I was recently invited to present cryptocurrency at a company all-hands. I’m not an expert, but by virtue of the Zulu Principle — my months of extracurricular obsession, and weekend tinkering with crypto has put me in the position of having more than a casual understanding — so I’ve become at least knowledgeable enough to educate my colleagues about it.

It’s not easy to distill some very complex and esoteric concepts to a general audience, so I took a very specific slice of information that I thought would help communicate, at a basic level: cryptocurrency, blockchain technologies, and Ethereum/smart contracts.

Here are my slides, with notes on what I spoke about –

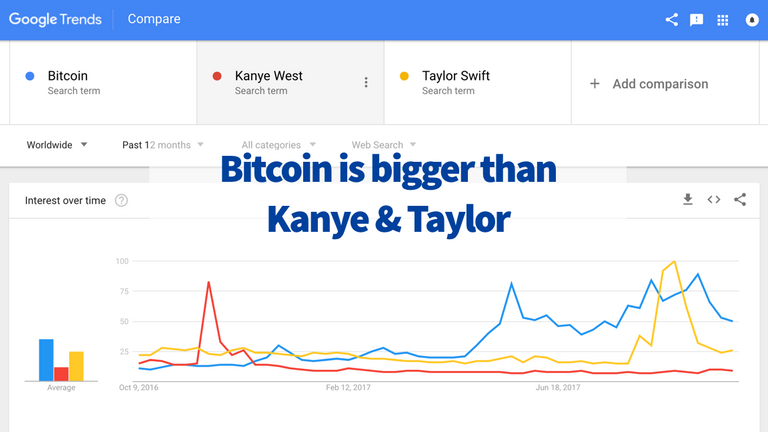

Over the past year, the cryptocurrency market has exploded, with Bitcoin increasing in value over 600% since 2016. It has also weathered setbacks, and naysayers who have tried to dismiss it as a fad, or as a tulip-bulb bubble.

However, it’s captured our collective consciousness. Bitcoin and cryptocurrency are now part of the mainstream culture.

So, how does cryptocurrency and the blockchain actually work?

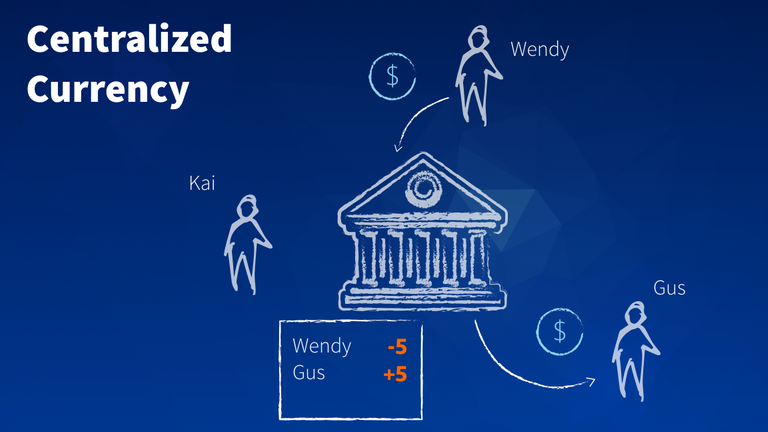

Here is a model of how conventional currency works. First, imagine that everyone belongs to the same bank. If Wendy wants to send $5 to Gus through an online transfer, she can tell her bank to send it. As the central authority, the bank deducts $5 from Wendy’s account, adds $5 to Gus’ account and records the transaction to their ledger.

This model works pretty well, however if the bank is the single source of truth, all of the parties involved have to place their trust in the bank to manage the transactions and their accounts. So, if the bank decides to deduct a $2 fee from everyone’s account, or if the bank is hacked and suddenly reports that all the accounts have a zero balance — we have to rely on external regulations and legislation to ensure that the central authority is well-behaved and honors the trust agreement placed in it by its customers.

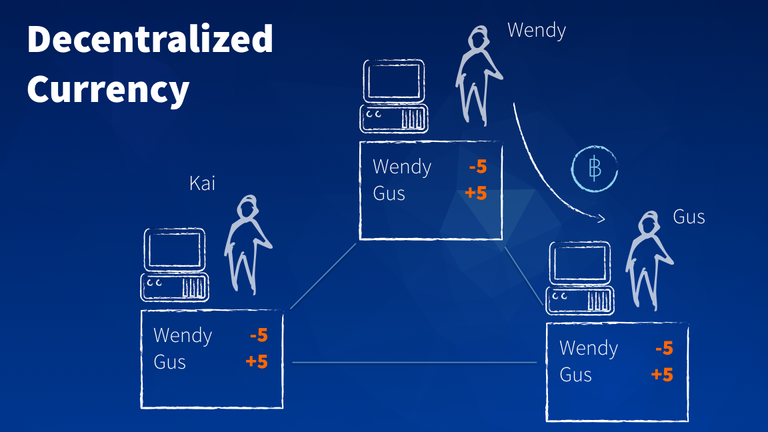

However with cryptocurrency, we can start to think about a peer-to-peer model where the central authority doesn’t exist.

