Just one day after posting about my gains and goals for my portfolio the stock market took a hit with the Dow dropping -167.58 / S&P -20.99 / Nasdaq -90.06.

Tech stocks plunge, Dow closes 168 points lower

The tech sector shed 1.8 percent to drag the broader market lower.

The S&P 500 declined 0.9 percent and briefly broke below its 50-day moving average for the first time since May 18.

Thursday also marked the next-to-last trading day of the quarter, usually a time when investors re-position their portfolios or take profits.

SOURCE: http://www.cnbc.com/2017/06/29/us-stocks-fall-tech-banks.html

My portfolio closed during market hours at $1591.24 and slightly climbed back up in after hours trading. I took this dip as an opportunity to add more shares to my portfolio as well as seize an opportunity for a swing trade on shares I have held.

Today started with a 2 share buy on Ford (F) for $11.08 and quickly placed a limit sell for two shares at $11.18 which sold roughly two hours later allowing me to take a +0.20 profit to the portfolio.

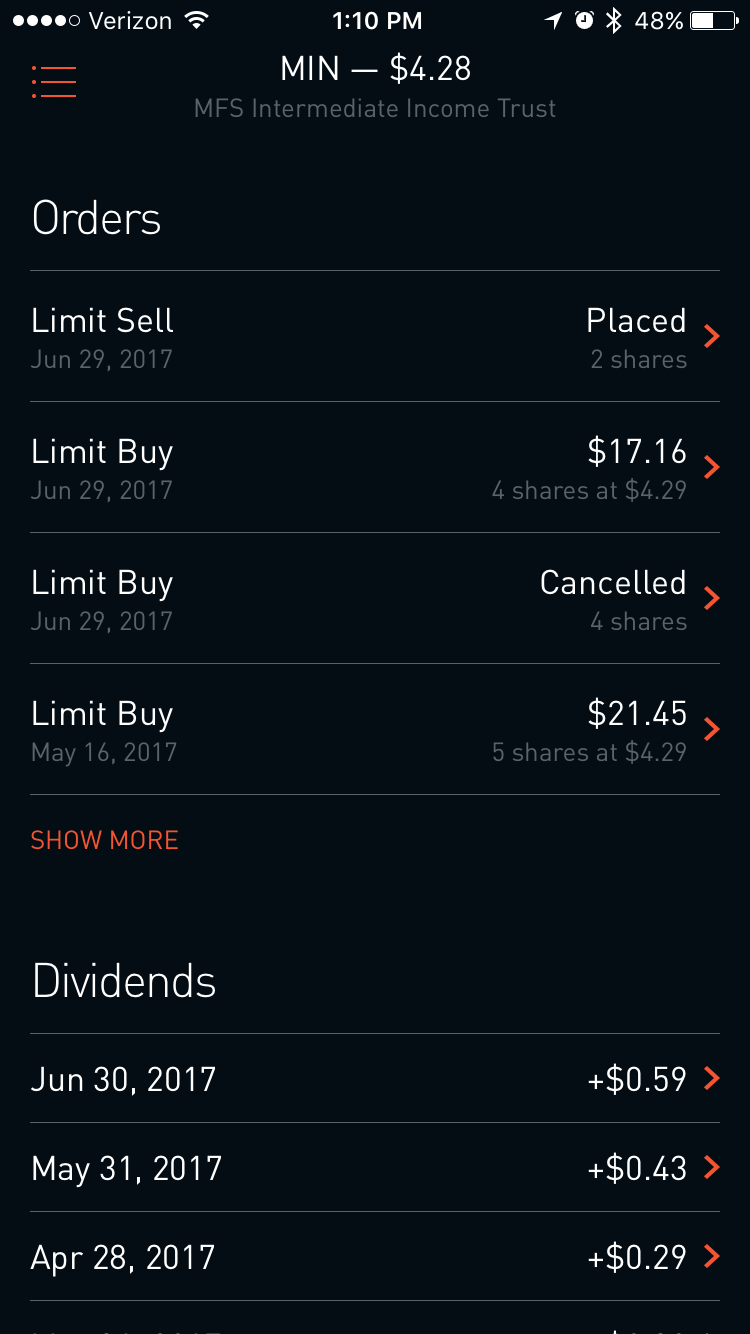

At the same time of waiting for this small swing trade I had received the funds from my previous weeks Ford (F) trade - which can be seen from my last post - and used the funds to cost value average down two stocks I already own. MFS Intermediate Income Fund (MIN) and Infinity Pharmaceuticals (INFI)

The process of cost value averaging (up/down) is the process of spending x amount of money to bring the average value of a stock up/down. Currently, my position in MIN at 22 shares averages at $4.32 while it closed at $4.28.

