Overview

Alt.Estate is a blockchain platform to trade tokenized real estate. It allows anyone to easily build their own portfolio of properties worldwide and become a real estate tycoon. 3 apartments in the US, Japan and the EU are already tokenized.

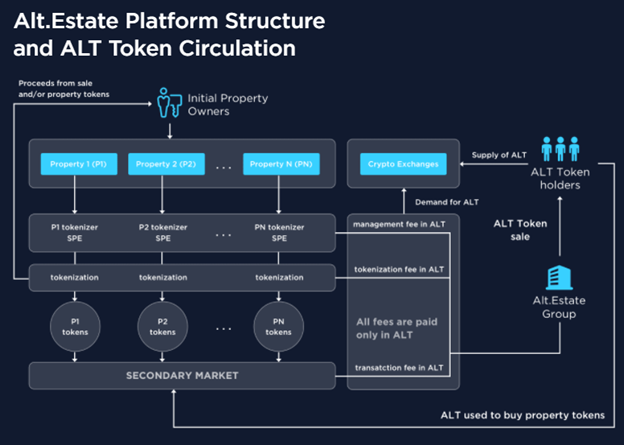

Alt.Estate Platform is the marketplace for primary sales and secondary trading of tokenized assets. The Platform allows users to trade real estate in fractions with higher liquidity and lower costs.Using Alt.Estate’s protocol, real estate owners can easily tokenize their property, in whole or in part, and list it on the platform where anyone can buy and resell it. Tokenization powered by Alt.Estate allows the real estate to be traded in small fractions, making it widely accessible as the entry ticket is very low.Alt.Estate provides its solution not only to individuals, but also to real estate developers, investment companies and brokers. They are interested in finding new sales channels and agree to contribute a part of their marketing budgets to promote the Alt.Estate tokenization protocol and quickly fill the company's property asset trading exchange with tokenized real estate from all over the world.

How it works?

ALT token is required to pay all the fees within the framework of the protocol and the platform, purchase property-specific tokens and get involved in decision-making through a special platform governance decentralization mechanism.Using Alt.Estate’s protocol, real estate owners can easily tokenize their property, in whole or in part, and list it on the platform where anyone can buy and resell it. Tokenization powered by Alt.Estate allows the real estate to be traded in small fractions, making it widely accessible as the entry ticket is very low. Based on a native blockchain technology implementation, Alt.Estate makes it possible to buy and sell tokenized real estate assets smoothly, in a transparent and trusted environment with instantaneous transactions and low transaction costs.

Why Blockchain?

• Decentralization: Alt.Estate pushes the real estate market to become truly peer-to-peer. The transition from a centralized system to a decentralized one must be smooth to mitigate implementation risks. The integrity of the Protocol can allow two parties to make a deal without the intermediation of a third party, or to use a third party when necessary.

• Faster Transactions: Alt.Estate Protocol eliminates third-party brokers, lawyers and banks by adding them to the network or assuming their functions such as listings, document flow and payments. Standard registration of the title of deeds with notarized documents could take up to 60 days. An Alt.Estate transaction can take less than 10 minutes.

• Lower Costs: Alt.Estate has the potential to greatly reduce transaction fees by eliminating third-party intermediaries and overhead costs for exchanging assets (up to 30% of property price). The Alt.Estate trading fee is 2% (a reduction of up to 15-fold compared to a traditional real estate transaction), which can be further reduced as the network grows.

• Liquidity: Real estate owners get access to both fiat and cryptocurrency investors without traditional cross-country boundaries, which highly speeds up the property sales process. Property-specific token holders can trade them in the secondary market within the Alt.Estate platform or wherever they want.

• Tokenization: Fractional ownership enables purchasing real estate with a smaller ticket. Property-specific tokens are customized for each property and jurisdiction. Sellers receive a flexible sales instrument, and buyers can choose from a wide variety of real estate opportunities without traditional cross-country boundaries.

• Transparency: Ownership and transaction data is accessible to all peers on the network. It is stored in the distributed web and hashes are recorded to the blockchain. The distributed consensus is achieved via a proof-of-stake algorithm: buyers and sellers are empowered with control of their information and have more confidence in conducting transactions.

Team:

● Vladimir Shmidt (CEO) - 10 years + experience in digital business.

● Alexander Popov (CFO)- financial and investment analysis professional.

● Anton Lysak (CTO)- Founder & CTO at software development companies, including ABBYY LS .

● Liana Tagirova (CMO)- Former online sales and marketing director at Acronis. 5+ years of experience in digital marketing.

Token metrics:

• ICO start date: 30.11.2017

• ICO end date: 30.12.2017

• Soft cap size: 25,000 ETH

• Hard cap: 15,000,000 USD

• Ticket: ALT

• Type: Utility-token

• Token Standard: ERC-20

• Additional Token Emission: No

• Token price in ETH: 1 Token = 0.001000 ETH

• Accepted Currencies: ETH

• Token distribution: 60%Public, 20%Network Growth, 20%Team and Advisors

• Funds allocation: 31.3%Online advertising, 17.1%Legal, 12.5%Technology, 10.7%Content & social marketing, 3.3%Brand awareness, 2.5%Finance, 2.4%Office costs, 20.2%Other (<2% each)

Verdict:

Alt.Estate is the first real estate tokenization project with a working prototype which is very good sign for the company. They have a clear vision on development and they have a very strong team. Which could add more value to their project. Thus it will allow Anyone in the world to build own real estate portfolio, which wasn't possible previously.

Additional Websites:

• Website : https://alt.estate/?utm_expid=.6CVPcRpLTVenAIiRmv2VAA.0&utm_referrer=

• Whitepaper : https://alt.estate/upload/files/altestate_whitepaper.pdf?utm_source=trackico.io