Welcome back to another Quarterly update from the Titan Crypto Management Team. In these trying market times, we’re very happy to announce a couple new assets added to the Titan Fund as well as where we think the market is headed (don’t worry…it's good news!).

As always, please subscribe to our website and follow us on Twitter @TitanCryptoFund. Feel free to share, tweet/retweet, and like our posts to help our crypto-community grow.

While the Titan Team has been actively working to manage our distributed portfolio, we do appreciate the respectful enthusiasm many of you have shown us as our strategy holds true even in substantial corrections such as the one we’re facing.

Our goal is to keep you as informed as possible, and we want to make sure you’re granted every opportunity for increased exposure in this nascent industry.

In this update, we’ll be sharing with you:

Portfolio Performance for Q1

Market Status and Future Predictions

Regulatory Outlook

Titan’s Future

Portfolio Performance:

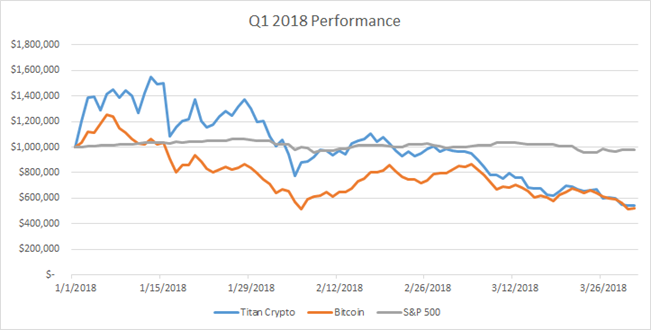

Coming off the incredible rally of Q4 2018 the overall crypto market saw a very difficult start to the year with asset values in retreat. This was to be expected as a natural offset to the astronomical gains of 2017.

We believe the consolidation is driven by many divergent factors but it's worth mentioning 3 of the big ones.

The first is a negative response to global finance and regulators further acknowledging and fearing the unbridled rise of crypto asset investing, as more countries begin regulating we will see investor sensitivity at any sign of bad news sentiment.

Regulatory scrutiny of ICOs with some high profile enforcement actions absolutely cooled the market and many serious teams moved to a private placement model locking the average investor out.

Another key factor is a large surge of uninformed investors flooded the market in the second half of 2017, applying a shotgun approach without understanding or appreciating any market fundamentals or having any real investment thesis.

Finally, its likely many large institutional investors and crypto “whales” took the opportunity to take gains in fiat toward the end of January, and the resulting sell volume likely spooked the more fickle investors creating a downward momentum on the entire space.

We have seen this all before - volatility occurs when uninformed investors who are highly news sensitive and lacking an investment thesis flood the market.

At Titan we understand the fundamentals and use a disciplined and diversified strategy to take advantage of these opportunities. The crypto market has been through periods where little progress was being made but valuations took an enormous step forward, but this case is more interesting because it's the opposite, we see lots of progress in the technology and broad adoption of distributed ledger technologies yet a stepping back in valuations driven by other factors.

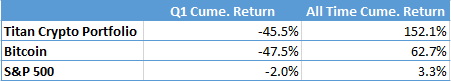

This is the sweet spot where investors who understand what drives the long term value in the space can deploy capital to incredible projects with real world traction at great prices. While portfolio values will reflect the turnaround in early 2018, the inception-to-date performance of the overall Titan portfolio remains at +152%.

As stated above, Crypto assets have lost 50% of their value since their December highs. Regulators have clamped down on exchanges and ICOs. Exchanges have continued to experience heists. Intra fighting amongst the crypto community has been rampant.

Despite the turmoil, we at Titan seen a larger market on the horizon. Here’s why:

Wall Street skepticism is falling to the wayside. The Goldman Sachs Macro Conference hosted a panel that included Mike Novogratz and William Quigley. The tone of Goldman employees and their buy-side clients was incredibly constructive on crypto. Even more interesting, while large banks continue to publicly denounce the space, nearly everyone we’ve spoken to (employees of Goldman, hedge funds, large asset managers) privately loves crypto, and trades significantly in their personal accounts. Fast forward a few weeks and now well-respected investors are going public with in their interest in crypto:

on April 7th Bloomberg announced that Soros Management had approved trading in digital currencies, John Burbank announced plans to raise $150 million to do the same, as did billionaire Alan Howard.

Talent is pouring into the space. The University of Pennsylvania Blockchain Conference was packed with students eager to get jobs in blockchain – and not just with fad-chasing MBAs, computer science engineers attended in equally significant numbers. MIT’s Business of Blockchain Conference sold out in a matter of hours. Universities aside, venture-backed firms like Consensys have hired (and are continuing to hire) armies of engineers to attack and re-invent industries on blockchains.

For example, high-profile enterprise blockchainers, like JPMorgan’s Amber Baldet, have determined that the timing is right to leave their corporations and launch startups.

The future is far from certain. While all this positivity may not translate to higher crypto prices in the near term, its clear the industry itself is expanding. What will dictate prices in the coming months?

First off, regulations are far from being definitive. Next, technological hurdles must be surpassed; scalability and privacy solutions will certainly grown adoption.

As the year continues to unfold, Titan maintains positions in dollar-pegged cryptos, with an emphasis on decentralized application platforms, and will continue to allocate capital to those projects that offer the most promising solutions to privacy and scalability. Yes, the ride down from mid-December has been a painful one, but we’ve seen this before, and are more confident than ever that the best is yet to come. It may be a wild ride, but we’re in it for the long haul.

STEEM BOT:

Recently, Titan entered into a partnership with a Philadelphia based software developer who created a bot that operates on the Steem Blockchain. Essentially, Titan is staking its Steem token on the Steem platform, and using this bot to provide additional voting power to users of the Steem social media website.

As a result, the portfolio is making additional Steem tokens on top of what we already hold. This is just another way to mitigate the inherent volatility risk associated with cryptos, and we’re happy with the results so far, adding almost 10% annual revenue onto of any value increase for the Steem tokens held in the portfolio.

CARDONA:

Separately, Cardona (ADA) has made significant waves over the last 6 months in the crypto space, and we think this is justified. Cardano is seen as a 3rd generation crypto meaning it’s ethos is to resolve the major issues we see in blockchain tech which is scalability, sustainability, and interoperability.

The goal of Cardano is to create a platform for the exchange of smart contracts, with a focus on security through a layered architecture. It is similar to Ethereum in that it is a platform for smart contracts but it is majorly different in its underlying technology. Titan has added ADA to its portfolio for the advanced technological aspects that we perceive to be changing the way we address decentralized application development.

For more detailed analysis of either of this new projects, email us at contact@titanventures.io

Final Thoughts:

First and foremost, we have long-term strategies in place with the majority of our holdings. In our experience, the most thoroughly developed portfolio wins out overtime. Our goal is to deliver strong results. While we believe we’ve provided that so far, we are looking to the future to further develop opportunities in the crypto space. We expect the markets to be choppy in the near-term, but are optimistic for the latter part of 2018.

Also, we’re hear to answer any and all questions, so don’t hesitate to reach out.

Looking forward to growing as a crypto family,

-The Titan Team