You have scrutinized a certain blockchain project, you have examined the whitepaper multiple times, you have checked all the team members, you have watched an overview of the project by your favorite blockchain vlogger, you have even joined project’s Slack channel, but still, no Moon. Why?

In this article, we are going to look at the main strategies of crypto investors in 2017 and 2018. We will try to understand how certain market characteristics and trends affected the success rate of these strategies. And finally, we will try to find out what to do in the current realities of the crypto industry.

Hindsight

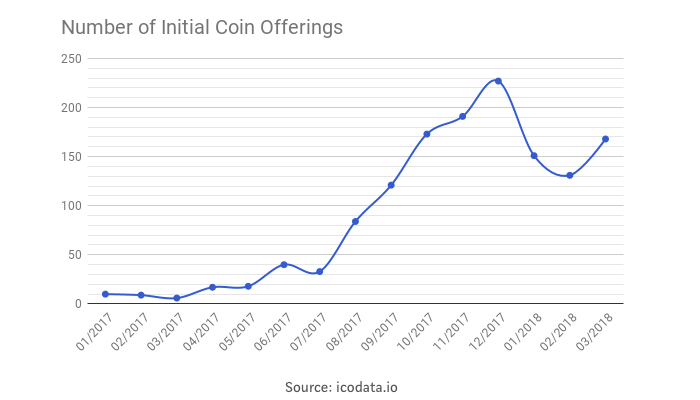

The tremendous success of the first ICOs has enchanted everybody: investors, projects seeking for crowdsale and scammers, of course. The number of ICOs has skyrocketed:

In the hunt for huge profits, crypto investors have been pouring billions of dollars into these crowdsales. For the majority of investors, the selection process literally consisted of checking the website, reading the whitepaper and maybe watching a couple of Youtube videos. That’s it! Funny enough this strategy did work just fine. Many investors thought they found new Klondike and bravely dived into this adventurous endeavor.

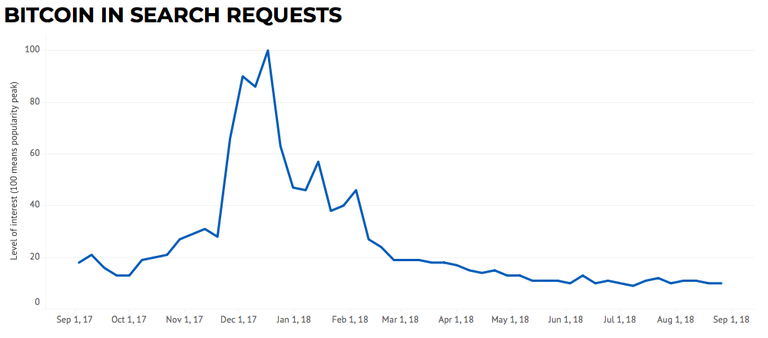

Why did it work? First, public awareness was rising very fast and the market was only preparing for the mission to the Moon.

Source: https://trends.google.com/trends/explore?q=bitcoin

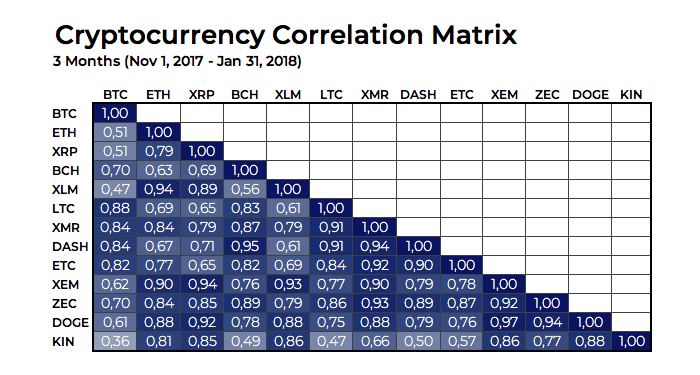

Second, when the market was on the rise, pretty much all more or less sensible projects were surging as well. In crypto, we have a highly correlated environment. Here are some stats:

The matrix shows that in the selected months the whole market was pretty much moving together. Even though it was a period of a high activity, we have been observing the same strong correlation throughout 2018.

