tl;dr - I'm buying 2 new ETF's. BLCN and BLOK. They are ETFs with tech companies that are "invested/investing" in blockchain applications.

Disclosure: This is not investment advice. Gracias.

I get asked about crypto investing all the time since a few of my buddies and I have been in the game for some time (Reddit silver if you know DPR).

If you do not know much about it or want to better understand the potential of crypto / blockchain, please please watch this short 6 min video:

There is SERIOUS FOMO right now. Mainstreet is / has been jumping on the bandwagon like crazy.

Two new ETFs (BLOK, BLCN) where launched the other day that I've taken an interest in.

Coindesk provides a nice brief overview of both.

These should be (in theory) much more stable. Obviously there is turmoil with China, regulation, etc...

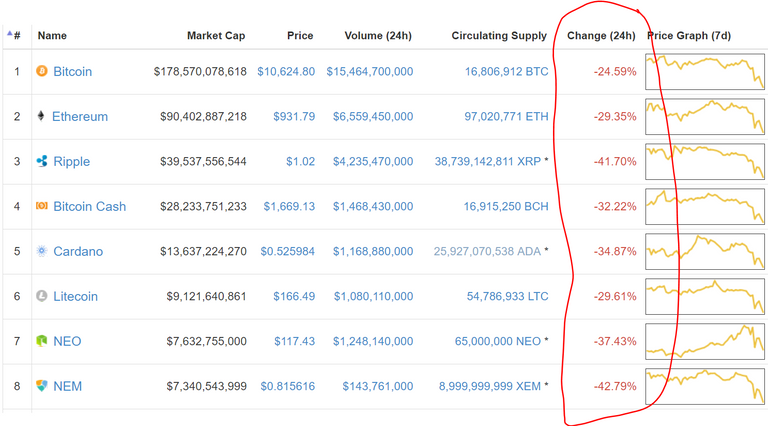

Monday - January 15, 2018 was fun!

Source: My screenshot that day - CoinMarketCap

The companies involved in each ETF are pretty big players (IBM, Microsoft, etc.), so it's more of a tech ETF than a truly blockchain based ETF.. but still, these organizations (and the smaller % holdings invested in) are making moves by utilizing blockchain, so it's an interesting play.

The Motley Fool provides a nice overview of BLCN plus some good insight:

Top 10 Holdings

Overstock.com | 2.5%

International Business Machines | 2.4%

SBI Holdings Inc. | 2.3%

Hitachi Ltd. | 2.3%

Cisco Systems | 2.3%

Intel | 2.2%

Microsoft | 2.1%

ZTE Corp. | 2.1%

NVIDIA | 2%

SAP SE | 2%

Total top 10 | 22.1%

BLCN:NASDAQ

Strategy for Reality Shares Nasdaq NexGen Economy ETF

The investment seeks long-term growth by tracking the investment returns- before fees and expenses- of the Reality Shares Nasdaq Blockchain Economy Index (the "index"). Under normal circumstances- at least 80% of the fund's assets- other than collateral held from securities lending- if any- will be invested in component securities of the index. The index is designed to measure the returns of companies that are committing material resources to developing- researching- supporting- innovating or utilizing blockchain technology for their proprietary use or for use by others ("Blockchain Companies"). The fund is non-diversified.

Amplify ETFs gives their brief breakdown of BLOK on their site:

Top 10 Holdings

TAIWAN SEMICONDUCTOR MFG LTD SPONSORED ADR | 6.31%

DIGITAL GARAGE | 5.31%

OVERSTOCK COM INC DEL | 5.26%

SBI HOLDINGS INC | 5.04%

INTERNATIONAL BUSINESS MACHS COM | 4.53%

HIVE BLOCKCHAIN TECHNOLOGIES | 4.48%

NVIDIA CORP | 4.40%

SQUARE INC | 4.27%

GMO INTERNET INC | 3.62%

ADVANCED MICRO DEVICES INC | 3.03%

BLOK:NYSE Arca

Strategy for Amplify Transformational Data Sharing ETF

The investment seeks to provide investors with total return. The fund is an actively managed ETF that seeks to provide total return by investing at least 80% of its net assets (including investment borrowings) in the equity securities of companies actively involved in the development and utilization of transformational data sharing technologies. It may invest in non-U.S. equity securities- including depositary receipts. The fund is non-diversified.

Congratulations @kirkn! You have received a personal award!

Click on the badge to view your Board of Honor.

Do not miss the last post from @steemitboard!

Participate in the SteemitBoard World Cup Contest!

Collect World Cup badges and win free SBD

Support the Gold Sponsors of the contest: @good-karma and @lukestokes

Congratulations @kirkn! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!