The block chain was developed for digitized transactions. It however took a different dimension when certain test-run was made. To test the popularity of fiat currencies, a variation was created. Soon after Bitcoin was unveiled, there was massive rush for it. Hence, the currency gathered widespread acceptance within the period of its launch. Drawing inspiration from this, many other projects were unveiled in later years.

It became apparent that the block chain was fast losing its direction. After a literal coup by powerful miners, Bitcoin was taken over and regulations concentrated on few hands. It was therefore ironical that the block chain that boasted of decentralization was centrally regulated. Subsequent platforms solved the problem to some extent. Technologies such as smart contract helped towards this.

As more projects were conceived, the number of cryptographic currencies and assets grew. Against the backdrop of limited regulations, one cannot say for sure if a currency is decentralized or not.

Unanimous Exchange

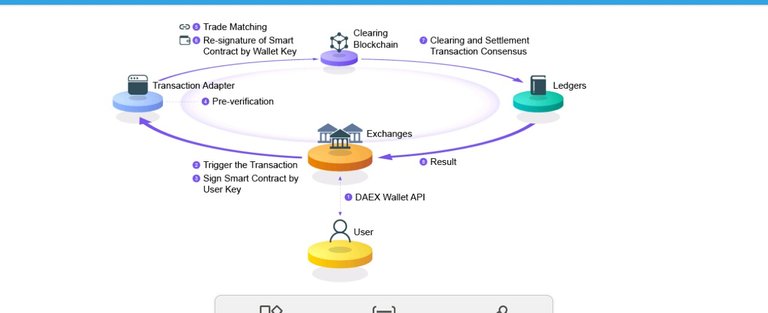

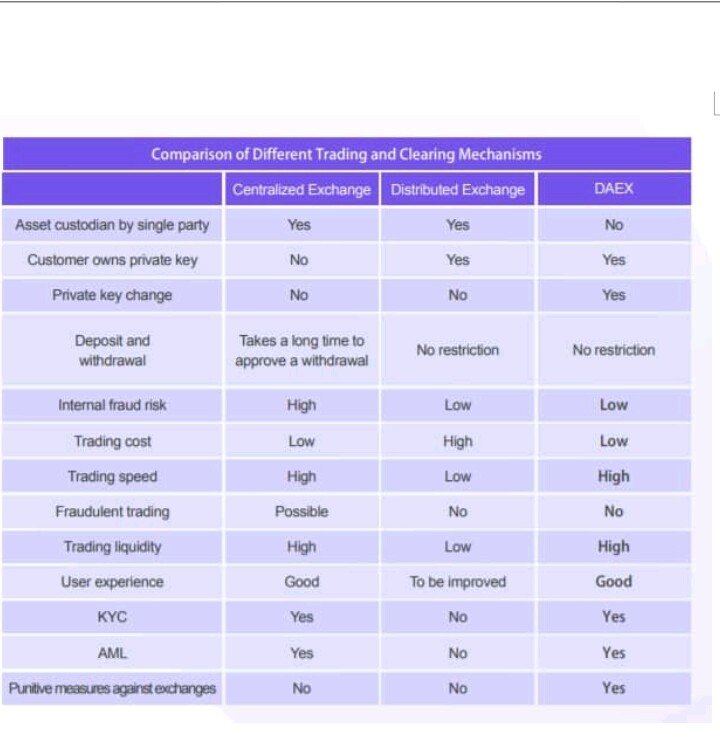

Cryptographic currencies can only be traded. Aside emerging platforms that accept it as exchange, exchanging these currencies are carried out on the net. Inundated by centralization of exchanges, a decentralized format was released. DEX has its downsides but is viable than CEX. For interoperability, DAEX joins these two. By this act, gains will be derived from them and released towards throughput of the platform.

With its coming, digital assets have grown into full-blown market. They now have regulations by themselves while fostering peer transactions. Haven taken cue from centralized exchanges, CEX held the stead till DEX was birthed. CEX was in turn decentralized. With its partnership with DEX, hybrid ecosystem was formulated.

Features

Ecosystem has same function as petrol to cars. Transactions processed by smart contracts are realized here. For this reason, concentration is laid on DAEX’s ecosystem. It meets the three core pain points of previous exchanges.

Patterned as open-source, DAEX has its ecosystem open to interested parties. Of prominence are exchanges. Different exchanges can take part and utilize what the platform has to offer.

There is also protection of assets. Powered by the block chain and smart contract, DAEX’s ecosystem is well-secured against third-party interference. There’s a literal 2FA embodied in private keys. Except a user authorizes access to his asset, same cannot be used.

Bringing on its clearing chain, DAEX decouples exchange clearance from its trade. Hence, there will be different approaches to these.

Clearing Exchanges

The core goal of the project is fostering transparency in exchanges. Over the years, there have been many digital assets under the alibi of decentralization. Critical insight reveals most are not truly what they claim.

