The second wave of stablecoin craze hit the market at the beginning of 2019, but the stablecoin today already differs from what it was last year.

I. What are stablecoins?

A stablecoin is a coin pegged to a fiat currency, usually the US dollar, to maintain a stable value. As the exchange rates of fiat currencies are relatively stable and less volatile, stablecoins allow for practical usages of cryptocurrencies in everyday life.

II. Why do we need stablecoins? What is their value?

This is a very important, yet seldom addressed question.

1. Stablecoin is a gateway to digital asset investment

Since the second half of 2017, some countries and cities have started to restrict or even ban digital asset transactions by limiting the payment channels for exchanges in banks, so as to limit fiat currencies from entering the crypto market. At that time, a lot of exchanges was forced to shut down in China, but there were new traders and new funds looking to enter the market. Their only choice remained was OTC trading, and they began to trade directly through Telegram and WeChat groups. However, they had to bear significant risks for trading on unsupervised channels and unestablished exchanges. To ease their hassles and risks, stablecoins that are pegged to fiat currencies, such as USDT (1 USDT : 1 USD), became an ideal gateway for investors to tap into the digital asset market.

2. Stablecoins offer a good store of value for digital asset investment

The prices of digital assets are subject to relatively high volatility, especially when the market is experiencing a downturn. If traders are unwilling to take the risk of price volatility or cash out, or when exchanges do not support fiat trading pairs, trading with stablecoins seems to be their only option.

The hottest stablecoins under the spotlight last year aimed to solve the digital asset trading issue. A good stablecoin has to have a reliable stability mechanism to ensure its price does not experience excessive volatility. It also needs to be influential among the mass investment communities. It should be highly accessible and in partnership with various exchanges that offer a good number of stablecoin trading pairs for investors to trade.

Fundamentally, stablecoins in the early days was a product that was quickly developed to answer the demand for digital asset trading, as well as to solve the controversies surrounding fiat trading regulations. The more the cryptocurrency prices fluctuate, the more valuable stablecoins are. We expect that when all countries have lifted their restrictions on fiat trading, stablecoins will lose their value.

3. Stablecoin is a convenient real-time payment settlement tool

The stablecoins by JP Morgan and Japan’s Mizuho Bank are good examples.

Blockchain facilitated significant improvement in payment settlement systems, notably on cross-entities payment. The stablecoins developed by these two banks are essentially blockchain settlement networks, which will grow in value when more financial institutions and clients join the network. Stablecoins might as well be considered “bank acceptance bills” on a inter-bank blockchain.

4. Stablecoins are decentralized global currencies and safe-haven assets

Let’s go back to the basics: Bitcoin was created as a non-state currency that allows for free competition.

Compared to the monetary system today, a transparent and stable form of currency like Bitcoin, could be a new safe-haven asset to the people in Venezuela and Zimbabwe who have to face hyperinflation and sovereign debt defaults.

It might seem impossible for now as Bitcoin price is not stable — a volatile asset cannot be used as store of value nor a safe-haven asset.

But it is only a matter of time for Bitcoin to shine.

It is possible to predict that when the value of Bitcoin is significant and when its market friction is low, it will become a stablecoin. Only Bitcoin, instead of stablecoins, can create a new kind of “credit” and realize the investment value of the asset.

The core value of stablecoin has been gradually shifted from facilitating digital asset investment to payment settlement. Stablecoin 2.0 marks the transformation of blockchain industry from speculation to creating value.

III. Different Models of the Stablecoins

In the past year when industry players jumped on the stablecoin hype train, many analysts attempted to categorize stablecoins, generally into three types: fiat-collateralized, crypto-collateralized, and algorithmic-collateralized. Yet, this kind of categorization is rather ambiguous, especially for the last one.

If we take a closer look at the protocol of each stablecoin, we can easily find that the logic behind them is simple — all stablecoins are very much alike to the fiat currencies created under the international monetary system.

The current international monetary system is developed from the gold standard. However, during the World War I, as the countries at war printed unredeemable money and restricted the import and export of golds to secure a military budget, the gold standard could no longer sustain. Until after World War Two, the U.S. government introduced the gold exchange standard by pegging U.S. dollar to the value of gold. Unfortunately, as the U.S. dollar crisis ascended in 1976, the Bretton Woods system collapsed, marking the end of the gold standard system and also the beginning of a free-floating phase.

