Thanks to Decentralized Finance (DeFi), crypto now finally begins to really play out its strengths. One of the major visions in the blockchain community is that by removing any centralized middlemen in financial products, such as loans, derivatives, or insurance, we can build a more democratic financial system that fairly distributes value among all participating key stakeholders.

Thanks to Decentralized Finance (DeFi), crypto now finally begins to really play out its strengths. One of the major visions in the blockchain community is that by removing any centralized middlemen in financial products, such as loans, derivatives, or insurance, we can build a more democratic financial system that fairly distributes value among all participating key stakeholders.

With the current rise of interest in DeFi, this sector of crypto and blockchain technology is beginning to emerge as an alternative to the traditional financial system and may, in years to come, replace centralized finance entirely. We are truly seeing the start of something amazing.

However, if you have been following the developments in the DeFi sector in the last few weeks, you have likely heard the same story over and over again. Every other day or so, there is a new platform where you can lend crypto tokens, take out a loan, or stake existing tokens to earn some other “worthless” utility token that is used for governance.

Interestingly, some of these “worthless” governance tokens have managed to accrue hundreds of dollars in market cap. This shouldn’t be too surprising though, as investors will also spend a good amount of money to have a say in what they invest on the DeFi platforms they provide liquidity to.

In terms of economics, there is however not much innovation going on right now. Most activities in DeFi still revolve around overcollaterlized loans and providing liquidity to DEXes. There are first approaches to decentralized insurance, derivatives, and synthetic assets, but there is still a long way to go until DeFi will become a serious contender to the traditional, centralized financial system.

Ultimately, it will come down to economists and other financial experts to create the decentralized solutions that seek to disrupt the centralized financial world. However, financial pioneers typically have little knowledge of programming. Likewise, programmers usually think in a straight-forward logic to implement their ideas. Economically, this does not warrant for a lot of innovation.

For this reason, we are seeing DeFi projects shooting out of the ground left and right, but they always pull out the same old chestnuts of lending and liquidity mining, incentivized by some new governance token. Overall, this does not add much value to the nascent DeFi sector. Clearly, one significant barrier to overcome is the fact that the current DeFi infrastructure is too complex for the quick deployment of sophisticated DeFi products.

What DeFi needs is a simple solution to creating complex transaction logic without the intricacies of smart contract development. This would not only lower the barrier for financial pioneers to bring their visions to life, but it would also decrease the risk of losses to immature and pooly audited smart contracts.

The DeFi project Dfinance is working on a platform that converts natural language into this transaction logic. When fully deployed, this could make it possible to create decentralized financial instruments simply by typing in English sentences, which are then automatically translated into code based on Libra’s smart contract language Move.

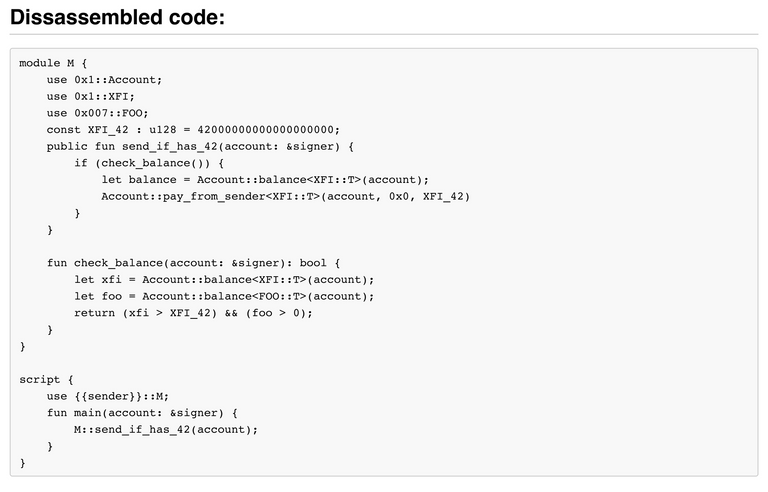

While this is undoubtedly a gigantic task, reverse-engineering smart contract code into natural language is comparably easier. Recently, Dfinance has released the Move Unscrambler, which can do just that. As an example, in their blog post introducing this feature, DFinance showcases that the Move Unscrambler can turn this:

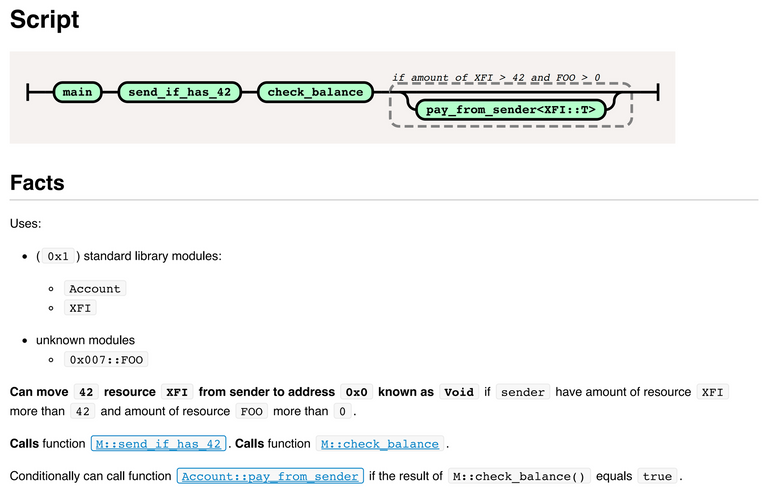

Into this:

By making smart contracts more readable, this both helps in code documentation, as well as smart contract auditing. In a next step, Dfinance will be working on the unequally harder task to convert natural language into smart contract code.

Surrounding their natural language processing tools, Dfinance is building a whole DeFi infrastructure, including a Proof of Stake blockchain based on Tendermint BFT consensus, an oracle solution, and parity bridges that make the Dfinance ecosystem interoperable with other blockchain networks.

In August 2020, Dfinance has released version 0.6 of their testnet nicknamed Balthier, which enabled the staking and delegation logic for their testnet protocol. With this, the development team behind the project is currently well on schedule for their mainnet launch in November.

In preparation for the mainnet launch, Dfinance has started a reward program, that allows interested users to earn their share of 125,000 Dfinance coins through various promotional and technical activities. For example, you can already describe your financial ideas you want to build on the platform and earn a reward. You can then test out how the platform processes your idea when the High-Level Language tool is released in October.

On the technical side, you can earn rewards by completing a number of programming challenges and get started with developing on the Dfinance ecosystem and the Move programming language in the same breath.

At the current time, it is not quite clear how the natural language processing will ultimately look like and what it will be capable of, but for both techies and non-techies interested in DeFi, DFinance will certainly be an interesting project to watch.

DeFi could, at some point in time, replace the traditional financial system, but we need to bring more financial experts into the space. Right now, we mostly have developers and although they are building interesting economic primitives, we need to empower finance professionals and economists to build financial instruments in order to improve the pace of innovation.