With its clearing chain, DAEX will sift verified exchanges and foster their trades. Using its Clearing as a Service (CaaS) protocol, DAEX makes unbiased judgment on these assets. Furthermore, assets are listed on the platform for trade in verified exchanges.

BENEFITS

Exchanges will derive immense upsides when listed on DAEX. Haven being separated from trades, exchanges can have more time attending to main issues. The platform also allows cross-trades among wallets. Buoyed by reduced costs and incentives, trading on DAEX will be beneficial to interested users.

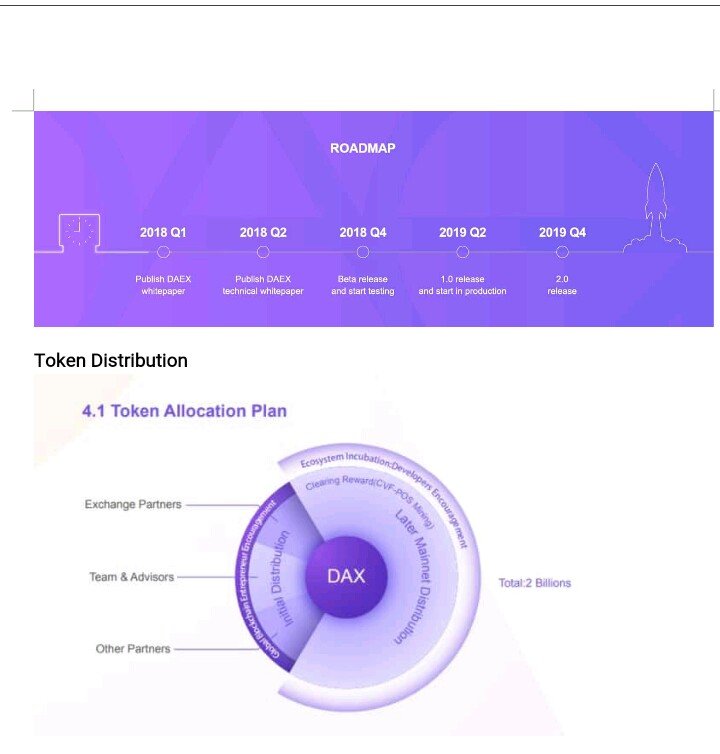

ROADMAP

