Trade and finance are the lifelines on which markets thrives across the world, with trade-finance different continents rely on their comparative strength to carryout import and export trades so as to boost their economics of scale and also ensure that a level of cultural/global/social and technological cohesion is established amongst this countries,

Finance and markets

Finance is necessary for the smooth running of markets across the world and it’s the sole responsibility of financial of financial institutions to ensure that cash flow in markets in constant; however over the years financial institutions have waned down on the amount of money it pumps into the markets majorly because of risk factors and this has on the long run had an adverse effect on the positive growths and gains of the markets in all its facets.

Trade and markets

Global trade is a function of import and export based on the comparative advantage of different countries across the world as each country rely on this function to boost its economics of scale. With global trade one can also say that global ties in cultural, economic and technology have been established.

As at today trade and finance in global market suffers a lot of deficiencies and this challenges limits infrastructural growths across board other deficiencies in trade-finance are:

Too many cross border latency that tend to drive up financing cost for businesses

Fragmented global marketplace: this markets are mostly centralised or regionalised thereby decreasing business spread and then increasing the cost of capital

The type of infrastructure investments available creates funding constraints as a result of the heavy upfront, uncertainties in government politics and very long cycles to realize returns.

Constraints of domestic providers: domestic providers can be regarded as banks and other financial institutions, a good number of these institutions are inundated by the challenges of balance sheet, unfriendly regulatory requirements on AML, KYC, collaterals, MSMEs etc.

Legacy related issues is also another major red flag affecting the trade-finance sector, there is usually a cumbersome process for documentation, letter of credit etc

Solution at last

Blockchain is set to changing for good the positives of the global marketplace by ensuring that it is able to:

Create very easy auditability and immutability: with this system all round security will be provided based on blockchain cryptographic structure, consensus mechanism is adopted whenever there is a need to make changes on records.

The digitalized ledger is highly impenetrable and so all records of transactions on its database cannot be compromised

The feature of decentralization in blockchain is also a plus as it will cut off all hitherto trade barriers thereby reducing cost and scaling p profits

Blockchain recognises that efficiency is key and so its smart contract feature is meant to handle settlements, payments, shipments, repayments in a very unique way.

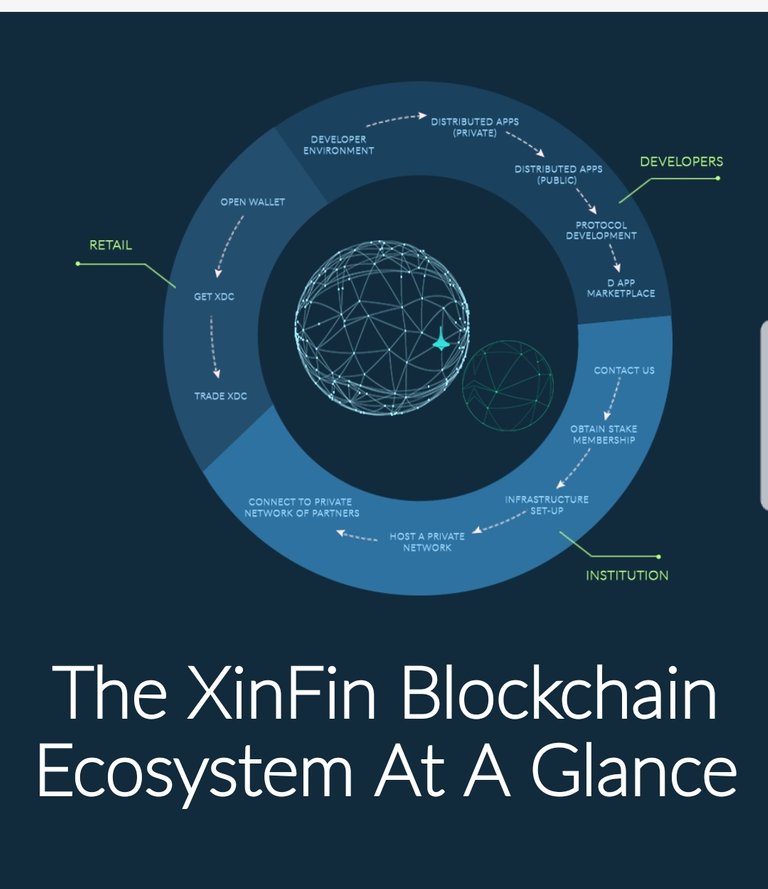

With the gain points of blockchain listed above, blockchain has even moved a step further develop a trade-finance tailored kind of project that will be operate better than any its other trade-finance project and this project is called XinFin blockchain hybrid technology. The XinFin blockchain hybrid technology offers the best of features for the public as well as for the private blockchain network. The XinFin project is designed to create an enterprise ready kind of solution by confidently surmounting all lingering public blockchain challenges; although blockchain is much more safer, flexible, faster and simpler but XinFin hybrid blockchain project makes it even more better, the hybrid blockchain consensus has an array of proof of stake and proof of authority all powered by XDC protocol.

CONCLUSION

Blockchain no doubt has made tremendous progress in transforming many sectors and the trade-finance sector is one of it, with its XinFin technology it has made a step further by its transformation of the business scenarios by bridging gaps so as to make it possible for investors to bid for different infrastructure projects and then finance them seamlessly with no hitches in its entire process.

For more information please visit the following links:

Website: https://xinfin.org/

Whitepapers: https://xinfin.org/resources.php

Youtube: https://www.youtube.com/channel/UCQaL6FixEQ80RJC0B2egX6g

LinkedIn: https://www.linkedin.com/company/xinfin/

Twitter: https://twitter.com/XinFin_Official

Telegram: https://t.me/xinfintalk

Github: https://github.com/xinfinorg

Author:

Name: Sunday Ojochegebe

Eth adress: 0x83047dC716A86ab36481d54b92128dad3d28d14a

Email: Ajprotocol50@gmail.com