Without a collateralized money creation system, countries started to set up different fiscal policies and a series of money supply controls to stabilize their currencies’ value. (In order to boost economic growth, most governments establish policies to manage inflation and currency devaluation. To “stabilize” a currency’s value means maintaining a planned inflation rate). Usually, the stability of a currency is determined mainly by its actual purchasing power, while its international exchange rate will also be taken as a reference.

We can simply divide stablecoins into two major types. One is asset-collateralized issuance, which shares a lot of similarities with the gold standard — reserving gold for issuing money of equivalent value. Asset-collateralized issuance can be further categorized into fiat-collateralized or cryptocurrency-collateralized.

- Stablecoins such as USDT, TrueUSD, GUSD, and PAX are fiat-collateralized.

- Stablecoins such as BitUSD and DAI are cryptocurrency-collateralized.

The other major type is “central bank imitation” issuance, for which a currency is not pegged to any other asset. In order to stabilize the currency value, its issuer has to estimate market demand and manage the currency supply dynamically. The means of management includes bond repurchase, interest rate adjustment, and open market operations.

- Imitating the bond repurchase model: Basecoin

- Imitating the variable interest rate model: NuBits

- Imitating the open market operations model: Reserve, Terra

Although the core value of the stablecoin is to maintain a comparatively stable price (mainly against fiat currencies), the current mainstream issuance models have their own disadvantages and flaws:

The main issue for the fiat-collateralized model is its reliance on the credibility of the issuance company — how we can guarantee the company to have a sufficient fiat reserve, to not over-issue, and to not run off with money.

The cryptocurrency-collateralized model is restricted by the volatility of the collateralized assets. This model can hardly succeed at the moment without a mature, well-developed cryptocurrency market.

For the bond repurchase and variable interest rate imitation models, the biggest challenge comes from the fall of stablecoins’ value. Issuers have to prevent investors from long-term short-selling in market downturn or not purchasing their bonds with the stablecoin, and increasing their own reserve. The problem is, their bond and savings interest do not own any intrinsic value and share the same fragility with the stablecoin system.

For the open market operations model, it is very difficult for the issuer to secure an adequate foreign-exchange reserve. In other words, the issuance company may not have enough funds to buy back an enormous amount of stablecoin from the secondary market.

IV. A Comparison of the Models

1. By the underlying protocols

Stablecoins like Reserve and Terra stabilize their prices by buying/selling the coins in open market. However, this approach is considered the least practical and is very difficult to scale and develop in the long run. Simply put, how can the reserve and the revenue of an e-commerce platform or an investment fund measure up to the purchasing power of the global stablecoin market? This kind of stablecoins may only work in small or regional markets.

Stablecoins such as BaseCoin and NuBits represent the “bond repurchase” and “variable interest rate” models, which faces the toughest difficulty in product design when compared to other protocols. The protocol is currently still in its infancy and has large room for improvement. Unfortunately, NuBits has already failed due to the unrecoverable flaw in its design.

Cryptocurrency-backed stablecoins like BitUSD and DAI are highly influenced by periodic market volatility and the maturity of the cryptocurrency market. At the current stage, the cryptocurrency market is not yet fully developed. The price stability of the collateralized assets is still undesirable. Also, many cryptocurrency investors in the market lack the sense and ability of arbitrage.

Comparatively, fiat-backed stablecoins such as USDT, GUSE, TrueUSD, and PAX run a much simpler protocol, but they also make the most practical model so far.

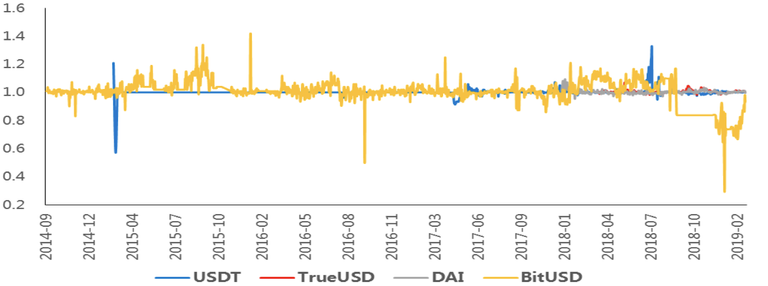

2. By the historical prices

In terms of price stability, the fiat-backed stablecoins performed the best amongst all stablecoins. Taking a >5% deviation as a standard, PAX’s ratio for price deviation from the normal range in the past 153 days is 1.96%; TrueUSD’s ratio for the past 358 days is also 1.96%; USDT’s ratio for the past 1458 days is 4.05%; while GUSD’s ratio for the past 144 days is 9.72%.

