Will you consider taking a look at your retirement investments again?

A study by two Yale Economists (links to a PDF) says that our traditional way to invest for retirement is fundamentally flawed. The standard advice? Well the standard advice is to hold stocks roughly in the proportion to 110 minus one's age. This means that a 20 year old would have 90-10 in stocks vs bonds, while a 60 year old is going to have 50-50. But the two Yale Economists found that this advice is flawed - and actually far too conservative. They found that the young people should be in 100% stocks, in fact, over 100% stocks - IE we should be using leverage.

In the early years young workers should be leveraged into a diversified portfolio of stocks. Then overtime, as they age, they should de-leverage themselves and ultimately become un-leveraged.

How big is this loss/misallocation?

The economists calculated out that the expected return on leveraged funds is around 90% higher than in traditional retirement plans. In otherwords, this means that people can retire six years earlier or maintain their standard of living through age 112, rather than 85.

But the reason why retirement plans are flawed is because of a fundamental misunderstanding of young people's behavior:

"The recommendation from the Samuelson (1969) and Merton (1969, 1971) life-cycle investment models is to invest a constant fraction of wealth in stocks. The mistake in translating this theory into practice is that young people invest only a fraction of their current savings, not their discounted lifetime savings. For someone in their 30's, investing even 100% of current savings is still likely to be less than 10% of their lifetime savings or less than 1/6th of what the person should be holding in equities if, as is typical, their risk aversion would have led them to invest at least 60% of their lifetime savings in stocks.

In the Samuelson framework, all of a person’s wealth for both consumption and saving was assumed to come at the beginning of the person’s life. Of course that isn’t the situation for a typical worker who starts with almost no savings. Thus, the advice to invest 60% of the present value of future savings in stocks would imply an investment well more than what would be currently available."

But the economists realize that this is not within conventional wisdom and recommend, for the average worker, to not invest over a 2x leverage. They realize that, for a risky investor, taking on a 3x leverage is more optimal as it provides bigger returns over the long run as even a 2x leverage is not enough for young workers.

What are the risks?

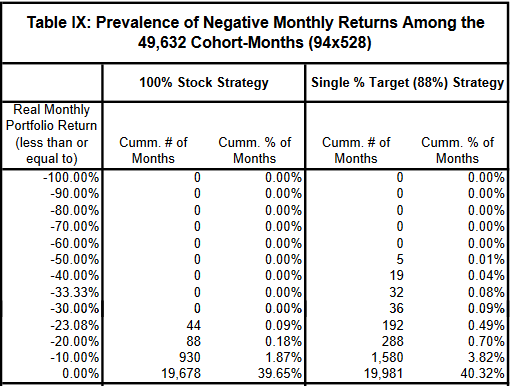

The economists looked at data from 1871 to 2008 and what they found was very interesting. They found the stock market never declined enough to wipe out any preexisting investments. Further, the ones that experienced a significant decline of 40% or more during one month, did not experience a significant retirement decline. Roughly, one forth of the fully leveraged portfolios studied saw a 40% or greater loss during one month - mainly during the 1929 stock market crash (or the Great Crash).

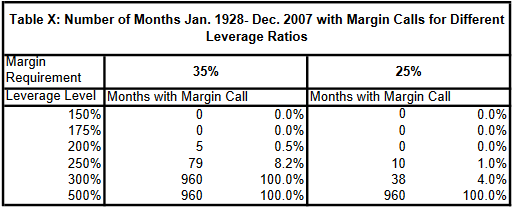

Further, there is some risk of being margin called, depending upon the strategy you use to produce leverage in your account. And among the ones that were margin called the results are still fairly small on lower leveraged levels.

Ayres and Nalebuff recognize there are some assumptions which might not hold true going forward. For example, their results depend on equity premium and similar stock market returns, as we have seen in the past. Which they recognize there is no guarantee that either will remain true.

But, as the economists show below, even the minimum for the leveraged portfolios there is still a significant profit over and above the traditional options.

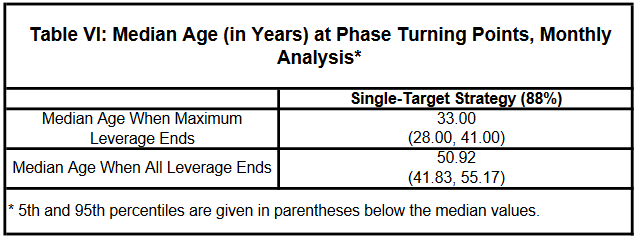

Overall, we can see that the leveraged portfolios do much better than the un-leveraged. However, you might be asking when the economists recommend you un-leverage your account, or do you keep it that way forever.

There is some indication that they believe you should keep it leveraged all your life. But the specific models they developed and used for this collection of data had people fully un-leveraged by the time they were 50, or 55 at the latest.

