With a relatively simple research and the use of an algorithm developed exclusively by FRANCHISING GROUP ARGENTINA, it is possible to measure the strength of a brand name as well as that of its territorial competitors within a certain period of time.

Determining who is the territorial leader is a very important piece of information to obtain, given the fact that the strategy to implement in expanding a territory will be depending greatly on the competitive position of our company.

Adding marketing efforts to an existing product starts the walk from "non-branding" to an "extreme branding" (a characteristic of a premium brand).

The branding grade depends on many variables such as: industry, activity, competition's passiveness and on the consumer's behavior. This is what it's called Imaginary Product (IP).

The IP, and by extension, the brand name can be built around several attributes going from product design and packaging materials up to the decor and style of the point of sale up to smaller things such as the punctuality of the delivery at the factory.

However, the main consideration is that when apply to brand positioning, the attributes to take into consideration are the ones that apply to the competition as well in our territorial zone of influence. Thus, it's possible that a well established brand name in Buenos Aires have no attributes at all in Rio de Janeiro, New York or Sydney.

In the process of "decommoditization" of a product, the company can work on the specific product: PP (physical product), IP (imaginary product), and EP (economical product), on the distribution channel as well as on the brand communication.

Investments made in these three aspects are what constitute for the company its marketing investment. Therefore, there's a direct connection between the brand strength and the marketing budget, and a connection to the brand's direct competitors and its marketing budgets.

Marketing budget can be identified as the "hard component" of the brand strength. In contrast, there's also a "soft component" of a brand, which is the component that depends on the consumer market.

There's a very particular fact about brands. They are the main asset of a company however they are not confined within the company itself but outside it boundaries. They are inside the mind of the consumer.

No matter how bigger effort a company do in order to build a brand, there's absolutely no warranty that this effort makes any improvement in building the strength of the brand inside the consumer's mind.

It becomes necessary to measure certain market indicators, known as "soft component" to realize if the "hard component' is doing what it's supposed to be doing, this is, achieving and maintaining the chosen market niche.

Having in mind that measures must be made in a particular zone of influence, and considering that with a bigger territory, a bigger sample must be obtained; lower values are to be expected regarding the measured variables. This is to be expected given the fact that with a bigger territory to measure brand strength, more of the competitors brand will became present, thus diluting the marketing effort of the original competitors brands.

Therefore, the elected variables of the soft component are the following:

Top of mind awareness or immediate brand recall (re). This is the percentage of the answers that mention the brand when asked: What is the first brand that comes to your mind in this industry? (Measured between 0 and 1).

Guided awareness (rg). This is the percentage of positive answers to the question: Do you now the X brand? (Measured between 0 and 1).

Target adaptation (at). This is a percentage that measures the quantity of potential buyers that belongs to the target market. Ideal value is 1, however, this happens only in very expensive or luxury products. One must be aware of infiltrations. As the value tends to 0, the brand loose strength. (Measured between 0 and 1).

Personality (p). Personality is as its name presents it, is a very personal value, given the natural difficulty to define "personality". Everyone has a different opinion regarding a particular product personality. The proper way of measuring is comparing our brand within a menu of competitor's brands, with a scale from 1 to 5, where 1 represents "product has no personality at all", and 5 represents a "have plenty personality" value. Then, comparing the results.

- Share(s). Represents the market share of the brand in a given territory. (Measured between 0 and 1)

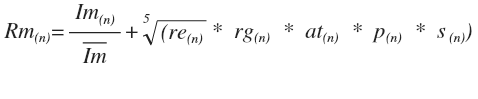

Then it is possible to effectively measure the brand strength using our following formula:

Whereas:

RM(n) Represents the strength brand index of the "n" brand

IM(n) Represents the marketing investment in "n" brand over the considered time frame and territory.

IM/ Represents the average investment in marketing of the competitors’ brands in the same time frame and territory.

re(n) Represents the top of mind awareness of "n" brand.

rg(n) Represents the guided awareness of the "n" brand.

at(n) Represents the target adaptation of the "n" brand.

p(s) Represents the personality of "n" brand.

s(n) Represents the "n" brand share of the market.

A complete understanding of the “brand map” for a given territory can be developed if this formula is used in the same way for measuring the brand strength of all incumbents, thus permitting the analyst to set the corresponding marketing strategy for the next period.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.linkedin.com/pulse/measuring-strength-brand-name-index-gerardo-saporosi-lion-