Thereby, the success of many “crypto experts” was mainly attributable to the market situation.

What went wrong

In January 2018, the temporarily overbought crypto market reacted with a sharp correction. Keeping in mind the correlation matrix, this correction affected every project and also airlifted a big part of the crypto community back to reality.

Source: Coinmarketcap

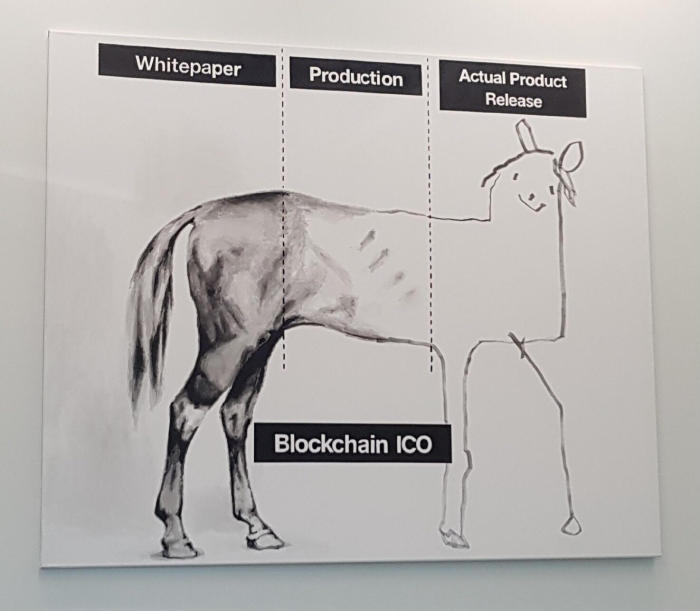

The returns on ICO investments not only slowed down but also turned to negative. However, the market situation is not the only problem. The year 2018 is the year for many ICOs to roll out their products and as some part of them wrote their whitepapers from scratch, it turned out that, so far, not every project is able to build a relevant, secure and a properly functioning product.

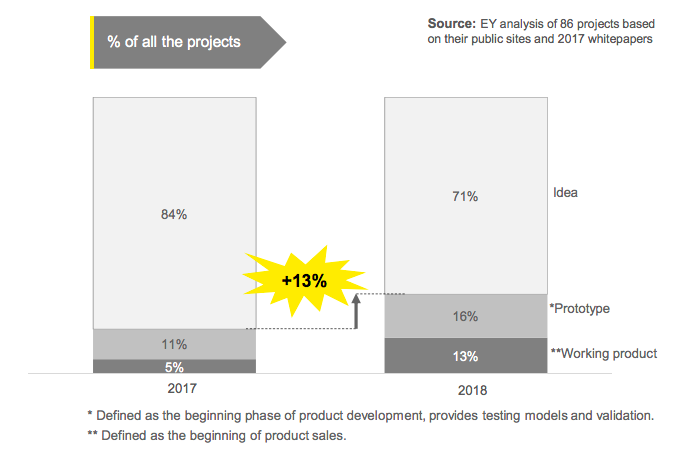

Recently, Earnst&Young published an update on their review of the top 141 ICO projects that in December 2017 accounted for 87% of funds invested in ICOs. In this follow-up study, they revisit the same group of projects to check the progress these companies have made. Here are the main points for our article:

- 86% of the projects are now below their listing price; 30% have lost substantially all value. An investor purchasing a portfolio of these 141 ICOs on 1 January 2018 would most likely have lost 66% of the investment.

- Of the ICO start-ups, E&Y looked at, only 29% (25) have working products or prototypes, up by just 13% from the end of last year.

- There were gains among selected projects, concentrated in 10 ICO tokens, most of which are in the blockchain infrastructure category.