In this model, Wendy can send 5 BTC to Gus, and everyone keeps an up-to-date copy of the ledger to ensure that it is a legitimate transaction, as well as the history of all transactions.

This shared ledger is the blockchain.

With Bitcoin, the integrity of the ledger is maintained through ‘mining.’ Mining is the way in which new transactions are recorded to history. It involves having the computers on the network solving a difficult mathematical problem, and when one succeeds in solving that problem, it records the latest transactions to the ledger and the network shares the ledger to ensure everyone has the same copy.

Because these mathematical problems take a lot of effort, and you may have heard about the dedicated CPU farms in China built just for mining, it is difficult to rewrite a transaction, and the further you go back in the history, the more difficult it becomes to change history– because you have to do the work to change each entry in the ledger. Also, if you were able to rewrite history, you would have to get the rest of the network, millions of nodes, to agree on your version of history.

So changing the blockchain quickly becomes an impossible problem.

Now we have a decentralized, secure network of transactions, where history cannot be changed.

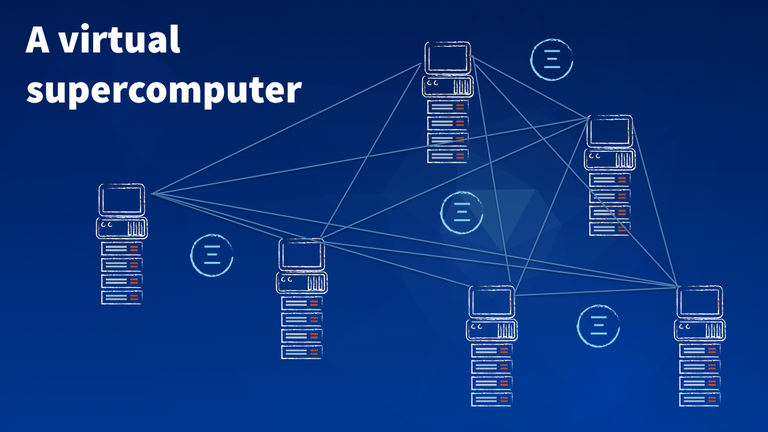

Now let’s say, instead of having all of the computers on the network solving an arbitrary mathematic problem, we have them run small programs. This virtual supercomputer that anyone can use to run programs is the basis of the technology called Ethereum.

Ethereum runs small programs, or smart contracts, and uses its own cryptocurrency, Ether, to fund the cost of running these programs on the network.

Also, when you hear about ICOs, or initial coin offerings, many of these are actually cryptocurrency tokens which are created and transacted with on the Ethereum network.

In fact, it’s so easy to create a cryptocurrency token, there is a website where you can create your own token. I was playing around and created the $KAI token over the weekend.

The difficult part is giving that token value so that people will have a reason to invest in it or trade with it.

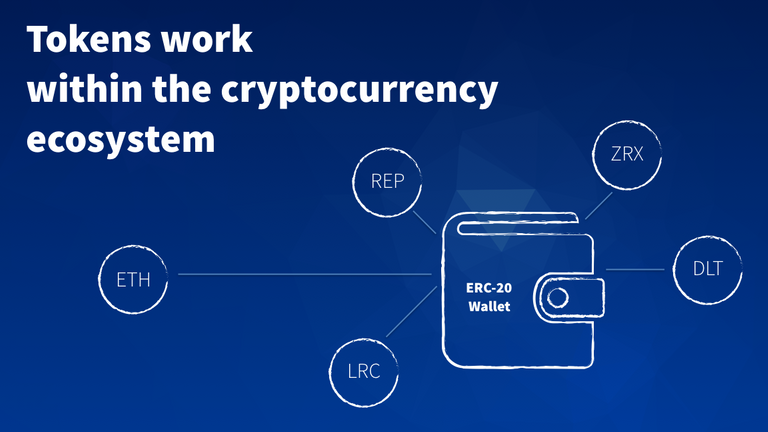

The benefit of creating cryptocurrency tokens, however, is that it fits into an existing transactional infrastructure.

If you make a token on Ethereum, you can easily integrate with existing wallets, or trade on existing exchanges without needing to build any additional services.

I hope you found this primer helpful — if you think of ways in which to simplify this cryptocurrency tutorial for novice audiences, please get in touch with me, @kaigani on Twitter.

Feel free to use these slides, and if you find them useful, please drop some ETH into my tip jar: 0x503dCB6684d37c1CF64EB1eE1c79267c7360Bee2

Congratulations @kaigani! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP@kaigani, thank you for supporting @steemitboard as a witness.

You can click on your award to jump to your Board of Honor

Once again, thanks for your support!