We Believed that Demand for the desired attainment of Crypto Possessions may be happy with significant Source of several Crypto Asset property and negotiated directly by Investor Peers.

While many Blockchain authorities are trying to find even more ways to tie the knot CRYPTO with FIAT,BQT Team holds in reducing dependence on FIAT entirely. Every Crypto Asset offers its worth and can be utilized as discussing device to acquire an additional Crypto Asset. We think that Demand for the desired acquisition of Crypto Property can be satisfied with significant Source of several Crypto asset holdings and discussed straight by investor peers.

Also, we believe the marketplace now needs for the ability to evade crypto assets for a brief period to acquire additional Crypto property. While it is tough to put into action perimeter investments and choices in the right G2G environment, BQT Group created innovative and however an even more useful tool to enable traders to generate short-term Hedge Investments.

BQT aims to build a society and culture of Crypto Traders utilize the stage, helping the arranged community and reaping helpful benefits from the city.

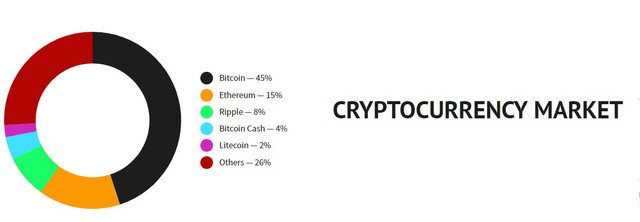

CRYPTOCURRENCY MARKET

The cryptocurrency market is evolving, and its marketplace capitalization was estimated to

US$268.23 billion on March 31st, 2018.

Since the start of Bitcoin in January 2009, thousands of cryptocurrencies have existed

today at some stage and, there are hundreds of cryptocurrencies with a market value

that are being traded. Still, Bitcoin is usually the undoubtful head addressing approx. 45% of

the total market place capitalization.

A multitude of tasks and companies have got emerged to provide services and products that facilitate the usage of cryptocurrency for mainstream users and build the infrastructure for applications running on top of community blockchains.

While the cryptocurrency industry is comprised of many important groups and actors, presently there are four key cryptocurrency industry sectors today:

- Exchanges

- Wallets

- Obligations Companies

- Mining

BLOCKCHAIN TECHNOLOGY: Steady AND EXPANDING

Blockchain technology is overcoming the world, and it transforms the way many marketplaces operate entirely. It is usually approximated that blockchain companies could experience an income pool of $6 billion by 2020 and $20 billion by 2030.

These figures are structured in the impact of digital ledger technology on payments:

- Business Cross punch Boundary,

- Remittance, seeing that very well as the effect about

- Capital Markets and

- Name Insurance.

The increasing adoption of digital money will put downward pressure on remittance payments shifting 20% of income to Blockchain companies. This is generally expected to accounts for $1.5 billion (24%) of Blockchain income in 2020 and $3.8 billion (19%) in 2030.

Remaining income is captured by the reduction of counterparty and infrastructure risk for

capital marketplaces, seeing that well while financial savings in Title Insurance commissions and maintenance price.

IMPORTANT LINKS FOR THIS PROJECT:

Website: https://bqt.io/ Whitepaper: https://bqt.io/assets/pdf/whitepaper.pdf Twitter: https://twitter.com/bqt_ico Telegram: https://t.me/BQTICO Facebook: https://www.facebook.com/BQTPROJECT

AUTHOR PROFILE:

Bitcointalk ID: Crypto rev Thing

ETH Address: 0xc39E66e5Eda31416e533BE5293ea7fe4D99f43EB

BitcoinTalk profile link: https://bitcointalk.org/index.php?action=profile;u=2371318