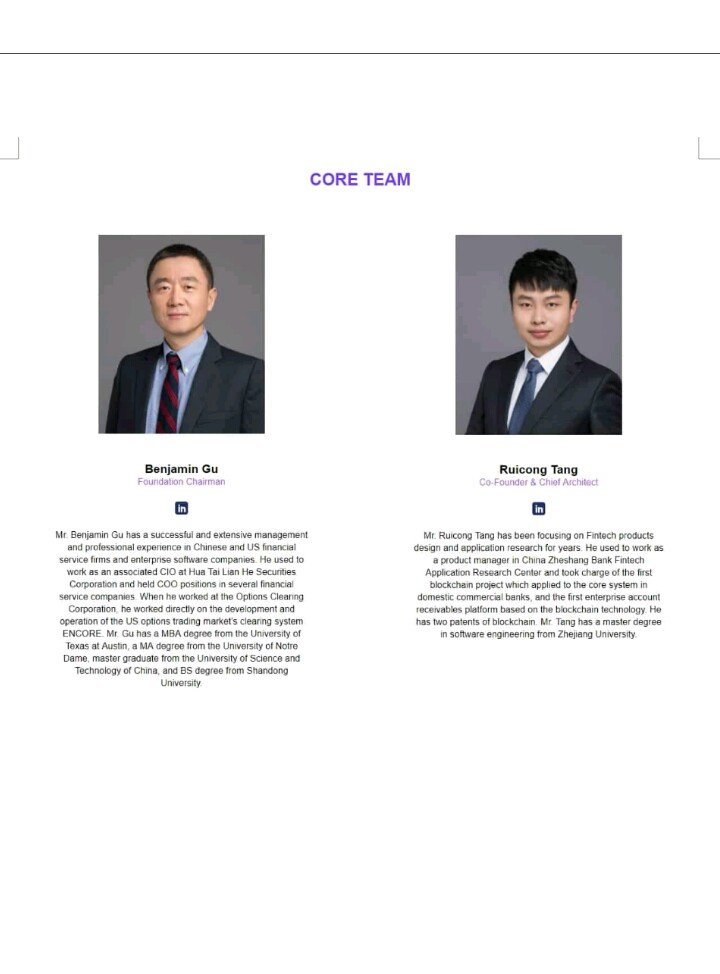

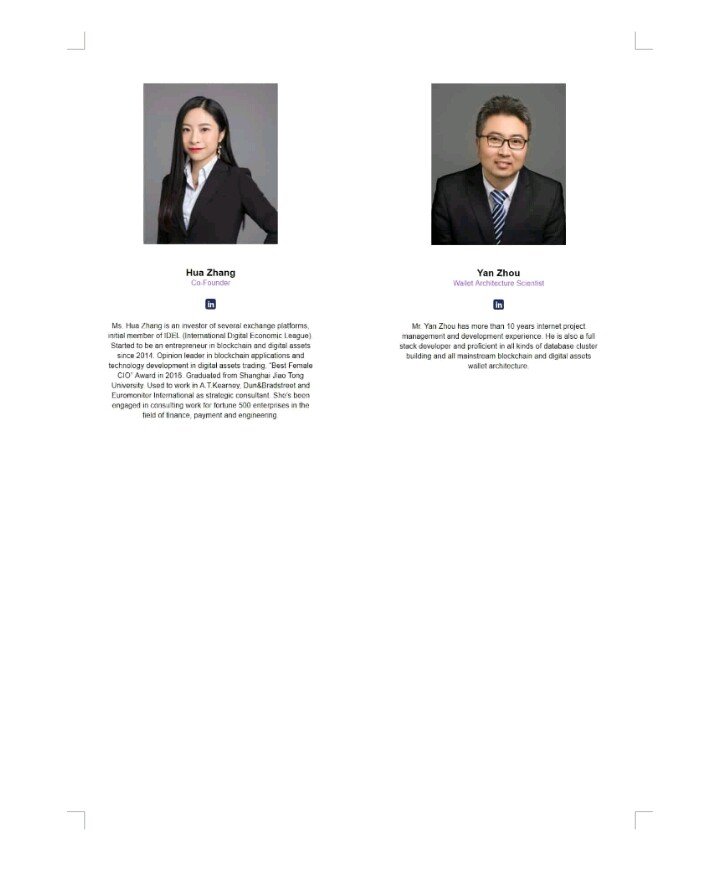

THE TEAM

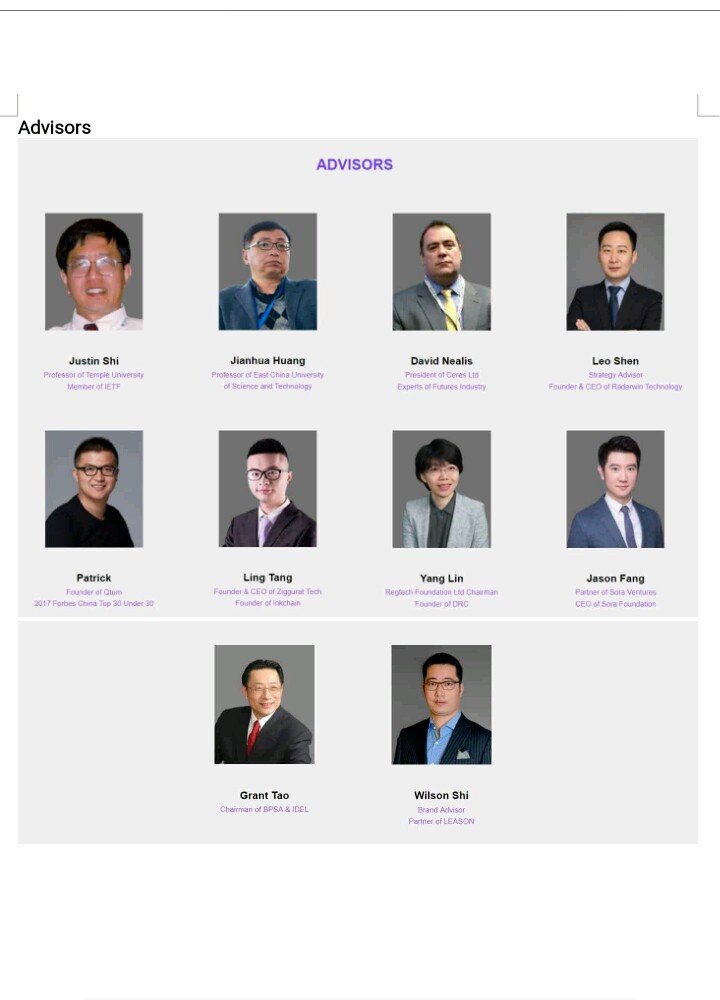

ADVISORS

Conclusion

DAEX had paved the way for seamless transactions. Digital assets can now be traded separately. Identities will be verified before they gain access to DAEX. With these upsides, trading on the block chain just got better.

For more information about DAEX, kindly visit:

Website: https://www.daex.io/

Whitepaper: https://www.daex.io/pdf/DAEX(EN)-NonTechnicalWhitepaper-V0.9.8c.pdf

Twitter: https://twitter.com/DaexBlockchain

Telegram: https://t.me/DAEXOfficial_en

Bountyox Username: sholex00