If you follow the news, you might have heard about Bitcoins and Blockchain but you couldn’t understand it really well. It might not be the easiest thing to explain, but I’ll try to put it simple.

What is the difference between Blockchain and Bitcoin?

Bitcoin is a digital currency, such as USD or EUR, only that it was created virtually in the online environment. On the other hand, Blockchain is the technology which allows Bitcoins to be traded in peer-to-peer transactions with the help of mathematics that send information in bits of data. The advantage of Blockchain is that it is a decentralized system, which means it is not own by any individual or private company, but rather is a service formed with the help of a community.

What are the risks of using Bitcoins?

One of the reasons Bitcoins have not become a standard payment method is because the sender of money cannot be tracked or identified. For some this is an advantage, and therefore the black market could be created to trade illegal things or services online. Another risk is that because of the decentralized system, there is no escrow service which guarantees that your peer-to-peer transactions end up successfully, an if they don’t, no one is going to be held responsible for your loss.

What are the advantages of Bitcoins?

Bitcoin is just another cryptocurrency and it does not offer any advantage in comparison to other digital currencies, except that it is the most trustworthy at the moment. We should look more on the technology behind Bitcoins, which is called Blockchain and is where the innovation really comes in.

Want to find out more about Blockchain? Then read our next article How can your business benefit from Blockchain technology.

Why is there so much attention around Bitcoin lately?

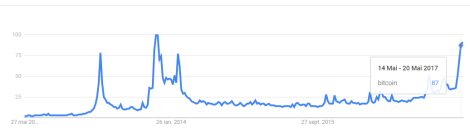

Looking at the past, Bitcoins have been around 2012’s but only took off in 2014 when the price hit USD 1,100. By looking at the google searches, the world “Bitcoin” was the 4th most searched “What is…?” term of 2014. Since than, it has been in decline, making a lot of people lose their trust in the currency and take their money out of this investment. It lasted three years until March 2017 when the price when to USD 1,200 only to see it rise over USD 2,000 over three months until the end of May. And together with Bitcoin, many other alt coins have been experiencing the same trend.

What other digital currencies are there?

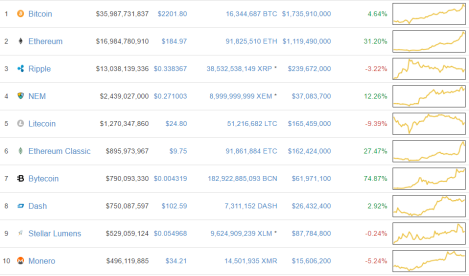

Over the last years there have been a huge increase in the number of digital currencies, mostly referred to as alternative coins or alt coins. Examples of this are mentioned below. Their size is reported to Bitcoin, which is the leader with market capital of USD 33 Billion, with one Bitcoin worth USD 2,000. As it can be seen in the right-sided price graph, the majority of these digital currencies have been doubled their value in just a few months’ time.

Why is so interesting about cryptocurrencies?

Cryptocurrencies (digital virtual currency that uses cryptography for security) are not new in the market, in comparison to Forex trading. Forex (FX) is the largest, most liquid market in the world, with average traded values that can be trillions of dollars per day and includes all of the currencies in the world. In contrast, the first cryptocurrency (Bitcoin) was launched in 2009 by an individual or group, having 14.6 million coins in circulation with a total market value of $3.4 billion in 2015 and $79 billion at current time of writing (May 2017). It still cannot be compared with the average $4 trillion a day by Forex, but the steady growth of digital currencies value is something you can’t ignore either.

What contributes to the rise in value of cryptocurrencies?

- Popularity

The first thing to mention is the rising interest of traders, as measured by trading volume at major exchanges. At the beginning of May 2017, Kraken indicated that the trading volume across all digital assets surpassed $178m, setting an all-time high and beating the prior record by 25%. The positive publicity will only continue to attract new capital into bitcoin from investors.

- Regulation

Another factor that drive bitcoins prices is the rising influence of Japan in the bitcoin markets, where bitcoin is seen as a legal method of payment starting 1st April. The Japanese yen is the single largest currency being exchanged for bitcoin, accounting for more than 45% of the money flow into bitcoin at the time of report, according to CryptoCompare data. In comparison, the US dollar makes up approximately 30% of money flowing into bitcoin.

- Trust

As cryptocurrencies gain momentum, other countries start looking at Bitcoin with other eyes. For example, the Blockchain industry is booming in Australia, recently after the Australian Tax Office announced changes to tax laws, surrounding how digital currencies are treated in the country. In the few weeks after the announcement, active Blockchain communities and events such as RegHack DownUnder have launched across the country, supported by universities and government regulators.

What makes a cryptocurrency worth investing in?

The answer is longevity, I'll tell you why.

Looking at the market, we see many different alt coins appearing every week. At the moment of writing there are 830 different digital currencies, as listed here. So what makes a currency better than the other? There are a few things everyone should consider looking at.

First of all, a currency worth to invest in is one that you can be sure will be on the market for a longer period of time for your long-term investment. A good sign to spot this is by looking if the cryptocurrency projects offer simple feature-projects or platform-projects, with the latest type being preferred.

For example, Ethereum is a platform that enables people to build applications and smart-contracts upon, and is at little risk of something like Bitcoin stealing its power – because it’s not based on a feature or two, but an entire “digital world”. Take Exodus, the multi-cryptocurrency wallet, as another example, which provides a real life use-case, and is available and easy to use by the masses. ICONOMI is another good example of cryptocurrency-based technology that will exist (later this year) as a platform for cryptocurrency investors to invest in. Another one which is worth taking a look at is Particl, an open source, decentralized privacy platform built for global person to person eCommerce.

This being said, out of the 800+ cryptocurrencies, there are only 20 to 30 arguably “viable” projects today to invest for a long-term orientation.

Why would you invest your money in cryptocurrencies rather than banks?

The cryptocurrency market is growing at high pace, with Bitcoin being the leader of it (which will probably stay like this), and some more alt coins which gain popularity and can double their value in just a few months. Events such as the regulation of Bitcoin in Japan make more that trust the movement and gives a feeling of security and attracts even more adopters. Taking a look at who is backing up some projects, we see big names behind it such as J.P. Morgan Chase, Microsoft, and Intel, together with other members of the Ethereum alliance which include Accenture, BBVA, BNY Mellon, BNP Paribas, BP, Cisco, Credit Suisse, ING, Thomson Reuters, and UBS. Having these names next to Ethereum proves that this is a trustworthy place to invest your money for long-term period. There are also other platform-based projects which are as trustworthy as this one, but for the sake of this article I will only mention this one, leaving the rest of them for your own research.

Want to find out more on how to start investing in cryptocurrencies? Then read our next article Step-by-step guide to invest in cryptocurrencies.