Overview

As we all know global pension industry is deteriorating day by day with funds remaining unfunded and nothing is really being done to solve this major problem. The reforms made to pension structure is not upto the mark and people are still facing the problems that is surfacing this infrastructure.Pension industry is one of the largest industry with estimated pension funds US$20 trillion (sources : Wikipedia) and to handle this we need such external source to look in this area. Akropolis is one such project that offers the users an alternative pension infrastructure that takes the help of blockchain making it the first blockchain project that enters into pension funds industry. Akropolis is coming up with an infrastructure that can bring a change to this current outdated pension industry and curb various issues surrounding pension funds.

What is Akropolis

Akropolis is a greek word that means a defensive core of a city and this organisation is building a decentralised pension infrastructure such that people can connect to variety of funds available for them and protects the pension funds to get misplaced thus this name. Akropolis will work on blockchain technology using smart contracts that will be transparent and accountable for all the funds. This platform acts as a gateway for individuals, pension funds and pension assets managers that manages retirement investments.Akropolis is aiming to get rid of the flaws that surrounds pension industry with immutable and transparent smart contract based pension funds industry.Their motto is building a decentralised pension infrastructure by and for the people,creating a safer financial future for humanity.

How will it work

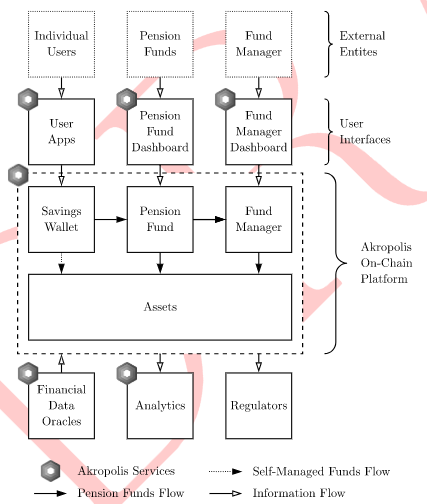

Akropolis is aiming to develop a decentralised blockchain pension infrastructure that delivers trustless retirement saving products.It will be designed such that it provides transparent, accountable and portable pension services to all the individuals who uses this platform. The platform will deal or provide a gateway for individual users, pension funds and funds managers. Listed below are the important actors and the interactions that all will undergo :

Individual users : A person who uses akropolis platform for their pension savings.

Pension funds : These are institutional entities who maintains their platform and collection of users.

Funds manager : These are institutional entities charged with purchasing and acquiring assets on behalf of PF or users.They will report regularly on the assets acquired or purchased under their management.They built portfolios of assets and make them available for the investors.

Asset tokenizers : Assets are tokenized in order for the system to work efficiently. These are centralised entities that provide a source for blockchain layer.

Developers : They are community members who are the key people for the akropolis platform to work efficiently and effectively.

Problems

In today’s era, Retirement plans that are being circulated is surfaced by various problems and challenges like:

Lack of easy access to pensions- Many people still lacks access to their own pension plans and savings.

Financial literacy is low — people lacks the knowledge about which retirement plans suits their lifestyle and what exactly can be done to their financial status to meet the requirements when retired.

Inadequate savings rates — People don’t exactly know what amount to be kept in their savings of their income that can meet their retirement plans, it is written that we must save at least 10–15% of what we earn to have a secured future without worrying about the money.

Individuals are responsible for their pensions — It is to be duly noted that the contribution systems are growing steadily with 50% of overall global retirement assets and but these plans are designed in such a way that puts overall responsibility of an individual to manage their own pension plans.

Solutions

Akropolis is aiming to curb all the above mentioned problems by building a decentralised pension platform on blockchain technology that will indeed give access to all the users about the variety of pension funds available to them. The users will also get to know how much to save so that they can live a happy life after retirement without worrying about income sources. Not to forget Akropolis platform will also provide fund managers to check with the users and suggests them the retirement plan as per se.

Token

There are two main tokens that akropolis platform will work upon.First is Akropolis external token i.e. AKT that will act as the utility token for all the members to participate and get access to this platform.This token will also provide the users to purchase premium services as per their requirement. Second one is Akropolis internal token i.e. AIT, that will be a stable coin and accountable to keep the track and record capital flow internally within the system.

Team

The team consists of experienced people who has good knowledge about the pension funds and also has the people who already worked in the area of blockchain and not to forget the CEO was one of the major advisor for the blockchain technology when it came into picture.

Anastasia O. Andrianova (Founder/CEO) — Anastasia is a member of Blockchain Ecosystem Network and she also is the advisor for web3 foundation. LinkedIn

Sandra Wu (Senior Advisor to the CEO and General Counsel) — Sandra has 10+ years of legal experience in corporate & securities law, and private equity fund formation.She also acts an advisor to ICO issuers and fintech startups.linkedin

Peter Robertson (Pensions Lead) — Peter has worked earlier in the pension firm such as Vanguard and he is quite experienced in this field. linkedin

Abhimanyu Dayal (Head Of Strategy) — Abhimanyu has an experienced in the blockchain industry for 5 years now and he is also involved with bitnation as the decentralised application fund manager. linkedin

Victor Wiebe (Blockchain Developer) — Software engineer and has 5+ years experienced in delivering mobile apps and web products. linkedin

Token metrics

Token Symbol: AKT

Total token supply : 900,000,000

Hard cap : $25,000,000

Max. token amount for sale : 360,000,000 (40%)

Token price : 1 AKT = 0.0690 USD

Presale: On-Going

Platform : Ethereum

Verdict

Being the first ever project to enter in the complexed industry i.e. pension sector itself is really commendable and that shows the potential of this organisation to even think about such a platform to solve issues related retirement plans.Making pension funds more accessible and transparent seems bit complicated but if achieved this will be one of a best reforms that any project can bring in the society. There are few negative points as well like the whitepaper is extremely technical and not user friendly, the team is not very responsive when approached to ask about the working or the funds that they collected and also there is no such prototype available in the market for this project. Overall the idea is good and still new. So, if you are planning to invest in this project then due diligence is highly recommended.

Reference

Website: https://akropolis.io/

Whitepaper : https://view.attach.io/HJQ3yvpcM

Hello! Good article! I'm interested in the them of ICO and crypto-currency, I'll subscribe to your channel. I hope you will also like my content and reviews of the most profitable bounties and ICO, subscribe to me @toni.crypto