com/2017/05/25/bitcoin-price-correction-record-high.html

A legitimate bitcoin price forecast for 2017

We believe that a combination of price analysis and fundamental analysis is the most appropriate way to come up with a legitimate bitcoin forecast.

Fundamentally, the bitcoin usage data look great: usage of bitcoins keeps on increasing, and that is exactly what it fundamentally is all about. Because of the fact that bitcoin is a form of money, the widening acceptance of bitcoin is the most fundamental data point to consider.

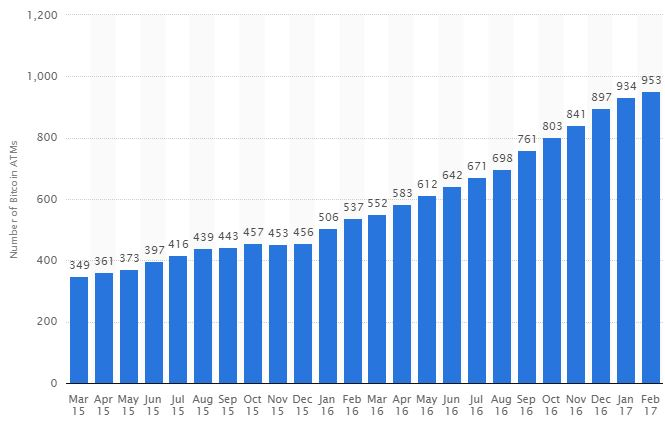

According to Statista, bitcoin usage keeps on growing as seen by the number of Bitcoin ATMs which increased from 538 in January 2016 to 838 by November. Most Bitcoin ATMs, as of July 2016, were located in the United States (345) and Canada (108). The Bitcoin ATMs located in Europe as of June 2016 constituted 24.02 percent of the global ATM market share.

A Bitcoin Price Forecast For 2017 Taki Tsaklanos 3 months ago Tags: 2017 Forecasts, BTC

(Ed note: end of May update on our Bitcoin price forecast at the bottom of this article.)

Several readers requested us to provide our bitcoin price forecast for 2017.

Bitcoin is a totally different asset type. Traditional analysis methods do not applying when trying to forecast the price of bitcoin. That’s why we apply a more fundamental approach in this article in order to come up with a bitcoin price forecast for 2017.

How not to forecast the future price of bitcoin

Most readers would turn to the cryptocurrency blogosphere where they will read ultra bullish bitcoin price forecasts for 2017 similar to this one from Coindesk. The issue with this approach is that those sites only feature bitcoin enthusiasts and entrepreneurs, so they offer a very biased view.

Another great option would be to use prediction markets such as the one that KoCurrency offers. They offer a bitcoin price prediction channel where predictions are output based on the inputs of the smartest members of the crowd. Their predictions model is very interesting (they use a proof based model which aims to solve the “biased view” problem mentioned above), However, they are very early stage so they need more data pouring into their platform before they can offer reliable predictions. I encourage you to sign up for their platform, so maybe we could all use this as a reliable predictions tool in the future.

Traditional financial media, on the other hand, have their classic story telling format. That is not a useful approach neither for investors. For instance, CNBC looked at the ongoing stream of articles that compare bitcoin with gold, and concluded that “the comparison is perhaps a positive signal that bitcoin is being commoditized. But bitcoin is not a commodity, while gold has been a commodity for thousands of years.” That obviously does not tell anything about the future price of bitcoin.

Fortune.com explained how demand for safe haven assets have fallen since the elections “on a stronger dollar, signs of future interest rate hikes, and potentially business-friendly policies that may arise from the Trump administration. Those potential regulatory changes would raise the chances of higher-yielding stocks.” That also is not useful as input for a bitcoin price forecast.

The most interesting headline comes from CNBC: “Bitcoin predicted to rise 165% to $2,000 in 2017 driven by Trump’s spending binge and dollar rally.”

There is obviously no correlation between the bitcoin price and the dollar or any other regular asset. Large investors simply don’t pull money out of currencies, stocks or gold in order to buy bitcoins.

A legitimate bitcoin price forecast for 2017

We believe that a combination of price analysis and fundamental analysis is the most appropriate way to come up with a legitimate bitcoin forecast.

Fundamentally, the bitcoin usage data look great: usage of bitcoins keeps on increasing, and that is exactly what it fundamentally is all about. Because of the fact that bitcoin is a form of money, the widening acceptance of bitcoin is the most fundamental data point to consider.

According to Statista, bitcoin usage keeps on growing as seen by the number of Bitcoin ATMs which increased from 538 in January 2016 to 838 by November. Most Bitcoin ATMs, as of July 2016, were located in the United States (345) and Canada (108). The Bitcoin ATMs located in Europe as of June 2016 constituted 24.02 percent of the global ATM market share.

Moreover, several bitcoin charts confirm a growing usage and acceptance:

Bitcoins in circulation rose 10% in last 12 months

Trading volume on major bitcoin exchanges is structurally higher in last 12 months

The average number of transactions per block is structurally higher in last 12 months

Last but not least, this research paper on bitoin’s big picture trends identifies 3 marked regimes that have evolved as the Bitcoin economy has grown and matured: from an early prototype stage; to a second growth stage populated in large part with “sin” enterprise (i.e., gambling, black markets); to a third stage marked by a sharp progression away from “sin” and toward legitimate enterprises.

In other words, fundamentally, the picture for bitcoin looks very good. This is not only a market for speculators anymore, but one of real users.

We are confident, based on the objective data set outlined above, that bitcoin’s price rise is not only legitimate, but will continue. That results in a bullish bitcoin price forecast for 2017 and beyond.

From a bitcoin price analysis point of view, the long term chart looks very constructive. Readers should compare the steep rally in 2013 with the steady and solid rise in the last 2 years. As the price of bitcoin took out all-time highs, it suggests it has much more upside potential.

The only ‘negative’ is that the price rise has accelerated in recent weeks. Investors want to see a steady rise, not a parabolic rise. So we hope there will be a healthy correction sooner rather than later, to cool off emotions.

(Update end of May: A revised bitcoin price forecast for 2017)

As our initial price target of $2000 was met already several weeks ago readers urged us to come up with a revised bitcoin price forecast.

That is not an easy challenge. Given the steep rise of Ethereum in recent months we start senseing that Ethereum will gain ground against Bitcoin. That does not mean that Bitcoin will crash, it merely means that the steep rise in Bitcoin could become a slower rise, and, potentially, consolidation in a wide range.

We are cautious with a new Bitcoin price forecast. Cryptocurrencies that have instrinic value will continue to rise, without any doubt, but we believe that Bitcoin will remain range bound between $2000 and $3000 in 2017. However, the price of Ethereum is set to rise sharply according to our Ethereum price forecast for 2017.

This article originally appeared on InvestingHaven.com

damn 6000

i will follow your account to see how are you doing;) please follow me

Will do

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://seekingalpha.com/article/4052261-bitcoin-price-target-2017