Hello!

I am Daniil Kapran, a sales manager at Platinum, our team creates the best ICO marketing strategy in the business. We’ve had it all, want to try? Hop on our site and see:

Moreover, we have an outstanding project, which has become our calling, the University of Blockchain and Investing! It’s the first practical blockchain education in the world. Wanna know all about ICO launch platforms and hype influence in the crypto world? Follow the link to learn more:

The Power of Perception

People’s perception of an ICO depends upon several key factors. Due to the incredibly large amount of paper wealth generated by investing in cryptocurrency, people are inclined to invest with less stringent diligence, even regarding their own money. That is, for better or worse, generally more true for crypto as opposed to traditional investors.

2.1 The Power of Perception

Intelligent investors pay particular attention to the following details when evaluating an ICO:

The quality and marketable potential of the idea.

The necessity of a blockchain solution to solve this particular problem.

The quality and commitment of the team to the company.

The tokenmetrics and tokenomics.

The ability to actually bring the solution to market as a viable business.

2.1 Signs of Market Hype & Anticipation

A solid understanding of the signs of market hype and any resulting hyper-anticipation requires a multifaceted approach to evaluating an ICO. All the circumstances, situations, prevailing market conditions, and other factors contribute in various ways and to various degrees, to each ICO.

2.1 Signs of Market Hype & Anticipation

It is important to also understand why different investors are investing. Some are committing capital because they truly believe in the idea as a viable business and are planning to hold on for a longer term. Some people are pure speculators hoping to multiply their money and take a profit as fast as they can. There is nothing inherently wrong with either one of those approaches or reasons to invest! The point is, you just need to know with whom you are investing so you can make the most advantageous decisions about your own funds.

The following are signs of ICO market hype:

The Social Media Factor

When an ICO is looking to build momentum among potential investors, social media is at the top of the list of ways to do it. Social media allows projects to market their product directly to investors without relying upon middlemen, and in many cases, basically, for free.

2.1 Signs of Market Hype & Anticipation

Professional marketers have also appeared recently to help projects focus on developing their project-specific technology, or business connections; while the regular marketing team is able to continue building the necessary awareness and hype.

Many ICO projects seek to build large Telegram communities, and of course, schedule their ICO at the most opportune time.

If you are wondering how a project is being perceived by the market and general community, reading their Telegram and social media posts will give you useful information. You will see how they think, and a get a good look at actual market opinion.

2.1 Signs of Market Hype & Anticipation

Market Participants

Proponents of an ICO token will try to convince people that the token will almost certainly multiply in value. They will attempt to convince people that the token offers a fantastic investment opportunity with great long-term potential and profits for investors.

2.1 Signs of Market Hype & Anticipation

Market dynamics, including liquidity, project support and authenticity of the team’s intentions can result in certain users controlling a very large portion of the tokens. It is important to know the vesting schedules that unlock at different time periods.

2.1 Signs of Market Hype & Anticipation

Some participants will hold their allocation of coins hoping to make more profit long term, while other participants will quickly dump their tokens on the exchange. It is always important to consider who holds what number of tokens, their unlock schedule, their history, as well as the type of investors in the project. That way, you won’t get caught holding at a bad time when you can do nothing but watch your token go down in both price and/or trading volume.

ICO Investors

Buy the full course to know all about the overall influence hype on a team and anyone involved in an ICO project.

Get this course!

2.1 Signs of Market Hype & Anticipation

The presence of sophisticated Venture Capitalists is an especially good indication of a strong and well-managed ICO. VC money can be used for future expansion etc. These are partners who will provide future business opportunities and support, as well as the domain-specific knowledge that can help the team actually adhere to their stated timeline.

Powerful partners will allow teams to retain key team members as well as supplement their employee team when they need to further develop and expand.

Tokenomics/Tokenmetrics Offered

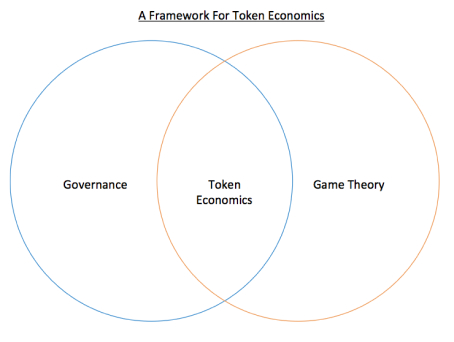

What is commonly referred to as Tokenomics (Token Economics) or Token Metrics, is vital to understand what makes a project valuable from an investment perspective. Both of these terms refer to the overall structure of a token sale and the function of its token as a utility or security.

2.1 Signs of Market Hype & Anticipation

The elements that constitute token economies are best thought of in three distinct categories:

2.1 Signs of Market Hype & Anticipation

ICO Fundraising Metrics

How much money will be raised, how will the funds be spent, what bonuses are given to investors, token lock-up periods etc.

ICO Token Allocation

What percentage of tokens go to the team and its advisors, what percent is sold to the public, how long are team tokens locked up, etc.

ICO Token Metrics

How will the token be used in the ecosystem, is there staking or other means by which the circulating supply will be reduced, is the token inflationary or deflationary, is it mined or pre-mined, token burn etc.

2.2 Hype’s Affect Upon an ICO

Over the years, too many crypto lovers invested in hyped and overrated digital assets that promised a 10x ROI (return on investment). This incredibly large rate of return attracted many eager (sometimes a little too gullible) investors. They eventually learned that while the price of ICO tokens may in fact increase 3x or 10x; they can also fall just as much, and just as easily.

