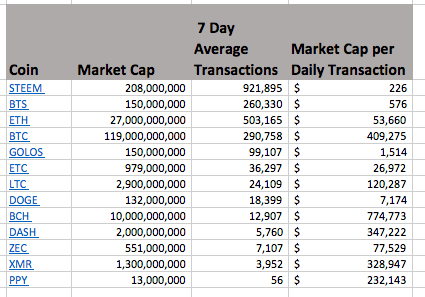

Another way you can look at this is how much is a daily transaction worth on each blockchain. Or if you buy the blockchain, how much of the blockchain do you need to buy per an average transaction? In order to generate an average daily transaction in bitcoin you need $409,275. Might be a bit expensive. In Doge it is only 7,174. Ultimately on could argue it is the transactions that bring value to a blockchain (as with no users they are worthless) but these valuations are not in the same ballpark.

You are viewing a single comment's thread from:

It's the same kind of reasoning behind the AVI index. You'll find your numbers twisted in another way but the ratio is the same. Nice table !

It is the same data, to me it seems easier to understand this way. (Well, to some extent both ways seem a little convoluted with ridiculous numbers, but I haven't found a better way yet. )