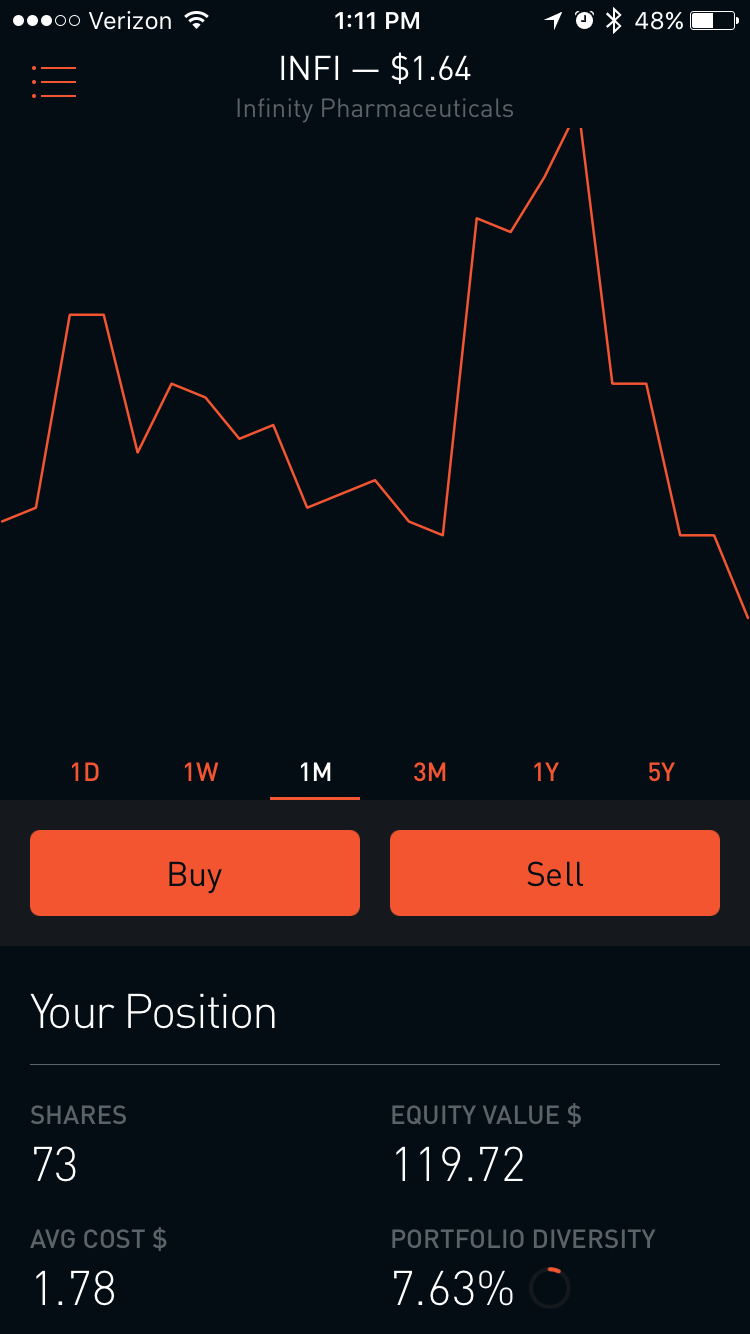

The second average down was my position in Infinity Pharmaceuticals (INFI) which is a pharmaceutical drug discovery and development company which engages in developing and delivering medicines for difficult to treat diseases. Their current focus has been in IPI-549 - a product that demonstrates activity in preclinical models of lung cancer.

My holdings in INFI are set for a long position as I wait for the latest news update from their last conference invitational set in July 25-26. As they continue to test their new product, today I have 73 shares for an average cost of $1.78 that was orchestrated by a 10 share purchase at $1.67.

The point of today's post is to show you that there are opportunities within a down turn to make a move and take advantage of it. As the sector rotates and the 2nd quarter comes to an end it shows that having a diverse portfolio and a goal will help flow through the losses.

What are you holding? Have any suggestions or comment - Let me hear them in the comment section.