As days pass, we continue to witness establishments and governing bodies move into the blockchain/web3 space. Demand for technical expertise in the blockchain space is higher than ever; analysts, engineers, and developers are rare to come by, so those able to fill the position are well compensated. Bitcoin ignited the spark that is the cryptocurrency ecosystem and has since grown into a formidable conflagration; global recognition is upon us.

What drives blockchain adoption?

Over the last decade, we have seen major innovations and integrations within the blockchain community. Cryptocurrency took the financial world by storm and introduced peer-to-peer (p2p) transacting to the economy (Bitcoin preceded Cashapp, Apple Pay, Samsung Pay, and PayPal, which introduced a p2p service in 2015.) As more blockchain-based projects began addressing other obstacles within our global economy, institutional interest began to rise. According to Crunchbase, four crucial factors play a role in the adoption of blockchain technology:

•Mainstream Adoption

•Price Volatility

•Regulatory Pressure

•Beyond Bitcoin

Mainstream Adoption

As big players in particular fields began integrating into web3, competitors will want to board the bandwagon just to keep up. Visa first launched a Defi-linked cryptocurrency card back in 2020, and since then Mastercard has approved a card of their own as well, and more recently, closed an NFT payment deal with Coinbase. Visa reported $2.5 billion in transaction volume for the first quarter of 2022, so additional competitors are likely to ride this wave, which grants additional access to digital currencies.

Price Volatility

From a novice retail investor’s standpoint, price action can seem pretty enticing. When you’re first getting started with investing, your primary focus is percentage changes, and seeing an asset rise over 50% in two days can spark an investor’s FOMO (Fear Of Missing Out). As seen with Dogecoin and other meme coins like Shiba Inu, seeing others make a hefty profit rather quickly grabs the attention of others looking for what they believe is free money. While volatility is something to consider for those looking to day trade, entering an unpredictable market can be dangerous if you’re not careful with your exit strategies.

Regulatory Pressure

As mentioned in the preceding paragraph, the crypto markets can be extremely volatile. This is due in large part to the unregulated nature of the ecosystem. In a permissionless environment, the cryptocurrency market is deluded in worthless tokens and projects mostly looking to scam naive investors out of funds. Depositors aren’t as inclined to get involved in the ecosystem without any standards and contingencies in place. Establishing some regulations will expand the market to additional institutional investors and firms who will feel much safer offering digital currencies to their clients.

Beyond Bitcoin

With Bitcoin being the top dog, most speculators view crypto as just another storage of value. While it can be used as such, distributed ledgers like Ethereum enabled developers to construct infrastructures showing all that blockchain technology is capable of. Ether’s framework provided insight on obstacles that came with hosting a blockchain, and since then competitors have capitalized with alternative infrastructures offering innovative and revolutionary functions. From the finance sector to healthcare, to IoT operating systems, and so on, the potential is endless.

