This past weekend was my first Berkshire Hathaway Annual Shareholders Meeting. I learn a ton and met many interesting people and plan to attend again next year. Here are some things I plan on doing differently next year to get even more out of the experience.

My goal is knowledge, not business opportunities or entertainment, so what I do is very different from most people who attended. I try to learn interesting things from people from conversation. In Tools of Titans, Tim Ferriss listed the questions he ask his podcast guests. I went around asking people my own questions as well as some of his questions. Some examples:

How many times have you attended Berkshire meetings?

What drew you return?

What's the most interesting thing you learned today?

What is a truth you believe that few others do?

What do you think makes a person successful?

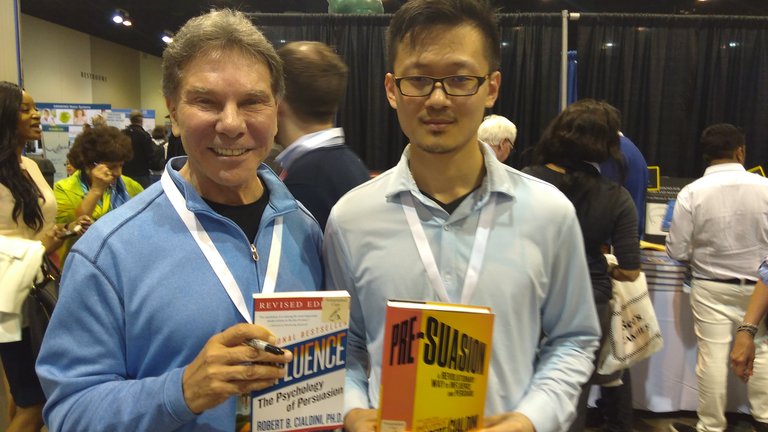

At the event, there is the Bookworm, a bookstore that sold Warren Buffett's and Charlie Munger's top recommended books of the year. On the Bookworm website, you could receive a newsletter updating you on the Berkshire Hathaway book selections. Some of the authors attended the event and I asked them questions on related to their books and also some of the questions above. You can read part 1 of my interviews with authors here. Part 2 is coming soon. In part 2, I will go deep into my almost 2 hours long conversation with the great psychologist Robert Cialdini, whose book Pre-suasion is Charlie Munger's favorite book of the year.

Next year, I wish to be even more prepared and get all that I could out of my experience. I will receive the list of books from the Bookworm newsletter ahead of time. Any book I'm interested in that I don't already own I will buy ahead of time. Then, for all the books, I will have read them, highlighted key passages in the books, and taken notes on them. I will take my annotated copies of the books to the authors for them to sign. I will also prepare more thoughtful questions for the authors from my notes ahead of time. I will meditate on the books and my questions to simulate their possible answers in my head. Then I will narrow my questions down to the most unique and insightful questions to ask them. I would try to stay most of the day at the Bookworm for Friday and Saturday.

Then, if I still have questions that none of the authors could answer, I would sign up to ask a question to Buffett and Munger. If I didn't get picked for that lottery, I would try to persuade whoever won to ask my question by knowing Buffett and Munger so well that I could answer any normal questions that are typically asked.

If I get fatigued, I would go take a walk outside. No podcasts, music, or audiobooks. Just walking meditation to clear the mind. To optimize energy levels without being overly hyper, I would stick to a ketogenic diet leading up to the event and keep coffee to a minimum and rely mostly on dark chocolate and cashews for energy.

I would also resist making any purchases other than books. Traveling and big events put people in an altered state of consciousness that makes people more open to suggestions. It's a hypnotic state... psychedelic trips are called trips for a reason. I've seen many people make terrible decisions on large purchases while traveling and I've suffered from such mistakes myself. This is a mistake that is easy to fall for over and over again if you don't keep conscious awareness of it. Think about it this way: if you're in your hometown, you never buy any overpriced souvenirs or take pictures of mundane or even beautiful scenery around you. Why change everything when you travel?

If you have enjoyed and learned something from this article, then please follow me.

Best,

@limitless

Apparently Warren Buffett reads 80% of his day, check out this article from CNBC

Great post

~Np

I wonder if he listens to audiobooks.

Probably, I read somewhere that audiobooks develop comprehension the same way reading does

meep

Wow I wish I could have that much time to vanish 🙄

Very informative post, q

Please comment on what you think about my method to use BRK as my metric to acquire value: https://steemit.com/stocks/@lucky.digger/how-i-have-beat-the-stockmarket-consistently-for-years