What is the use case?

The use case is the use of a distributed ledger technology for bank guarantees in commercial property leasing.

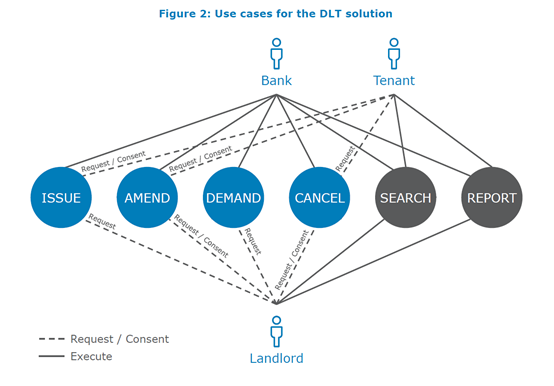

The current process involved in the issuance of a bank guarantee is illustrated below (Westpac, 2017).

(Figure 1 — (Westpac, 2017))

The current process in issuing and managing a bank guarantee involves multiple pain points that can be significantly improved.

i) Physical document management — Banks currently issue a physical document, signed by tenants. The tenant must then physically deliver the document to the landlord. The landlord must produce this physical document in the event of a tenant’s failure to meet leasing obligations to make a claim. The process is inefficient, time-consuming and costly.

ii) Tracking and reporting — The physical guarantees issued must be stored securely and their statuses must be reported on regularly.

iii) Lack of standardization — Currently there is a lack of a standard format, and it varies between banks and landlords.

A blockchain based distributed ledger can address the problem (i) and (ii) by the tokenization of the bank guarantees. The creation of the shared ledger that can be maintained and displayed on the blockchain system can address the problem (iii) above.

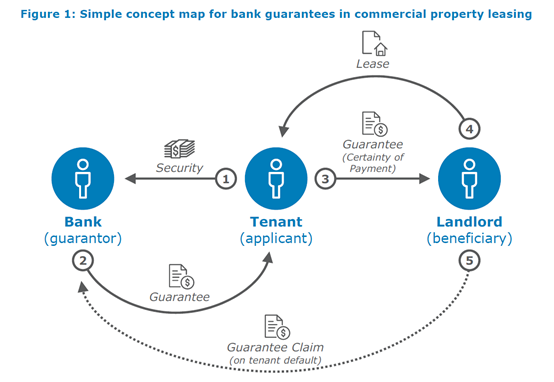

The use case of the distributed ledger is illustrated below (Westpac, 2017).

(Figure 2 — (Westpac, 2017))

Key criteria (As per strategy document):

- Is there a predictable, repeatable process that lends itself well to automation?

YES. Bank guarantees have set common and repeatable procedures that are repeatable such as the physical issuance and exchanges between parties such as the landlord, tenant and the bank. Automating will eliminate the long and time-consuming process as well as the physical issuance of paper-based documents.

- Is there an ongoing or long-running transaction or process, rather than a process that only occurs once?

YES. Bank guarantees are a long running transaction as each bank guarantee has transaction processes at initiation and finally at termination sometime in the future. This process is also unnecessarily long and time consuming and by nature the process inefficiencies become compounded.

- Are there multiple stakeholders in this process or value chain?

YES. Bank guarantees involve many stakeholders. The stakeholders involved in the value chain include the tenant, the landlord and the bank. Other potential indirect stakeholders involved are services providers such as lawyers and record keeping facilities that provide secure storage of the bank guarantees for the holders.

- Is the role of reconciling disparate data usually played by one party or a limited number of parties?

YES. The role of reconciling disparate data is generally played by the bank. The banker preparing the bank guarantee must reconcile information gathered from the tenant as well as the landlord to meet the requirement of the document.

- Is there an element of value transfer? Remember, value is not only monetary.

YES. The value transfer in this occasion involves monetary value as well as non-monetary value. The tenant and the bank will transact a monetary value specified by the bank guarantee, while the bank and the landlord will transact a future payment guarantee if certain conditions are met.

- Is there value in an immutable record? Or is an immutable record a requirement?

YES. Bank guarantees must be immutable for tenants and landlords to be protected. In the event a landlord claims nonexistence or alters a bank guarantee the tenant suffers financial loss. In the event of a tenant failure a “muted” Bank guarantee creates a financial loss to the landlord.

Protocol layer

● Is it possible to use public blockchains, or is there a defined need for a private implementation?

● What are the design expectations regarding speed, programmability, or functionality?

● Do you have developer resources available, or is the protocol you are using supported by a robust, sustainable open-source developer community with access to resources? Or will you need to foster a developer community?

