Forecasting

Our apologies, I know it's been two weeks since our last post. We have been busy with other sideline projects. Nevertheless, put your safety belt on and enjoy this ride that will teach you on how to use useful and practical tools for forecasting. This segment has three levels: beginners, intermediate and advance level. We will start with the beginners level then move to intermediate and finish with the advance level. The segment is 1- 2 weeks long, by following this segment you will be able to make forecasts of prices.

What is forecasting?

Forecasting can be a useful tool to predict potential prices (or sales). There are many different types of forecasts, and there are differences among the forecasting methods. The differences between the forecasting methods relies on the accuracy of each method. Some forecasts are not reliable at all, while some forecasts are.

Is forecasting complex?

Depends on the type of forecasting. Nowadays sites like Binance or bitfinex give you the tools to forecast. If you are not interested on working on these sites, don't worry we will explain by using excel. There are in general some forecasting methods that are really easy to understand and you can do it within 10 minutes. While, other forecasting methods such as econometrics forecasting models can be difficult if you never had statistics and mathematics.

So, how can I forecast?

When you are forecasting, you are trying to answer the question: "what will happen next year if everything remains as it has been in the past?"

Forecasting can be done in two ways, by judgement based methods and by prices extrapolation methods. It might sound difficult, but basically the first method is based on your own judgement. If read a lot and keep up with the recent news and trends you can make your own judgement. This method is subjective, and as seen in many cases it is not accurate. In real life about 30%-40% of the forecast are based on judgement methods. While, in some circumstances judgement methods are better than models of forecast, however, one cannot simply base its forecast on only subjective opinion. The best forecasts are always the ones that combines several methods.

Judgement based methods

1. Naive Extrapolation: uses lat-period prices level and adds the estimated percentage in prices, also known as graphical eyeball.

2. Information based: Follow the news, latest MOFO or FOMO and based your judgement on the market opinion among investors. If a lot of investors are skeptical and there's a lot of market uncertainty, then is a good idea to sell and have a forecast conclusions that the prices will fall. If the market is moving up and there's a lot of positive signs and news then the forecast conclusion is that the prices are going up.

Model based methods

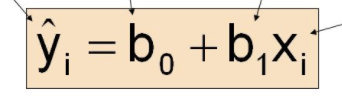

1. Regression: statistical linear regression.

2. Other methods: Moving average, exponent smoothing and BASS MODEL (is used in marketing for sales, but can be used for prices as well)

3. econometrics models: Requires statistical and mathematical background.

We will be explaining the Model based methods. DO NOT worry if you don't have a statistical background, we take you by the hand and explain and the next post everything you have to know in order to read regressions and econometrics models. If you follow this segment by the end of one or two week you will be able to forecast on the prices of bitcoin or other data. Don't be afraid, it may seem and sound difficult, but in fact you just have to read one number that will give you the indication whether the prices will go up or down.

Hope you liked the post. If you have any questions do not hesitate to ask. We are here to help out. Any issues you have with any type of forecasts just let us know, we can definitely help. Cheers, enjoy spring sun ;)