Global Adoption Index

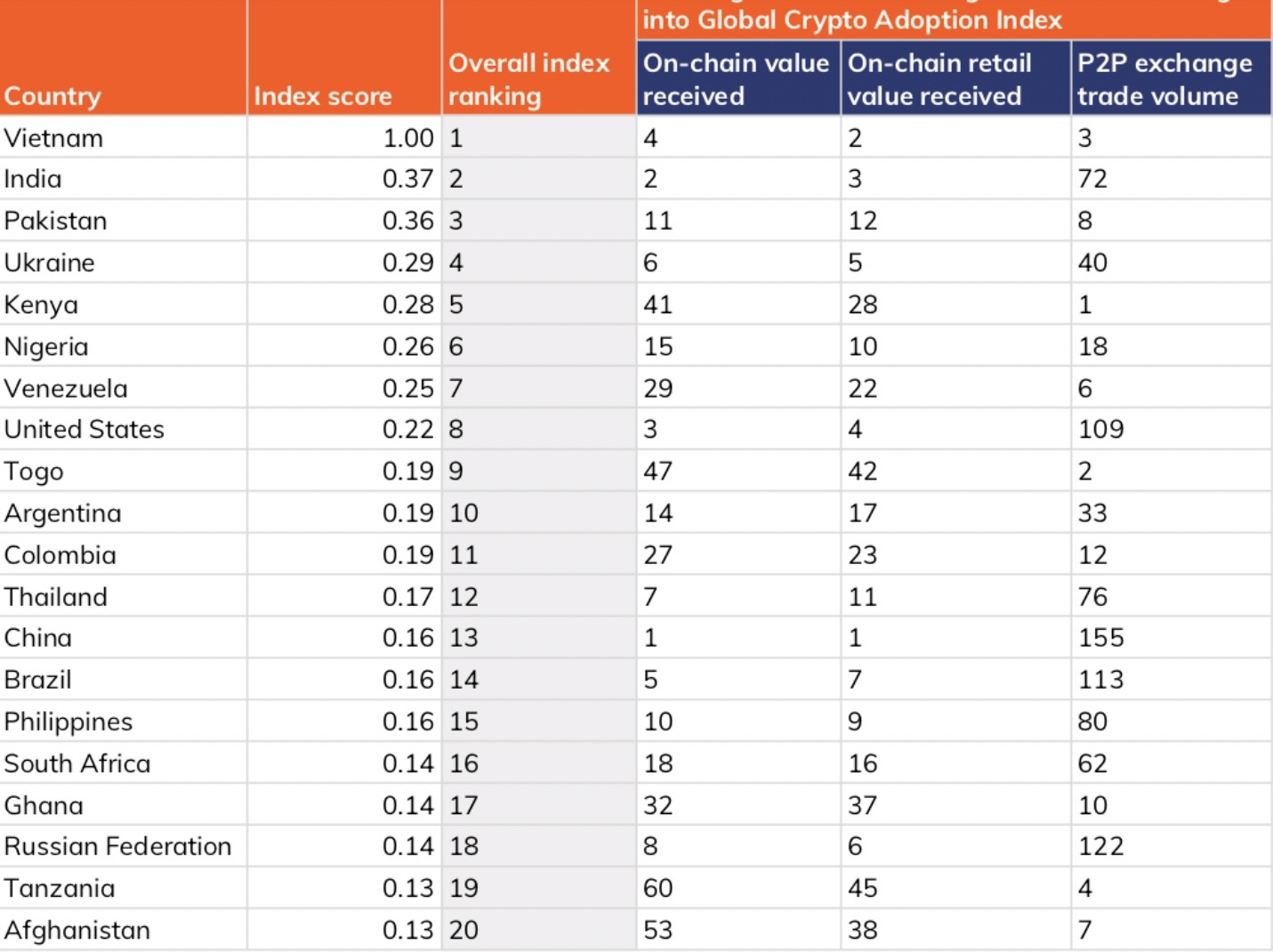

According to Chainanalysis, worldwide adoption has surged 880%, with p2p platforms being the catalyst for the spike in cryptocurrency usage. Looking at the chart above, we can assess the top 20 countries in terms of crypto adoption with metrics weighing each province’s total on-chain value, retail value, and exchange volume. A country’s overall score is calculated by ranking each country according to the three metrics, then taking the mean for each country’s rank in those metrics and modernizing the final number on a scale of 0-1; the higher a country is to 1, the higher they rank. We’ll discuss each of the metrics in further detail:

On-chain crypto value received

This metric measures a country’s overall cryptocurrency activity, favoring countries where activity is more significant based on the wealth per average citizen. A country’s purchasing power parity (PPP) compares a country’s currency value to that of another country’s currency in terms of specific goods (in this case, crypto assets). Chainanalysis weighs a country’s total value received by a country’s PPP which gives us a ratio, the higher a country’s ratio, the higher the rank. Countries with a lower PPP will rank ahead of countries with a higher PPP if they share an equal value of on-chain cryptocurrency, being because the former country has more overall wealth tied into digital assets than the latter.

On-chain retail value transferred

Chainanalysis measures retail trading activity based on individual transaction volume and compares it to the country’s average wealth per citizen. Any transaction with less than $10,000 worth of crypto is considered a retail transaction.

P2P exchange trading volume

This metric focuses on countries in which citizens are allocating a greater portion of personal funds into p2p cryptocurrency transactions. When the total volume is calculated, it is then divided by a country’s PPP, and those with lower purchasing power outrank those with higher purchasing power when there is an equal amount of trading volume. All these metrics play a role in determining a country’s overall index score, which affects ranking.

Bottom Line

Cryptocurrency is far from dead, progress may not be moving as quickly as speculators may like, but it continues to move forward nonetheless. Governments and enterprises continue to take that leap of faith into the blockchain-backed economy, many of which are influential players that lead by example. Builtin.com compiles an extensive list of blockchain use cases and applications.

Congratulations @b-kno! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 50 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!