There are couple FB groups where one can find really valuable information and professionals from all aspects of business, trading and consulting. One post really grabbed my attention:

“hope this isn't one too many but lots of good stuff here to discuss!

When: March 11, 2000 to October 9, 2002

Where: Silicon Valley (for the most part)

Percentage Lost From Peak to Bottom: The Nasdaq Composite lost 78% of its value as it fell from 5046.86 to 1114.11.

Synopsis: Decades before the word "dotcom" slipped past our lips as the answer to all of our problems, the internet was created by the U.S. military, who vastly underestimated how much people would want to be online. Commercially the internet started to catch on in 1995 with an estimated 18 million users. The rise in usage meant an untapped market--an international market. Soon, speculators were barely able to control their excitement over the "new economy”

Interesting, right? He then proceeded to explain his point of view in comments and it is a lot for this article but one article pulled me in thoughts about basic working principles of business in general, not just Crypto:

“In hindsight, the dotcom era was a textbook example of a bubble, with excessive optimism, high valuations and growth rates extrapolated out for years on companies with no sales.”

Complex systems and how they work in business was big part of my education so this was my reply:

“My first question, better yet, something I am not clear with is how much this new technology is relatable to old ones. When talking specifically about dot.com bubble it was new paradigm so different from anything else that it took some time for people to actually realize that they can now write and read on and from screen. This new technology is revolutionary but it is not new paradigm in terms of how it relates to existing condition. Computers were long way from type writers but blockchain is glued to successful effects of dot.com era. Problem with current technology is technical, scalability, and when that is solved it will become available to everyone because it will blend seamlessly with computers and handhelds. To say that no new value has been created and that is all based on hype is an understatement in my opinion. Value is already out there, all this new technology is doing is decentralizing use of that value and making it truly democratic. BTC is just first of many and is gold standard of the future for crypto currency world. Will it become obsolete like gold standard in modern economy, it remains to be seen. But altcoins are too many and to varied to be so easily put and say what is going to happen. Crypto is not new paradigm, but it is revolutionary use of old and successful one, meaning that is becoming what was thought Internet would achieve (freedom and world democracy) but it was built and still is on servers and centralized providers of services. I agree, it is wild west out there and bad idea is bad idea regardless of it being offered in IPO or ICO. When something is new, hype gets up and bubbles appear. But history has shown (as we were so eloquently reminded by Scott Scheenk) that nothing can stop good idea which time has come. Dot.com bubble left us with internet, we`ll see what we will receive with Blockchain and ICO bubbles but if you look at darkest days of previous financial crises, not everybody lost. Except for those who manipulated the markets, there were people who saw the bad weather through and made successful companies whose products and services we use every day. And that is both hope and warning. For me at least.”

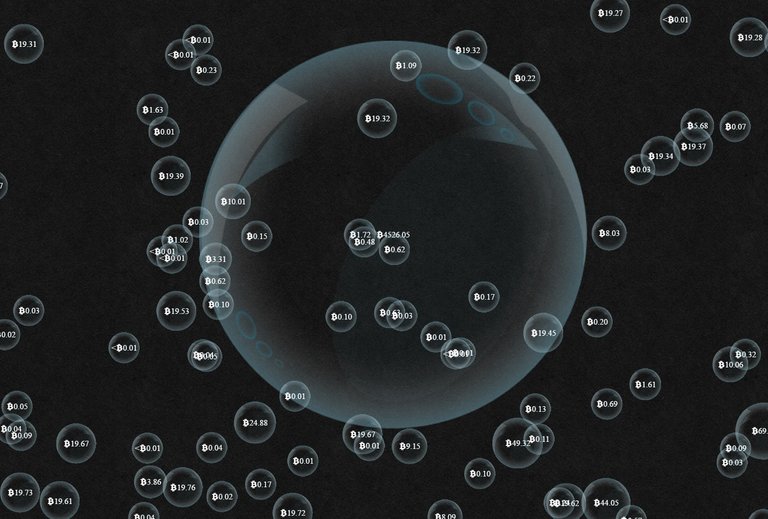

To conclude and to wrap this up, when looking at ICO boom from this year, it is riding on wave of excessive optimism but also on pure potential of Blockchain Technology. ICOs are nothing more, in this shape and form, than start-ups. And as with all start-ups, some time has to pass before first results are seen. I think that next year total market cap will have at least one more zero in it. Could be more even. Some big projects will have first results next year and awareness of this technology could grow exponentially. Just this summer it grew from 80 bln to 160 bln (cca 140 bln currently). It is chain event waiting to happen. When I look at history of great ideas which time has come, it is apparent to me. Is Bitcoin a bubble? It could be, but like that picture paints it so well – if it is, there are a lot of them, varied in size and spread, different proportions. That means that they should behave differently.

Credit where credit`s due.

Professional trader is Scott Schink who is working hard to transfer his Forex knowledge to crypto newcomers so that they would know how to “protect their capital” and thrive. For this whole discussion and much more of Scott and his expertise, apply for Crypto Live FB group ( https://www.facebook.com/groups/CryptoLive/ ). It is very well run and quality members have set up roots there and call it home.

Image used is from BitListen site. There you can see real time BTC transactions in shape of bubbles. Very fitting for this whole story and article.

Link: http://www.bitlisten.com/

EDIT:

For more in-depth approach, this is great article. Thx @Lubo Remenar from Cryptocurrency Collective for this input.

https://www.forbes.com/sites/wwoo/2017/09/29/is-bitcoin-in-a-bubble-check-the-nvt-ratio/#2643ccf16a23