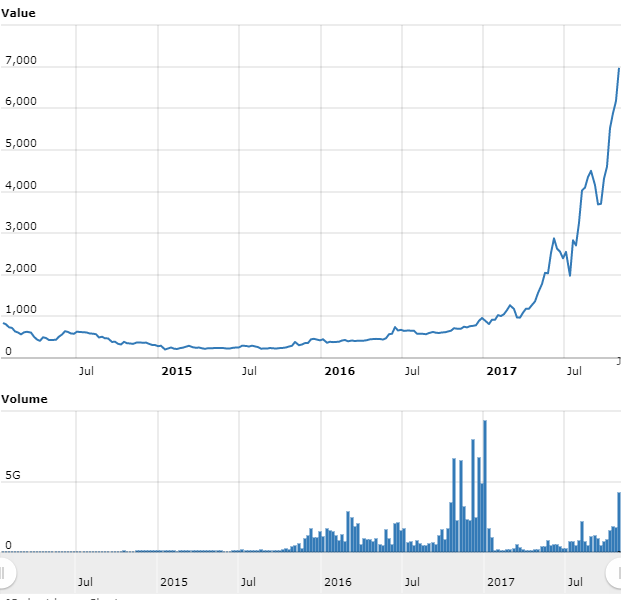

Adam Smith’s unseen hand of supply and demand no doubt gives explanation to the current astronomical value of BTC (Bitcoin)?—?given that market value is literally just what anyone is inclined to shell out to satisfy a need or want?—?but remove the drivers of such extrinsic value and what’s left? Its intrinsic value.

In the same way precious metals maintain their gleam, pliability, as well as resistance to discoloration, thereby making them ideal to meet various industrial and fashion needs no matter their rarity, many wonder just what inherent worth does BTC actually hold?

You would probably feel the answer is glaringly self evident, yet instead, it really is anything but. Never before in the recorded history of commercial enterprise has such a lively speculative market developed about an asset that had simply no clear intrinsic value.

Just where, then, can the inherent worth of BTC be found?

BTC’s Mystifying Intrinsic Value

A lot of people?—?both enthusiasts as well as naysayers?—?doubt whether BTC possesses any kind of implicit worth. All things considered, money ought to be both a medium of trade as well as a moderately constant store of value. And it continues to be entirely unclear the reason for which BTC should be a stable store of value.

Generally speaking, countless deem BTC’s utility to be the basis of its implicit worth?—?a seemingly rational deduction at first blush, since the intrinsic worth of numerous assets’ is contingent upon its usefulness.

Certain experts even go as far as to assert that BTC’s only real intrinsic value is its utility. “BTC’s utility as a store of value is dependent on its utility as a medium of exchange,” explains John Kelleher, a freelance web developer, in Investopedia. “We base this in turn on the assumption that for something to be used as a store of value it needs to have some intrinsic value, and if BTC does not achieve success as a medium of exchange, it will have no practical utility and thus no intrinsic value and won’t be appealing as a store of value.”

Currency Is Necessary But Money Is Not

All through history, various forms of money have been utilized as currency: gold, silver, copper, salt, peppercorns, tea, Rai stones, decorated belts, shells ( which happens to be where we get the idiom, “shelling out” to mean “making a payment” ), alcohol, pelts, cigarettes, cannabis, cocoa beans, cowries, barley and even candy. Accordingly, whereas money may take numerous forms, it only ends up being currency when it becomes essential for the exchange of products or services.

Thus we come to the heart of the dilemma: Utility. All things considered, absolutely no cryptocurrency is backed by the ‘full faith and credit’ of any nation, and neither is it guaranteed by real, unconsumed goods. Still, if it truly enabled the trade of goods and services it would possess enormous worth as currency.

Hence the real question we must ask is, “Is BTC genuine currency?”

BTC As Currency

When figuring out whether any asset meet the requirements for a currency we must evaluate its scarcity, fungibility, divisibility, durability, transferability, portability, its difficulty to counterfeit, its widespread use, verifiable authenticity and non-consumability.

BTC passes these all of these tests with the exception of one, and it’s a doozie: Widespread Use.

The simple truth is, although Satoshi Nakamoto succeeded in creating something truly groundbreaking, he gave no thought to a circulation apparatus that would permit one and all to use of it as bona fide currency.

You see, the model he engineered made it easy for far too much BTC to be held in too few hands which is the reason why it is affected by such dramatic price instability; all it takes is for a few to coincide in a particular market move for a tsunami of trades to wreak havoc on its price on exchanges across the globe.

And it is this very price unpredictability which hinders its own efforts to serve as a currency. Just think, what business owner in his right mind would accept any kind of payment whose value was so uncertain? He could be a tycoon one minute to only become penniless the next and then just be scraping from there.

And so we it’s easy to see why BTC’s sky-high value at this moment doesn’t matter in the least. Because it has ZERO intrinsic value.

Nevertheless, with the cryptocurrency wars still raging on ( at last check there were 1,253 cryptocurrencies available on the market ) one cryptocurrency must emerge as the one to rule them all.

Which one?

That one which behaves like money yet somehow cracks the distribution problem to attain worldwide utility.

So, sit tight and enjoy the ride. The best is yet to come.

Here To Serve,

Jo Polanco

CEO/Founder

Nexus Labs LLC

You are exactly right. The only reason why Bitcoin is so expensive now is because it is a fad or a hot trend.

Just like baseball cards. It will lose it's trendy value one day.