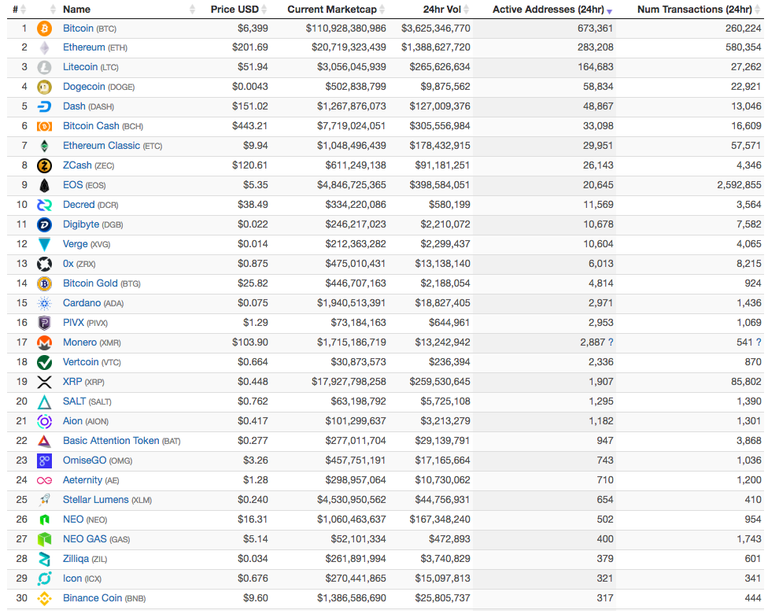

There is also another statistic to support our point, it is the number of active addresses. As of October 22, only 26 projects have more than 500 active addresses in a 24-hour period.

Source: https://onchainfx.com/

This table shows that despite all the big words on websites and whitepapers a huge part of blockchain projects lack use cases and people just don’t use them, for now, they are mostly tools for speculation.

Consequences

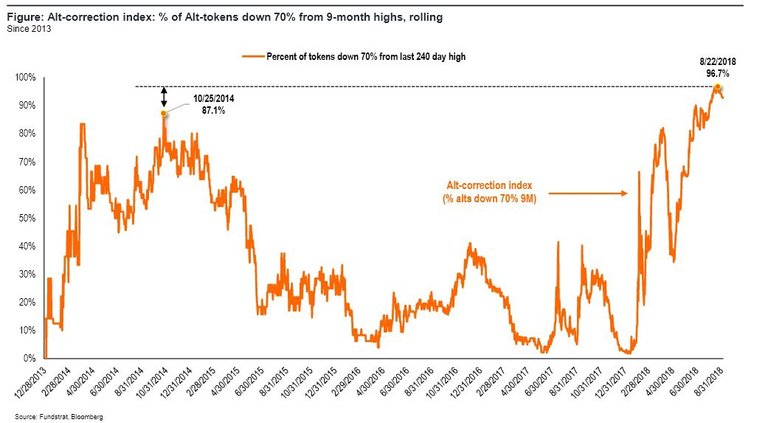

On September 6, 2018, Fundstrat Global posted an interesting statistic, called “Alt-correction index”. The chart below displays that on August 22, 2018, 96.7% of altcoins were down 70% and more from 9-month highs:

This shows that investors are leaving beloved ICOs and trying to find a safer place in the crypto world during this storm. Most of them try to move their funds to the top coins, but even these assets are experiencing some significant bearish tendencies. For instance, ETH has plummeted even tougher than BTC due to the overall trend in the ICO market.

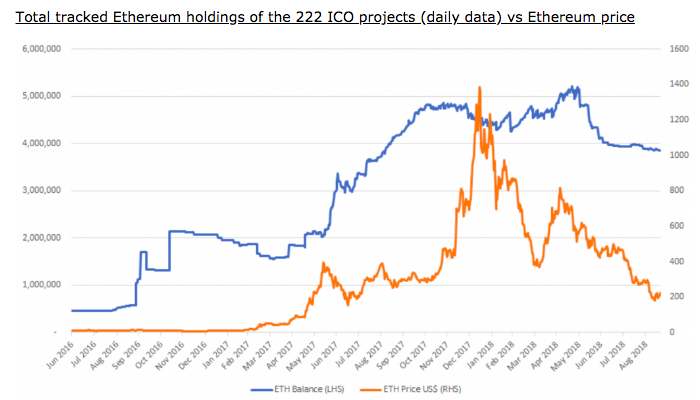

Recently BitMex published an interesting article named “Ethereum holdings in the ICO treasury accounts”, which is telling us about an economics behind of ICO funding and how these projects affect the price of ICO fuel — ether.

