SBI Ripple Asia, a Joint-venture based in Tokyo, Japan has launched its blockchain based money remittance app. The app called MoneyTap can make real-time, no-cost domestic transfers using Ripple’s xCurrent payment solution.

Simplifying Domestic Bank Transfers with Blockchain Technology

As announced via a tweet on Ripple’s official Twitter handle, the payment app is a product of the Japan Bank Consortium arrangement– a partnership between SBI Ripple Asia and several Japanese banks.

MoneyTap, powered by Ripple’s xCurrent payment solution has seen increased adoption by financial institutions in various countries. The xCurrent network built on Distributed Ledger Technology (DLT), facilitates instantaneous payment settlement with end-to-end tracking.

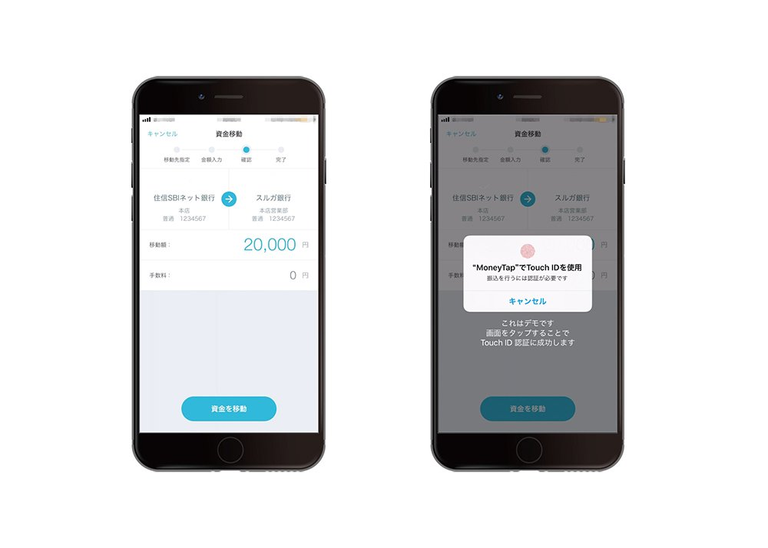

According to the app’s web portal, users can make transfers to phone numbers or QR codes, instances where the user does not know the receivers bank account number. Also, the app utilizes various authentication measures such as fingerprint scanning to ensure secure access for users.

Unlike other Ripple payment solutions offering cross-border efficiency, MoneyTap is dedicated to domestic bank transfers. Local bank transfer is presently a rigid process in Japan, only available on weekdays between 8:30 am and 3:30 pm. MoneyTap seeks to present an ever-present solution to domestic transfers, 24hours a day, 365 days of the year.

This launch comes after SBI Ripple Asia received the license to operate as an agent for electronic payment settlement last month. Following new regulations issued in the country (Act No. 2 of the Kanto Local Finance Bureau, Electronic Settlement Agency No. 2), SBI Ripple Asia had to receive authorization for its MoneyTap app from the Treasury Department.

Speaking on the app, SBI Ripple Asia CEO, Takashi Okita, had this to say:

We are proud to leverage Ripple’s blockchain technology through our new mobile app, MoneyTap, to improve the payments infrastructure in Japan. Together with the trust, reliability, and reach of the bank consortium, we can remove friction from payments and create a faster, safer, and more efficient domestic payments experience for our customers.

SBI Ripple Asia – Offering Blockchain-Based FinTech Solutions in Japan

SBI Ripple Asia is a Joint—Venture arrangement between Japan’s Strategic Business Innovator (SBI) Group and U.S Based FinTech company Ripple. This Joint-Venture arrangement is geared towards the delivery seamless, real-time, low to no-cost cross-border payments and money remittance solution to Japanese customers.

To meet its goals, SBI Ripple Asia established the “Japan Bank Consortium to Centrally Provide Domestic and Cross-border Payments” (with over 60 participating banks as at 2017) to develop RC Cloud – a blockchain platform for domestic and cross-border payment using Ripple’s xCurrent payment solution.

The recently launched MoneyTap app utilizes the RC Cloud platform. However, as previously reported by EWN this initial launch supports only available to three-member banks – SBI Shumishin Net Bank, Suruga Bank, and Resona Bank. There are plans to increase support to the other 58-member banks of the consortium.

Articles from: https://ethereumworldnews.com/ripple-blockchain-powered-mobile-payment-app-moneytap-comes-online-in-japan/

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://ethereumworldnews.com/ripple-blockchain-powered-mobile-payment-app-moneytap-comes-online-in-japan/