INTRODUCTION

The daunting challenges of MSMEs in the aspect of obtaining loan in the decentralised marketplace is worth attending to since there is no way the affected enterprises could grow should it linger on. For sometimes now, the decentralised loan in the marketplaces that should serve small entities have no been accessible to the majority not to talk of being enough, and lenders too in the centralised system in some ways lenders in the economy could be blamed for the inefficient credit models and the loan rates that were just too high. This kept most loan receipients that have no formal credit history in a position of disadvantage to be given no loan no matter how in need they might be. Thankfully, they wouldn't have to be pushed to the dead end because the PNGME platform is made for the purpose of rectifying these problems.

THE PNGME LOANING SOLUTIONS

This platform has come with the way out to the challenges of loan receipients which often times lack lenders or don't meet up with their standard to qualify for loans. They won't face high APRs as before and the lending rates will be minimal and lesser than the 200APR.

The solutions brought however includes;

An exposed marketplace lending where all loan receipients can have suitable lenders and capitals in form of digital assets to help them raise their capital and make them independent. The loan receipients includes the MFIs, the digital assets hedge funds,. MSMEs and the mobile money network. They are going to be the beneficiaries of the new solutions.

The loan to be given here could be obtained with any form of collaterals be it the digital assets, traditional money or anything that is valuable and possessed by the loan receipients and not necessarily one type. This will reduce the risk involved in the process and make loan receipients confident.

The loan receipients alone won't just be the only ones to benefit from the credit scoring models but also their customers as well. This way, the mobile money network clients will be benefited. The application will be massively adopted by so many and lenders will be aware of the difference that has made as well as the new composition of the digital bonds offered to all in the marketplace to manage risk profiles. This solution however will lead to the effective pricing of the coupon rates that should improve the digital bond operation.

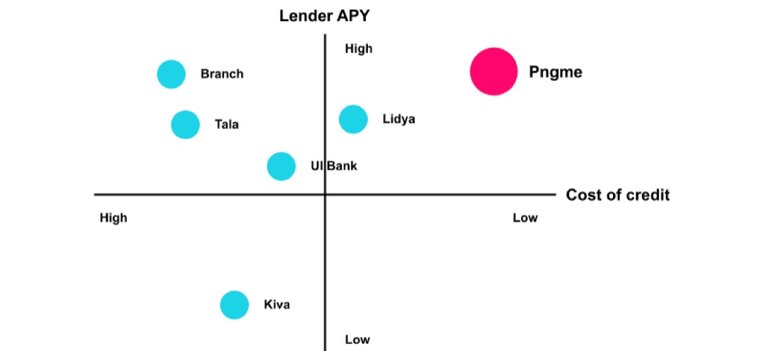

There would be a perfect distruption of the lending applications with an aim to improve on the pricing models and to raise the competition in the market. The pricing models as well will be improved on with an effective APR to make customers satisfied with their chosen enterprises in the marketplace.

In this platform, a reverse Dutch auction is used to set the lending rates and that makes participants who are ready to buy loans get them at friendly rates in ybe market. Lenders here can also buy loans from the borrower with minimum risk as they settle on the very transparent risk metadata.

[https://docsend.com/view/x4ts5tm)

[https://docsend.com/view/x4ts5tm)

CONCLUSION

Finally, PNGME provides loan receipients in its ecosystem with an hybrid credit score that makes them access cost effective credit even if they don't have a formal credit score which could have served the same purpose. They can however get the credit from the established network of the Mobile Money Network or the MFIs because they work with the app as integrated into it. The lending marketplace is now well structured through this platform and its mobile friendly interface and app which will serve all lending and payment transactions to the customers.

USEFUL LINKS

Website: https://pngme.com/

Whitepaper: https://docsend.com/view/x4ts5tm

Telegram: https://t.me/pngmecommunity

Twitter: https://twitter.com/pngmemobile

Facebook profile: https://www.facebook.com/pngme

AUTHOR'S DETAILS

Bitcointalk Username: Waltermeks

Bitcointalk Profile Link: https://bitcointalk.org/index.php?action=profile;u=2576323