"Understanding Blockchain" is akin to understanding the universe. The field is vast, and those that wield this tool come from different galaxies of ideology, and separate worlds of utility.

Just like the internet, the potential of this new suite of technology is only limited to the human imagination.

And similarly so, you don't have to understand how a secure hashing algorithm works in order to transact across the blockchain. Anyone without a technical background can open an encrypted wallet and send or receive value across the network (such as sending someone $20 worth of bitcoin)...just as one need not understand Hypertext Transfer Protocol to send an email.

It's worth mentioning that a basic understanding of blockchain is necessary, particularly on why it's considered so "disruptive". Buzzwords deployed throughout the articles that litter the internet with the word "BLOCKCHAIN" in the headline mean nothing without context and on how it can be applicable to the reader.

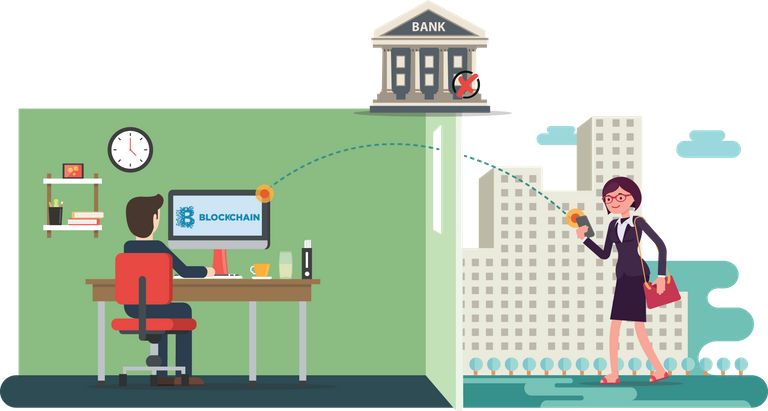

Below is a phenomenally concise and informative visual description of blockchain and its potential to disrupt the very intermediary systems that inspired its creation.

Disclaimer: In the spirit of propagating only correct and easily digestible information, I've transcribed most of the audio script. The writing below is 98% a transcription of the video I've featured in this article. All credit goes to TED Institute

Blockchain and the Middleman | TED Institute

Entire industries such as payments or securities clearing have evolved to rely on middlemen.

Why? Because they establish TRUST, where there is none.

It's worth mentioning, however, that the word "trust" is often deployed as a buzzword within any article written about blockchain and its impact on industries from healthcare to gambling.

Let's break down what this word means within the context of

intermediary ecology:

Middlemen have traditionally established trust by:

- Establishing OWNERSHIP that the seller has the right to sell what is being sold.

- Attesting a HISTORY that there is a clean transaction record.

- Certifying the ABILITY that the buyer has the money to buy an object from the seller.

These are all pretty critical details when you don't know the person on the other side of the transaction. Hence why we've relied upon middlemen such as banks and brokers for so long.

Intermediaries know and trust each other. Their business is based on it. So, they have more to lose than gain from breaching that trust.

But what if there were a better, faster, CHEAPER middleman? One that didn't add as much cost, complexity, and chance for human error?...Perhaps one that didn't rely on trust between humans at all?

There is, and it's called Blockchain and it has the potential to disrupt the entire ecology of intermediaries.

Blockchain is a distributed ledger that relies on large networks of computers that redundantly encode transaction data by solving complex mathematical equations.

The secure ledger provides an inviolable record of every transaction that has ever occurred.

If the history of an instrument is incorruptible and available to all parties, there's no need for a third party to vouch.

Remember the 3 Ways by Which Middlemen have Traditionally Established Trust Between 2 Parties? Blockchain replaces this as:

Proof-of-History

Proof-of-Ability

…in non-centralized, encrypted form that's fast, transparent, and free of error

The question is not whether blockchains can cut out the middleman in complex transactions, but rather which middlemen and when?