INTRODUCTION

Cryptocurrency is an encrypted decentralized digital currency transferred from one electronic technology wallet to another which has been digitally signed for security purposes. This process is confirmed in a public ledger called the Blockchain through mining where everyone on the network is aware about the transaction and the history of each transaction can be traced back to the point where the coins or altcoins are produced.

Recently, news gathered from SEC reports on the potentially unlawful nature of online trading platforms for cryptocurrencies and the dangers attached to all the existing exchange platforms. It warned of the danger in such platforms which could lure users into a false sense of security by not adhering to existing securities regulations. Token exchanges have experienced tremendous growth, their often-amateurish setup and ambiguous regulatory status has left the biggest money managers, such as hedge funds unwilling to put their clients’ money to work in crypto assets. As crypto exchanges continue to settle into a regulatory framework, large investors are beginning to view crypto assets with more interest, and it has become clear that there is an emerging need for a trusted and institutional-grade exchange.

Existing crypto exchanges and traditional financial institutions are conveniently positioned to offer their services to institutional investors, their scorecard on security, trust, and product innovation has left much to be desired by investors. Analysts at Goldman Sachs have pointed to the limitations of crypto exchanges as a key factor that has kept institutional players on the sidelines. Moreover for both Wall Street and crypto exchanges, the old centralized trading business models present rather serious conflicts of interest to the intermediaries who operates them.

According to Christian Catalini of MIT Sloan et al, one of the two ways blockchains will shape innovation is to remove the power from platform operators by allowing a marketplace without the need for a traditional intermediary. Decentralized technologies and exchange such as UberDelta.com, Bancor.Network, oX protocol and atomic wallet platform exchange are well positioned to present compelling solutions to the inherent conflicts arising from intermediaries operating centralized exchanges. It is clear that compliant decentralized equity exchanges have far more to offer institutional investors seeking security, transparency and a more significant share of their trading profits.

Atomic project been a convenient and versatile decentralized solution for the custody-free cryptocurrency trading was basically created as a reaction to the current challenges facing the crypto exchange industry. This platform is the simplest way to connect buyers and sellers within a decentralized framework and that's why Atomic Wallet is a completely new type of decentralized cross-blockchain exchange.

Atomic Wallet is a light wallet solution which works immediately after installation. It includes all essential features:

BTC-LTC Atomic Swaps

Receive and send over 270 assets

Track your portfolio value in different fiat currencies

User-friendly interface

ATOMIC SWAP

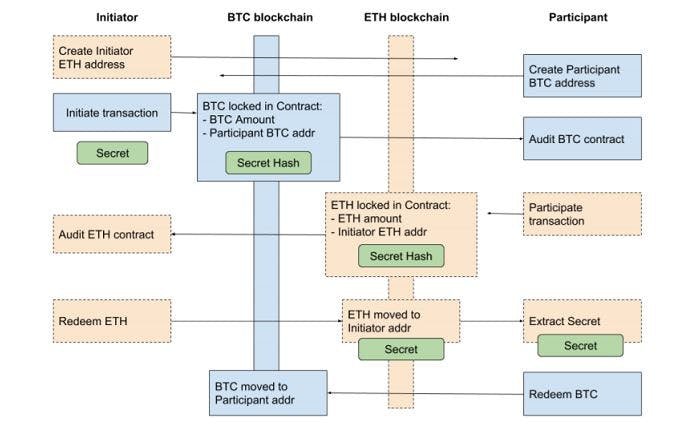

Atomic Wallet works with built-in Atomic Swap Exchange cross-chain swaps avoiding third-party risks. Basically, party A sends Coin A to party B’s Coin B address through blockchain while party B does the same with Coin B. These actions happen independently on parallel blockchain in a one-way fashion, such setup raises the possibility of either of the parties never honoring their end of an agreement. One of the ways to solve this issue is involvement of a trusted third party and atomic cross-chain swap on the other hand solves this problem without the need for a third party. Atomic Swap main features include the following;

● Blockchain-based and peer-to-peer order execution

● Rapid and secure data transfer with Atomic Distributed Order Book

● Distributed Order Book anti spam and fraud protection

● Lowest transaction fees: for instance, each party pays 0.0002 BTC and 0.0001 LTC for BTC-LTC swap for any amount of coins

● An order is an offer, not a commitment

● Order placement doesn’t block customers’ funds

● An order can be executed with multiple trades

● Offline traders cannot trade

● Execution is a manual operation

● Maker is free to reject execution

ATOMIC WALLET TOKEN (AWC) ANALYSIS

AWC is issued to regulate Atomic Wallet service prices in a decentralized and egalitarian manner been a universal method of payment for cryptocurrency listing in Atomic Wallet, currency promotion or swap order interface placement.

Ticker: AWC

Full name: Atomic Wallet Coin

Decimals: 8

Total supply: 100,000,000 AWC

Team vesting plan: 25% per year

CONCLUSION

In conclusion, Atomic Wallet is designed as multicurrency light wallet which will support all major currencies but if you want to speed this process up the payments in AWC accepted to cut the line. To know more about this project, the links provided below will really be of help.

WEBSITE: https://atomicwallet.io

WHITEPAPER: https://download.atomicwallet.io/atomicwallet-whitepaper.pdf

TELEGRAM: https://t.me/atomicwalletchat

MEDIUM: https://medium.com/atomic-wallet

TWITTER: https://twitter.com/atomicwallet

ANN THREAD: https://bitcointalk.org/index.php?topic=4437510.0

WRITER BITCOINTALK USERNAME: lumibaba

WRITER BITCOINTALK ADDRESS: https://bitcointalk.org/index.php?action=profile;u=2151502

WRITER ETH ADDRESS: 0x83b1556667E1A776Db4Eb9e9373c5Ea1F3308a24

Coins mentioned in post: