I have not been posting much as my portfolio has not seen much activity this would be the obvious case across any small cap portfolio since many start off ideas would be a buy and hold strategy.

With that, I would like to introduce you to simplywall.st the aesthetically pleasing portfolio monitor. It is a free (learner plan) service with the option to purchase a yearly (investor or pro) plan that offers everything from company report views, and further data gathering for your portfolio ideas. Upon sign up, it provides you with 10 days of free "investor" plan services. I will be sharing with you my portfolio below.

Upon Login: you are greeted by the search field that immediately provides you with top performers for review. Not my interest - let's get straight to my portfolio.

You can review the balance of your portfolio with the snowflake that is based on 30 checks and provides and instant snapshot of your portfolio helping you decide how heavily invested you are in your holdings.The Portfolio Snowflake is calculated from the weighted average of the individual Snowflakes that make up the Portfolio. ETFs and Funds are ignored from this. It also breaks down your holdings the same way so you can further research companies you have invested in and or would like to invest in.

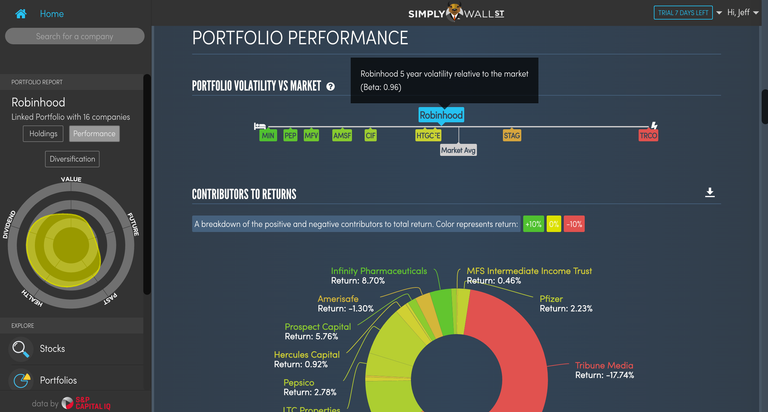

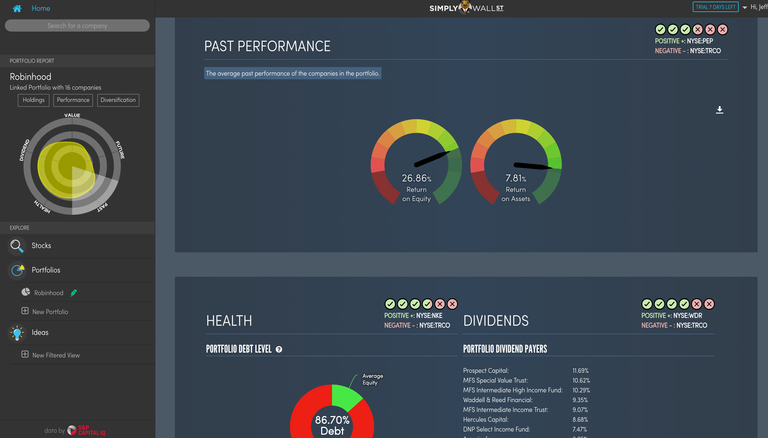

Scroll down on the platform and you see your portfolio's performance. This part provides you with your portfolio's compared to market average number. In my portfolio you can see NYSE: TRCO 5 year volatility is in the red, this is a result of the sudden drop of price after its special dividend issued on ex-dividend date January 11th which my main means of purchase.