Meanwhile, cryptocurrency-backed stablecoins have the worst price stability. DAI’s ratio is 8.67% for the past 427 days; BitUSD’s ratio is 68.9% for the past 1579 days.

The market of the algorithmic stablecoin NuBits, which shares the similar issuance protocol with the central banks, has already crashed with no signs of coming back in the near future.

V. Analyzing the Prospect of Stablecoins

1. Fiat-collateralized stablecoins are still the mainstream

In the coming two years, fiat-collateralized stablecoins is expected to flourish. It will require more reliable issuers, a better audit system, and a more mature regulatory framework.

In 3 to 5 years, blockchain asset-collateralized and algorithmic “central bank imitation” stablecoins will see further growth, driven by the maturation of digital assets market and investors.

In the future, when the digital market becomes mature, it is possible to predict that Bitcoin will eventually develop into a stablecoin.

2. Digital fiat currencies and stablecoins are still not competitive

If stablecoins are designed to satisfy the need for digital asset trading, as long as the regulation on fiat-to-token trading worldwide remains tight, stablecoins will still have their market value.

When a stablecoin is used by a bank as a payment settlement tool, it becomes a “digital fiat currency”. In this case, what backs the stablecoin is not a central bank, normally the highest monetary authority in a country, but the credit of a commercial bank. The premise is that the bank should have enough fund to back the issuance.

3. The stablecoins by JP Morgan and Mizuho Bank are essentially payment settlement tools, but they are cornerstones for building an ecosystem

JP Morgan’s JPM Coin is pegged 1:1 by the US Dollar and will circulate between the bank and its institutional clients. J Coin, invented by Mizuho Bank, is redeemable 1:1 for 1 Japanese Yen and can be used by general consumers to settle retail payments.

To the clients, both cryptocurrencies make no significant difference from putting their dollar notes in the bank and seeing their balance figures going up. However, for the banks, they will be able to take advantage of the blockchain-based “The-trade-is-the-settlement” network, which will grow in value as the network expands. As the pioneers of this kind of “stablecoin”, they will enjoy first-mover advantage against their peers in the future.

Last but not least, it has come into question whether the growth of stablecoins signifies the so-called Cryptocurrency 2.0 period. The article aims to clarify two important points:

The stablecoin does not represent a Cryptocurrency 2.0 period. Instead, it is merely a branch developed under the regulations on blockchain investment market. However, it reflects the goal that the digital assets market is longing for — a “stable” Bitcoin.

Bank giants’ adoption of the stablecoin means a great advancement to blockchain application, as it has taken the technology from digital asset investment to real-world financial settlement.

So far, the stablecoins issued by bank giants are fully redeemable for the pegged fiat currencies without any problem of currency creation. In the future, by being adopted by financial giants worldwide to elevate the efficiency of upstream and downstream payment settlement, the stablecoin will potentially play a greater role in the blockchain revolution.

Risk Warning: Trading digital assets involves significant risk and can result in the loss of your invested capital. You should ensure that you fully understand the risk involved and take into consideration your level of experience, investment objectives and seek independent financial advice if necessary.

Follow OKEx on:

Twitter: https://twitter.com/OKEx

Facebook: https://www.facebook.com/okexofficial/

LinkedIn: https://www.linkedin.com/company/okex/

Telegram: https://t.me/okexofficial_en

Instagram: https://www.instagram.com/okex_exchange

Medium: https://medium.com/okex-blog

Website: https://www.okex.com

Warning! This user is on my black list, likely as a known plagiarist, spammer or ID thief. Please be cautious with this post!

If you believe this is an error, please chat with us in the #cheetah-appeals channel in our discord.