We see that this huge amount of ETH collected by ICO projects is downward pressuring the ETH price and till the majority of these projects won’t deliver products and get to the point when the operational profits will at least cover recurring costs, this situation will remain unstable.

Reaction from investors

As a result, we have a huge number of investors moving away from altcoins. However, holding even the top cryptocurrencies in 2018 is an arduous business, not everyone can watch at one’s portfolio melting every day. BTC price chart is far from being as mesmerizing as it was in 2017:

Trading in the crypto world is highly inconvenient and, as we all know, it is the place where retail investors usually lose money. Quitting crypto completely is not an option too. First, it’s a tough moral choice to leave at these prices, and second, the market shows signs of consolidation, so no one wants to miss the next bull run.

So what are the most adequate options for investors right now?

What to do?

Here we have a list of the most sensible strategies that investors may employ:

A. To hold coins of those projects that have backed up their words with action. We need to appreciate these rare specimens with a working product.

B. To move funds to the very top coins and forget about them.

C. To use robots and algorithmic trading tools. As far as hodling in 2018 is not the sweetest thing, more and more investors turn to active strategies.

Apparently, a wise move will be to mix these options and build a portfolio of strategies fitting your investment preferences. While with points A and B it is possible to do everything on your own, with the point C, technically speaking, not everyone can build a home-made trading robot. Thus it is much easier to use a readily available solution.

Blackmoon’s solution

To start with, we are the only operational blockchain investment platform. Yes, we are one of those projects with a product.

Today, we offer ten investment opportunities, six of them related to algorithmic crypto trading.

For those investors bullish on the crypto market’s future, we have an option to just index the market with our BMxT10 and BMxT20 tokens, which represent the top coins by market cap and are automatically rebalanced monthly.

For those looking for more active strategies, we currently have another 4 products. For example, BMxVTP token follows the performance of the most volatile coins, features trend protection mechanism to reduce downside risk and is rebalanced daily.

Finally, we have unprecedented for crypto industry products represented by tokens that follow the performance of assets from the world of traditional investments. It brings diversification of your crypto portfolio to a whole new level and lets you get exposure to traditional assets without leaving the crypto.

With these options already, investors can make a huge number of combinations for different risk/reward preferences. However, we are not content with these achievements and will continue to establish new standards in the field by constantly developing our product. Furthermore, we try to make our services available in as many countries as possible. Recently, we have opened our doors for US citizens, now accredited investors have an access to the investment opportunities on our platform.

Stay tuned for further updates as new options will be appearing in all of our product lines!

For more information: https://blackmoonplatform.com/showcase

Summary

First of all, it is impossible to make a solid investment decision based only on the website and the whitepaper. With such a small percent of projects with a working product, it is much safer to wait for some kind of an MVP and only then make final research and decision.

Second, the market conditions have changed dramatically, some of the working strategies are not relevant anymore. However, the market shows signs of consolidation, and despite bearish tendencies in 2018, the industry is still very promising.

Third, in current circumstances, investors are looking for new solutions, innovative investment products and various combinations of those. Some of the most appealing opportunities are trading robots and algorithmic solutions. These options are already available for investors around the globe.

We hope that this article will help our readers to navigate themselves in the current realities of the blockchain industry and will prevent them from possible risky or unreasonable decisions. Take care!

Handy links to stay tuned to our updates:

website: https://blackmoonplatform.com

telegram chat: https://t.me/blackmoonplatform

info video:

DISCLAIMER

Investment in cryptocurrencies carries a high degree of risk and volatility and is not suitable for every investor; therefore, you should not risk the capital you cannot afford to lose. Please consult an independent professional financial or legal advisor to ensure the product meets your objectives before you decide to invest. Regional restrictions and suitability checks apply.