Following the recent release of the unique opportunity for investors to participate in the Lyft Inc IPO, Blackmoon is glad to introduce you the new Brexit Thematic Portfolio! This Portfolio allows you to capitalize on one of the most important events in modern European history — Brexit.

The story so far…

In 2017, the British people on referendum decided to exit the European Union, believing that will bring them more opportunities to benefit.

However, not only English people may benefit from Brexit. This may bring additional opportunities for British exporting industry.

Since the Pound Sterling continues to fall relative to the foreign peers, revenues of these companies, received in foreign currencies, grow in nominal value what’s more their goods become cheaper and attractive to external customers, pushing sales up. This changing landscape creates solid profit opportunities for leading exporting companies making them very alluring investment options.

As it happened

- 2016: Shortly following the referendum results statement, FTSE100 returned to historical highs.

- 2017: FTSE100 observed an overall increasing trend. The national earnings gained energy which boosted index growth, notwithstanding GBP improvement.

- 2018: GBP and FTSE100 were concurrently slumping. Concerns of Britain exiting the EU without an agreement founded risks of a major change in business conditions for national firms. Consequently, FTSE 100 has lost approximately 15% from its highs by years end, due to doubts of a no-deal “hard Brexit”.

Enter Blackmoon’s Brexit Thematic Portfolio

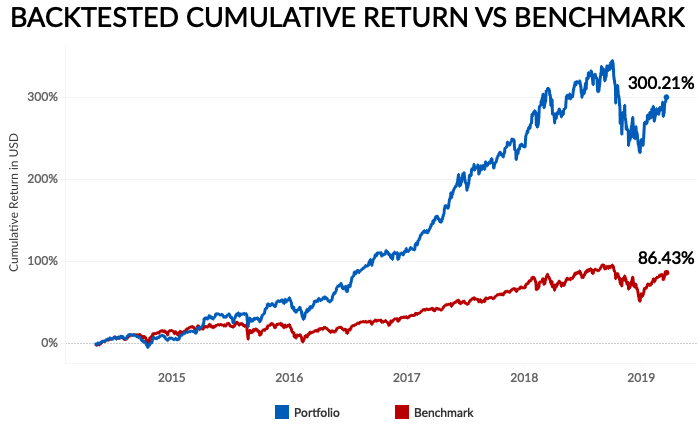

The Brexit Thematic Portfolio is benchmarked against FTSE 100, a leading index of the London Stock Exchange covering 100 companies with the largest capitalization listed on LSE.

Strategy

The portfolio is composed of the eight largest publicly traded companies in the United Kingdom and receives most of its revenues from sales overseas. The portfolio itself is very diversified, composed of companies from different sectors, such as mining, pharmaceutical, oil and gas, medical suppliers and technology developers. The underlying portfolio of stocks is equally dollar weighted and automatically rebalanced every year.

Gross of fees. As the benchmark, we used the FTSE 100 Index as a leading index of the London Stock Exchange. The backtested results are given solely for explanatory purposes and do not indicate or guarantee future results.

The backtested results display the positive effects of depreciating Pound on exporting companies. We can see how portfolio started to diverge upwards after the Pound Sterling began to weaken against major currencies and continues to do so. During the observed period, the portfolio significantly outperformed the benchmark earning +122.54%, while the benchmark itself moved down -5.50%.

More information, including the full list of stocks, is available on the product page.

More innovative investment opportunities to come!

Four new products were added to the Blackmoon Platform this month. We are not content with these achievements and will continue providing our users with more innovative investment opportunities. In the nearest future, our product collection will expand significantly, so stay tuned!

Handy links to stay tuned to our updates:

website: https://blackmoonplatform.com

telegram channel: https://t.me/blackmooncryptochannel

info video:

DISCLAIMER

Investment in financial instruments carries a significant risk of loss and may not BE suitable for every investor. Before purchasing our investment products, please consider your level of experience, investment objectives and risk appetite, and consult an independent financial or legal advisor to ensure the product meets your objectives. Please note that your investments do not have capital protection and carry a risk of loss, including the loss of the entire investment amount; therefore, you should not risk the capital you cannot afford to lose. This material is presented for information purposes only and does not constitute a solicitation or investment advice.