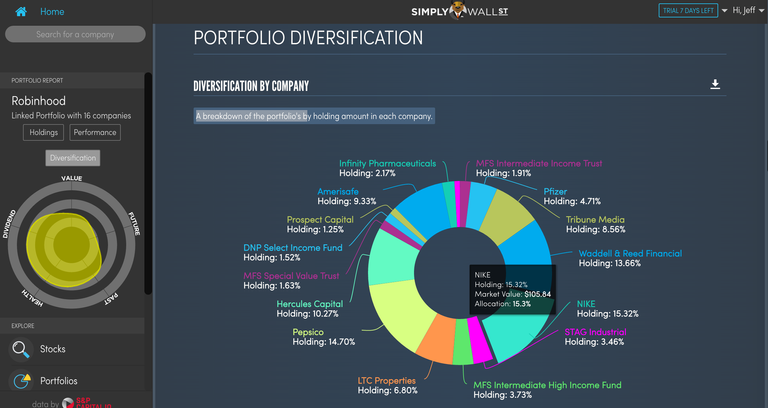

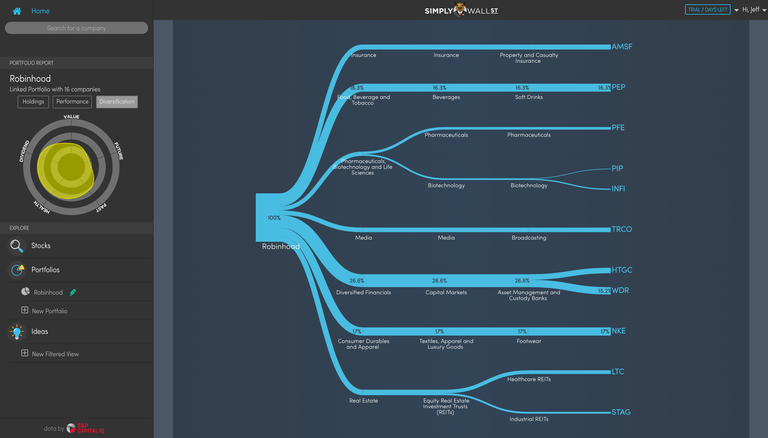

Diversification: Are you diversed enough or possibly too much? Simply Wall can help you look into that as well. My portfolio definitely needs some tweaking but currently I feel like I am poised for a good long hold on many of my shares which leads the the next section of simplywall.st.

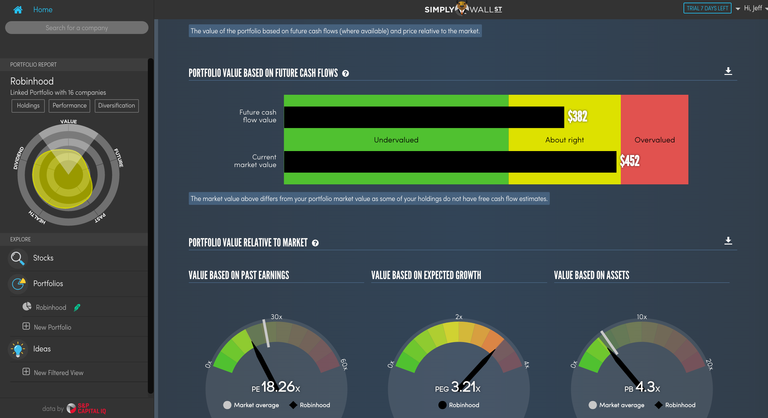

Value & Future: Simply Wall.st provides a pretty straight forward presentation of where it believes your portfolio is at. This is of course where your own personal feelings come into play. I purchased my shares with the idea to hold for a long and continue to build capital from it's dividends, this includes special dividends. As per my previous example of TRCO, I made this purchase for it's special dividend payout, I do not intend to hold this for a long. I missed my limit sell and feel that it is volatile enough for me to hold onto for it's first quarter to get it's quarterly dividend.

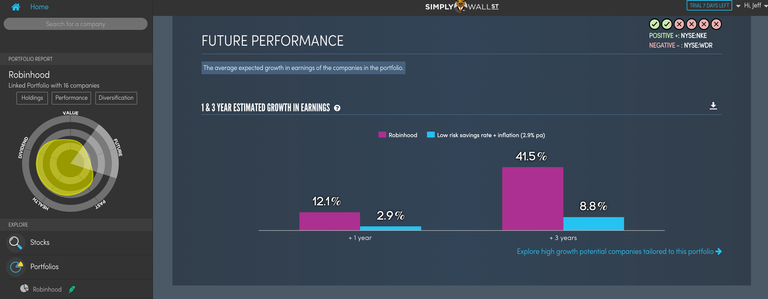

SimplyWall.st values your portfolio as "under valued," "about right" or "overvalued." Because I am new to investing, this plays with my emotions since I am under the ratings system of what they have created, and this can have an affect of one's plans and ideas for future holdings. This section also provides you with an ESTIMATED growth in earnings for 1 - 3 year comparison and the average expected growth in earnings of the companies in the portfolio.

In conclusion, SimplyWall.St is an aesthetically pleasing platform. It full of information on the "investor" plan that can be used for a range of situations and valuations. It is simple to use easy to look into idea's and review company information. It does lack data in Funds and ETF's but in a world of google and other search engines, these slow movers can still be added to your portfolio. Would I recommend simply wall st? Yes, I think the ease of chart reading, and information gathering is ideal for a new investor like myself. I will not be purchasing the $118 a year investor plan as I still need to learn more as a trader what I am going to do with the information provided.

**Disclosure: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it . I have no business relationship with any company whose stock is mentioned in this article.

My Original Post from Jan 15

nice thx

Thanks for the comment, good luck!

Congratulations @kiloran! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPNice post @kiloran, I think I'm going to check out this portfolio-tool. Does it also include small-cap American stocks? For example, stocks traded on Pink current? And does it include stocks on other major exchanges in the world, like Europe?

Hey Unknown. it does include small-cap American stocks but not all OTC's (there's been a few I wanted but could not purchase.) It does not feature stocks in other major exchanges although they are looking at that option. In summary Robinhood is for the new investor looking to get into stocks and start learning all commission free.

After building up capital I plan to move over some of that capital access more markets like TD AMERITRADE / FIDELITY