Bitcoin Halvening is about 9 days away - and its interesting to see how markets will react in both the short and far term to this event.

The laws of economics state that the higher the demand, the higher will be the price. Similarly, the lower the supply, the higher the price of an asset. In technical terms, price and demand are linearly correlated, but price and supply are inversely correlated. However, what happens when there is high demand and a sudden reduction in supply. The price ought to increase in such circumstances.

How could it affect BTC price?

Bitcoin's average mining time is 1 block ( 12 Bitcoin) in approximately 10 minutes, or 6 blocks (6*12.5 = 75 BTC) in 1 hour and approximately 54000 new blocks and 675000 BTC are created every month and released into the market (mostly to miners who are rewarded for their work of mining the coin). The average trading volume of Bitcoin globally, according to coinmarketcap.com ranges between 2 and 4 million BTC which is approximately 10%-20% of the total supply of Bitcoin (currently at 17.7 million BTC). The people most likely to trade Bitcoin are the vast majority of speculators and miners - who will have instantaneous need for cash in order to sustain operations.

Now, with the Bitcoin halvening happening, the supply of new bitcoin into the market dropped by 50% from about 54000 new blocks mined or 675000 BTC earned as mining rewards - to - approximately 337500 new Bitcoin every month for the same number of blocks . Considering that miners will usually sell their BTC to pay for operating costs, these BTC mined are usually available in the market for trade or exchange instantaneously, and are usually. This reduction in supply, is a small fraction of the total supply but consists of approximately 0.1% of the daily trade volume of Bitcoin.

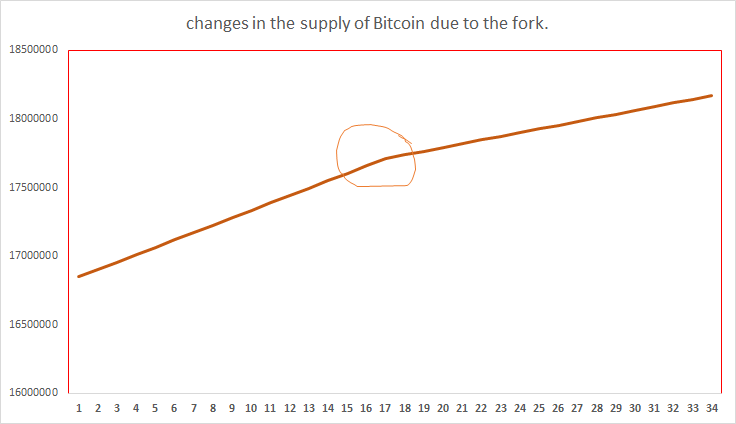

Changes in the Supply of BTC

Below, I have plotted the old trend of the monthly supply for Bitcoin, and the new trend for the monthly supply for Bitcoin in one continuing line. The small kink seen in the middle is where the old trend changes into the new trend. Visually from this figure, we see that this effect is really a very small drop in the supply of bitcoin (amounting to approximately 337500 new BTC to not be traded per month). At scale this means that 11250 new BTC will not be available for trade every day. This 11250 BTC is a very small fraction of the 2-4 million BTC traded per day globally on exchanges (as per coinmarketcap.com). As a result, I do not expect that this change in supply (or supply shock) is large enough to provide a sudden boost to BTC prices. Nevertheless, the prices of BTC can possibly increase due to other factors such as global volatility in prices of other assets, etc.

Posted from my blog with SteemPress : https://www.cryptonewtech.com/2020/05/03/bitcoin-halvening-will-it-see-a-surge-in-price/

Congratulations @enterprof! You received a personal badge!

You can view your badges on your board and compare to others on the Ranking

Do not miss the last post from @hivebuzz:

Vote for us as a witness to get one more badge and upvotes from us with more power!