Gm legends of Hive!

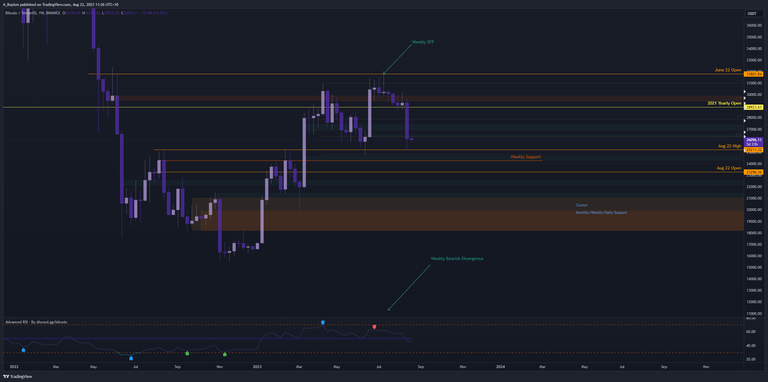

Last Friday we finally saw a reaction from the HTF signals, Monthly SFP at Monthly/Weekly Resistance and a Weekly bearish divergence on the RSI. It seemed like only a matter of time before we corrected to the down side but apparently not obvious enough since we saw the largest liquidation event event since the FTX collapse.

Starting with the monthly SFP that tagged the June 22 open, wicking just above and closing back below the weekly OB (orange).

That Weekly OB has been the major hurdle since we first failed to close above it in April, so when we closed back below it in July as an SFP it seemed logical that bulls were not able to break it as resistance and therefor a larger correction was likely, you can also see on the weekly chart that the move up on the Blackrock ETF news, whilst strong, was a much smaller move up than previous expansions in January and March. Suggesting a slowing rally, noteworthy is the lack of volume also.

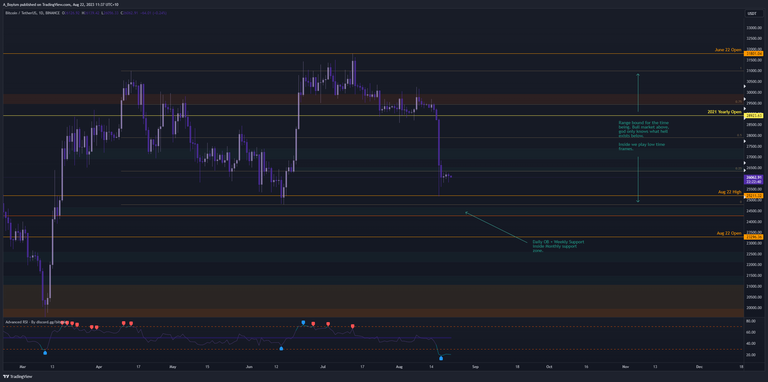

There is a pool of liquidity below June's low that isn't that far away and this lines up with Daily and Weekly support levels and the area/zone of monthly support. I'll have to wait to see how where this month candle closes but if it closes close to where we are now then next months candle could potentially be a bullish SFP sweeping June's low, best case scenario and we could see a weekly falling wedge structure into support.

Starting to close weekly candles below 24800 and things start to look uglier, worth noting is this is a HTF lower high so if we begin to break market structure to the downside then who knows but we have to wait and see. The weekly FVG down to 22700 is also noteworthy.

On the Daily you can see very little reaction after the breakdown, I'm leaning more towards this slowly bleeding out and we see how price reacts when/if we sweep the lows or breakdown further. If we do get a squeeze up I will be looking for shorts with any signs of weakness and a run of Fridays high at 26832 as my deviation trigger level.

Treating this area between 25k and 31k as a range, below and reclaim = long.

As always I will update if and when I enter a trade, otherwise I'm just observing.

Will be looking at some alts and will share anything I find interesting.

Have a great week, thanks for the upvotes and re-blogs!