Hello!

I am Daria Barkova, the head of HR department at Platinum, a business facilitator of the next generation. Our team knows everything about ICO and STO advertizing, and we have more than 100 happy clients on the list! Want your clients to be satisfied? Visit our site:

I am also a part of the UBAI, the world’s only platform for practical education in crypto-economics. Do you want to raise funds for a project and don’t know how? Follow the link and learn all about it:

We continue our journey toward expertise in knowledge of blockchain technology and ICOs, and the opportunities they present for the future. At the end of this lesson, everything about the potential of the ICO fundraising method will be clear to you. We will demonstrate how ICOs have operated in the past. We will examine the innovations likely to be incorporated into this form of fundraising in the future. We will see the opportunities available to future projects as a result of using the ICO method.

Lesson Objectives:

By the end of this lesson you will have learned the following things:

The history and growth of ICOs as a way to raise funds for a project.

The different approaches used by ICOs that have disrupted major industries and sectors.

The industries that have experienced disruption due to the advent of the ICO fundraising method.

How professional teams and companies can help ICO firms in the same way VC’s help early stage companies in traditional industries.

How ICO companies will be adopted and integrated into the mainstream.

Fundamental changes that will be necessary to make ICOs more organized, trusted, and legally compliant.

Why ICOs matter for the future of business & finance.

Terminology:

KYC: Know Your Customer. This is the process of collecting personal information about potential customers or investors to assess the risk of illegality, before entering into a business relationship.

IPO: Initial Public Offering. This is the method a traditional private company uses to offer its stock to the public for the first time in exchange for investment capital.

VC: Venture Capitalist. These are individuals or firms that provide funds to start-ups or small companies.

2FA: Two Factor Authentication. This is an extra layer of security that is also known as “multi factor authentication”. The Google authenticator is the most common example.

Phishing Scam: This is a type of online scam where cyber criminals send an email that looks like it is from a legitimate company, asking the recipient to provide sensitive information.1.

ICO As an Avenue of Opportunities

1.1 Introduction

Why ICOs matter for the future of business & finance? Get the answer after finishing the full course!

1.1 Introduction

Since the first appearance of blockchain technology, people have been debating the continuing preeminence of fiat currency. Pro-crypto analysts argue that cryptocurrency has the potential to replace fiat as the currency of the future. Cryptocurrency is aided by the fact it transcends national borders, and it can transform and innovate quickly in response to different situations in a way that fiat currency cannot.

One of the most valuable innovations of blockchain technology is that it renders intermediaries unnecessary and obsolete. Middlemen acting as trusted third parties between unknown participants in a transaction will simply not be essential in the future. Banks have always been the safe storehouses and trusted channels to transfer money up until now. But the blockchain provides a secure, decentralized, and tamper-proof ledger which poses direct competition to the traditional banking system. Transactions are executed quicker and at lower comparative costs.

1.1 Introduction

MoneyGram has been a major player dominating global money transfer services. Blockchain start-ups are coming forward with competitive platforms that offer faster, cheaper, and more versatile methods of international remittances. After witnessing the exceptional performance of Bitcoin, a vast number of new currencies have sprung up that also base their platform on the principles of blockchain technology. The potential applications of blockchain technology have been most notably demonstrated in the financial sector. The real estate industry, for example, was disrupted by the introduction of Rentberry. The marketing and advertising industry was disrupted by Gnosis, and a host of others as well.

1.1 Introduction

We saw an explosion in the use of the ICO fundraising method in 2017. In May, the ICO for a new web browser called Brave generated approximately $35million in under 30 seconds.

Having previously issued $50million tokens called “Kin” to institutional investors, the popular messaging app developer Kik’s ICO sought to raise an additional $125million from the public, on top of the close to $100million they had already raised.

1.1 Introduction

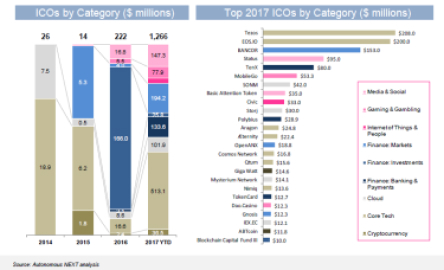

At the beginning of October 2017, ICOs amounting to $2.3billion had already been conducted during the year. This is more than ten times as much as in the entire year of 2016. As of November 2017, around fifty offerings a month were recorded. The highest-grossing ICO as of January 2018 is Filecoin which raised $250million.

You will be amazed to know that $200million of that was raised within the first hour of their token sale!

1.1 Introduction

By the end of 2017, ICOs had raised close to forty times as much capital as they had raised in the previous year. But this amount is still less than 2% of the total capital raised by traditional IPOs, just to provide a degree of context. This comparison is not necessarily fair because most IPO companies already have a functioning, profitable business in operation. But it does give us insight into the sheer depth of our capital markets, and shows us how far the ICO method of fundraising can mature from here.

According to industry newsletter Cointelegraph, companies raised around $6billion via ICOs in 2017; 37% of that amount was made by only twenty ICOs. By February 2018, there was an estimated failure of 46% of the 2017 ICOs. Crowdfunding and syndication lawyer Amy Wan described the coin in an ICO as “a symbol of ownership interest in an enterprise—a digital stock certificate” stating that they are likely subject to regulation as securities in the USA.

1.2 The Most Successful ICO Industries

When ICOs First Launched

Mastercoin was the first project to introduce the ICO model. They secured $5million worth of Bitcoin during their ICO, and that was certainly seen as a big success at the time.

1.2 The Most Successful ICO Industries

The crucial factors to think about in the success of an ICO have been the following:

Is the technology new or inventively applied?

Are reviews on ICO rating sites such as ICO Drops positive?

Does the project clearly solve a problem?

Is there a distinguished team behind the project?

What technical edge does the project have over similar projects?

What is the community sentiment and marketing situation?

1.3 The Most Successful ICO Industries Present Days

Some of the recent projects that have experienced tremendous success are BAT (Basic Attention Token), Rentberry, and EOS. We will examine BAT and Rentberry as our examples.

BAT (Basic Attention Token) – Advertising Industry

Why ICOs matter for the future of business & finance? Get the answer after finishing the full course!

Contact me via Instagram, Facebook, Linkedn and Vkontakte to get the details:

Congratulations @ubai! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!