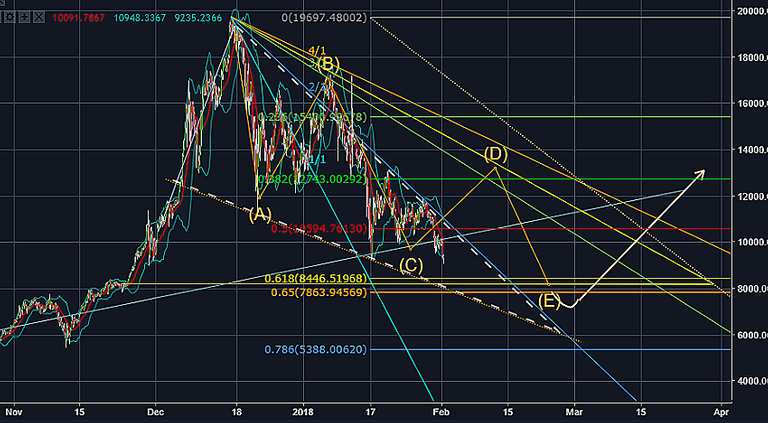

Here's my take, and it has been unchanged and so far correct since 10 days - it's frivolous to just use Elliott Waves in a situation like this, I haven't even bothered to adapt the ABCDE.

The lowest wave is missing out one it seems, and now we're having a small bounce... not for long.

Because.

It has been clear since awhile that we have a bear market with lots of new and fearful investors, and we can only break out once certain requirements have been met - most importantly, institutions are waiting to buy at below 8k, they have been stating this for months but nobody listened... so the FUD keeps coming and nobody wants to buy.

Look at the momentary triangle (dotted lines, the upper one corresponds with the 2/1 blue line of the Gann Fan), and where they meet the Fibonacci golden pocket, it happens to be at the $8000 resistance line.

Institutional investors cannot overlook this, and they will be using it - they may be pushing further down to 7600 or even 6000, but not for long, no reason to be afraid of that at all - it will be 'healthy' but all the guys who have their stop losses below 8000 will be forced to sell, as institutions will need much volume to buy... never trade against them.

Once they are done with this sorry business, they will want to see the market go up again of course...so the way I see it, the faster Bitcoin drops a bit below 8k, the better.

There's a trillion dollars on the sidelines waiting for btc to dip below 8k. I predict the fastest growing market cap ever seen.