Summary:

The paper concludes by saying that there are obvious advantages to using leverage in your accounts while you are young, then de-leveraging at the recommended age, above. But while I could summarize this for you, I'll let the economists do it:

"Our recommended investment strategy is simple to follow. An investor who targets a single percentage or a single present dollar value follows three phases of investment. The worker begins by investing 200% of current savings in stock until a target level of investment is achieved. In the second phase, the worker maintains the target level of equity investment while deleveraging the portfolio and then maintains that target level as an unleveraged position in the third and final phase.

The expected gains from such leveraged savings are striking. With increased longevity, people need to save more for their retirement. The expected gains in retirement accumulations relative to the traditional 90/50 life-cycle strategy would allow someone to finance an extra 27 years of retirement (well past age 100) or to retire at age 59.5 and still finance retirement through age 85. Or, to the extent that current savings are inadequate to maintain pre-retirement standards of living, this can boost retirement consumption by 90%."

But if you find these results interesting and want to learn more about the strategy, feel free to pick up the book at Amazon.

What are our choices for leveraged stocks with low expense ratios?

There are many leveraged ETFs out there that try to give 2x or 3x the underlying index or stocks. For a bigger list follow the link. Some of the best options for broad market indies with low expense ratios are: $SSO, $UPRO, $SPUU, and $SPXL are among the best leveraged S&P 500 ETFs.

ProShares Ultra S&P 500 ETF (SSO)

- Issuer: ProShares

- YTD Performance: 50.02%

- Expense Ratio: 0.90%

- Dividend Yield: 0.47%

- Price: $159.65

This leveraged fund seeks to double the return of the S&P 500 for a single day (from one NAV calculation to the next) using stocks and derivatives. The Fund pays a quarterly dividend.

ProShares Ultra Pro S&P 500 ETF (UPRO)

- Issuer: ProShares

- YTD Performance: 79.14%

- Expense Ratio: 0.97%

- Dividend Yield: 0.37%

- Price: $75.99

This ProShares ETF is similar to its sister fund (SSO), but UPRO aims for returns equivalent to 300% of the S&P 500 using swap contracts for leverage. Both funds are rebalanced daily, so multiplied returns may not exactly match the returns of the underlying index over the long term.

Direxion Daily S&P 500 Bull 2x Shares (SPUU)

- Issuer: Direxion

- YTD Performance: 48.56%

- Expense Ratio: 0.68%

- Dividend Yield: 1.40%

- Price: $70.42

SPUU is one of a series of leveraged ETFs offered by Direxion. The Direxion S&P 500 leveraged ETFs utilize swaps and futures contracts to achieve the targeted objective. This Fund seeks to replicate two times the performance of the S&P 500.

Direxion Daily S&P 500 Bull 3x Shares ETF (SPXL)

- Issuer: Direxion

- YTD Performance: 78.41%

- Expense Ratio: 1.06%

- Dividend Yield: 0.77%

- Price: $71.65

This ETF is another leveraged ETF from Direxion. It seeks to produce three times the return of the S&P 500 on a daily basis.

Disclaimer and Author's Bio:

Kendon started TheCryptoDivision in 2017 in order to help people understand cryptocurrency/finance and learn about the unique opportunities in the cryptocurrency world and in the financial world. Kendon is an economics graduate from BYUI. He worked for an investment bank in the foreign exchange department.

If you haven't invested in cryptocurrency yet, Kendon recommends using Coinbase as a good jump start. Invest $100 dollars into Bitcoin and you'll get another $10 dollars’ worth of Bitcoin for free using the coinbase link.

Kendon recommends trying to fight the fed's devaluation of your dollars by using SoFi's free banking and getting around 2% on your checking accounts. You'll also get a free 25 dollars.

The author gets support/income for this website by donations, using affiliate marketing, and google ads. But he has never taken any financial compensation for any research or post. This is not meant as financial advice.

If you want to get into contact with me, DM on Twitter, follow on facebook or follow on the crypto-social media platform steemit or email TheCryptoDivision@protonmail.com

Learn more about cryptocurrency If you have liked the content and feel like supporting the page, anonymously, feel free to donate:

Bitcoin Wallet: 31xJ7rmDTD5TSS62wg5ipg2Nv6RvMPoXmN

Eth Wallet: 0x641a67147FE99E438F74cD868a4C8D97adFf51b2

Monero Wallet:

4262AwLVeLwVem8JNzLuQ73kjdjRJEpSygyGncSwnWZsCXC7v4a9WtvhTZopoJBeF8f5Z3SMyHUArHrpssobJbJU972137B

Follow me on:

Website: http://www.thecryptodivision.com/

Twitter: https://twitter.com/CryptoDivision

Facebook: https://www.facebook.com/TheCryptoDivision/notifications/

Steemit: https://steemit.com/@cryptodivision