Many tokens offered as a part of the early ICOs either never went to market, or failed miserably when they did. Of course there are no guarantees in traditional investing either, but crypto is still at a particularly volatile and treacherous stage of growth.

Basically, an ICO token price should primarily be driven by business fundamentals, such as cash flow and profitability. But the wild swings in value, and the low barriers to launch an ICO, have grossly amplified the influence hype has upon an ICO token price.

2.2 Hype’s Affect Upon an ICO

Naturally, investors are focused on their own return on investment more than anything else. So, that is where we will focus our attention now too. This return ultimately rests with the token price, and the ability of the investors to buy low and sell high. There are four key attributes or characteristics of hype which directly lead to stronger demand for a token, and thus, a higher price.

If the ICO is backed by influential and well-known crypto investors/Venture Capitalists, the team is very likely to have a large investor base to which they can pitch the coin. This is also true for successful entrepreneurs with a good reputation and track record.

2.2 Hype’s Affect Upon an ICO

They may have a following of possible investors, people who made profitable investments in their projects before. So the ICO can be put in front of a large number of investors, all of whom might purchase tokens, further driving demand and increasing good hype in the project.

2.2 Hype’s Affect Upon an ICO

It is also worth noting that the opposite is equally true. Investors who have lost money before are likely to have a very clear memory of who was involved in, and responsible for, that disappointing venture. While an increasingly large number of early stage ventures have thought of an ICO as a quick and easy way to raise funds without the cost and complications of other middlemen; the lack of a good reputation and the lack of support for a project will severely handicap the ability of the ICO to raise funds.

Quality of the Idea

Many ideas have failed at their ICO for one reason or another. But we must be honest and say that with the extremely low barriers to entry, there have simply been many terrible ideas that have been brought to market.

2.2 Hype’s Affect Upon an ICO

This market experience has, however, taught the increasingly discerning crypto investor to be able to determine if an idea is viable, as well as calculate its relative value in the marketplace. If an ICO team has a product that solves a significant problem which produces actual commercial value, it will be to easy build good hype. A project with a strong foundation can produce extraordinary results in token sales.

Another key thing to note is the complexity or technical knowledge required to assess the quality of an idea. Many projects might be incredibly technical, wherein only those with domain specific knowledge are able to properly evaluate the idea. There have been many examples of incredibly technical ICOs both succeeding and failing. A project does not automatically succeed because everyone involved is a domain expert regarding that solution. But a project is in fact more likely to fail because the investors are not trading upon fundamentals and they lack a sufficiently nuanced understanding of the project.

2.2 Hype’s Affect Upon an ICO

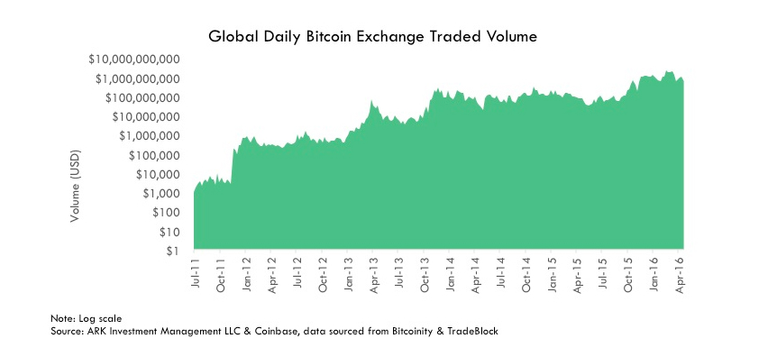

Exchange Listings and Liquidity

The ability to list on exchanges again provides a larger investor base to which to pitch the token. It raises the token profile and also provides an increasingly large amount of market support for current and future token holders who can trade in a more liquid market. The exchanges on which a token is listed, as well as the trading volume and liquidity of that token, play a tremendous role in the support and upward movement of the token price.

2.2 Hype’s Affect Upon an ICO

Market Support for the Token after the ICO

Consider that many investors either buy into an ICO at the pre-sale or during the primary sale. And, there are varying vesting schedules attached. Therefore, all investors keep an eye on the environment into which they will be trading when the token vesting schedules vest. It creates a great degree of uncertainty about price if all of a project’s tokens become unlocked at the same time. Many successful projects will not only produce a clear timeline of their vesting schedule, but also other significant plans, actions, and future partners. All of that is so investors are able to see what the primary influences upon a coin’s value will be, and perhaps also see pockets of opportunity for the investors to either sell and exit, or buy to build an even bigger position.

2.3 Hype’s Effect on the Team Behind ICO

The team structure behind an ICO plays an important role in the hype process. If an ICO is successful, the developers are likely to draw more attention to themselves, thereby becoming key figures in that success. In that way, an ICO allows a project to both fund an early stage idea, as well as to create a reputation among investors for the individuals involved.

2.3 Hype’s Effect on the Team Behind ICO

After having achieved success on previous ventures, as we have mentioned before, investors will be keen to invest based on an established track record. These factors encourage entrepreneurs to try new ideas as a benefit of having a greater funding profile and a tangible resume to use in all aspects of their business, not just fundraising.

A strong resume like that encourages confidence that would allow an individual associated with a successful project to partner with larger, traditional firms. Such an individual would also be more valuable on other projects by both providing insight and access to more investment capital.

That’s all, folks! Buy the full course to know all about the overall influence hype on a team and anyone involved in an ICO project.

Learn more about Platinum ICO promotion services, contact me via LinkedIn right now:

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://medium.com/@UBAI_blockchain/hype-in-an-ico-bb6a44ace4b8

✅ Enjoy the vote! For more amazing content, please follow @themadcurator for a chance to receive more free votes!