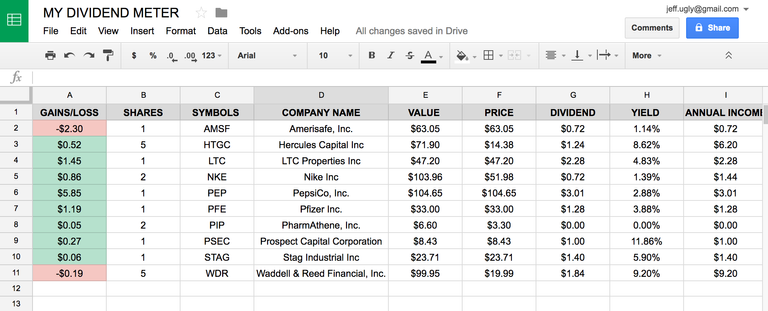

A month ago I invested my first dollars into my Robinhood portfolio account and could not have been more excited. I definitely didn't think I would be able to jump into stocks, look into financial reports and make my own risk to reward decisions. Since December 1st I have invested $550 into my account.

On the first day of trading in the new year, my portfolio entered at $561 and shot down to $559. As the day proceeded it continued to flux from $558-$563 to close at $562.00 with an after hours gain of $0.91

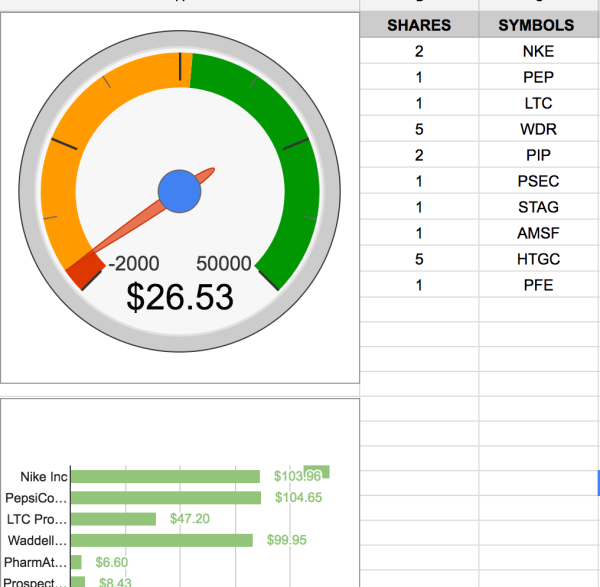

Currently my portfolio is compiled of small holdings with an expected annual dividend return of $26.53. I am still working on building my capital with stocks that will pay monthly dividends but I definitely do not want to put all my eggs into one basket. I have been purchasing some stocks for special dividend payouts but as my previous post, the price changes for them are not always worth the purchase.

Do you own stocks? I'd love to hear your recommendations and thoughts on how to diversify.

My Original Post from Jan 3rd