Westpac consortium uses a private blockchain Hyperledger fabric. A public blockchain has the advantages of higher levels of decentralisation and immutability. However private protocols such as Hyperledger fabric is much faster and scalable than the public protocols (Vukolic, 2018). The suitability for an application requiring speed and scalability as well as control in situations where accidental transaction errors have occurred is better fulfilled by a private ledger such as Hyper ledger fabric.

Hyperledger fabric that is explored by the Westpac consortium is a better fit as the level functionality can be adjusted and scaled to the bank’s requirements and meet client expectations. A public blockchain such as rootstock as a solution providing smart contracts with slightly higher transactions speeds can also meet the programmability and functionality required for this application, however does not meet the flexibility that is offered via Hyperledger.

The bank guarantee application is driven by a bank given the nature of the use. Hence the resources available for a bank in terms of human capital such as the developers, and strategists, marketing and PR will be abundant. If a start-up project was to attempt this opportunity, the resources on a private blockchain are limited. There are less developers available to them, and the costs are higher. In contrast public protocols have robust, sustainable open-sourced developer communities.

Given the advantages, availability of resources and stakeholders involved, a private blockchain that allows for speed, scalability and more importantly flexibility in corrections of errors is a better solution.

Network layer

● Who needs to run a node? Who has read access? Who has write access?

● What are the technology integration requirements?

● How significant are the resource (calculation) requirements at a given node?

● What are the data storage requirements regarding network capability (e.g. Storj), archiving and regulation?

In the case of bank guarantees on a private blockchain, the nodes will be run by trusted assignees. The parties that require read access are landlords and tenants i.e. “Data on a need-to-know basis”. The write access can remain with the bank in the case of required adjustments that may occur at times.

Technology integrations at the nodes are all specified, and instructions are provided by Hyperledger fabric. This is also customisable to an extent and the user can define node behaviour and transaction processing methodologies.

In a private blockchain such as Hyperledger the resource requirements are much less than the public chains given the reduced intensity and requirements of consensus calculations. Due to the level of customisation possible coupled with the trusted parties involved, the consensus requirements can be reduced to minimise resource consumption.

Data storage is important, and it can be hashed and stored in the blockchain. In a public blockchain situation the need for storage can be explored with solutions such as storJ. However, a storage solution utilising the banks internal storage facilities are an adequate solution for a Hyperledger deployment.

Other data requirements involving the jurisdiction of the location where the data is stored and archived can also be easily addressed using Hyperledger fabric or any other private blockchain solution. As an example, GDPR, data requirements for storage and archiving can be addressed swiftly and with ease through a private blockchain, due to the ability to control of the node locations and behaviours.

Application layer

● Who is going to use the application? What are the implications for user experience and design?

● What is the existing organisational structure, and what behavioural patterns do users have today? How does this product or service fit into their existing workflow?

● Are there any behavioural or organisational changes necessary to implement this use case?

The Bank guarantees application will be used by the Banks, landlords, and tenants. The indirect users will include external service providers such as lawyers.

User experience needs to be tailored for each group with access levels for different needs and user interfaces catering for their capabilities of operating dApps. The user interface must maintain privacy of all data gathered and visibility of data gathered should only be if it is relevant and required for each user.

Existing workflow of the typical bank guarantee involves manual printing, signing and hand delivering which causes large inefficiencies and time consumption. The dApp will fit into this existing workflow by significantly reducing the need for this coordination and increasing efficiencies by an automated procedure. This will improve the workflow of the banks significantly as well as enable the business bankers to focus more on client requirements to solidify existing relationships. Self-executable smart contracts leading to further efficiencies adding to optimised workflow for all stakeholders could potentially also be developed in the future (K, 2018).

Behavioural changes that need to implement via a change management strategy will include issues such as the use of the interface in automating the process, retrain administration staff to higher skilled jobs, and further training for business bankers to leverage automation to provide better customer outcomes.

Bibliography

K, K. (2018, March 23). How are Smart Contracts Executed in Hyperledger? Retrieved from hackernoon.com: https://hackernoon.com/how-are-smart-contracts-executed-in-hyperledger-57efebf03f12

Vukolic, M. (2018, Februrary 02). IBM Hyperledger facbric. Retrieved from IBM: https://www.ibm.com/blogs/research/2018/02/architecture-hyperledger-fabric/

Westpac, A. I. (2017). Distributed ledger technology and bank guarantees, for commercial property leasing.

Congratulations @gsamarakoon! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!