Here is a summary of an empirical research that is exploring best practices of ICOs. To fully satisfy rigor in this exploratory research an empirical approach is taken using both quantitative and qualitative methods, splitting the research paper up into three parts. Starting out with a thorough literature research, followed by a quantitative method through gathering various data points from all the ICOs that have taken place in Switzerland. The third and final step is through interviews with major players in the field to validate the findings or adding new findings. The goal of this research is to build a base of findings that not only discovers various best practices for ICOs, but also tries to define what an ICO actually is. To additionally help in clarifying best practices of ICOs and also give a structure of the various facets an ICO has, the PEST analysis approach is found most fitting that covers the topics of political, economic, social and technology.

1 Literature research

1.1 Starting off with the general findings through literature Research:

- ICOs raised $5.6 billion plus $1 billion in direct investments during 2017, compared to $188.8 billion through IPOs and $8.51 billion through Angel and Seed-Stage Venture Capital deals [1] [2] [3].

- The first ICO took place in 2013 with Mastercoin, the biggest is Filecoin with $262 million, the fastest is the Brave ICO raising $35.5 million in 30 seconds and the most impactful is The DAO [4] [5] [6].

- Compared to crowdfunding ICOs are more liquid, compared to IPOs much faster, less complex and expensive to do and compared to VCs, one don’t have to give up their equity and are more borderless in nature to reach potential investors [7] [8].

- ICOs fulfill much needed funding needs which dried up due to the turmoil in the financial service environment i.e. regulation [8].

- The phrase for Switzerland being “Crypto Valley” came in 2014 from one of the Ethereum founders [9].

- Switzerland is attractive for ICOs because of the highly qualified workforce, decentralized government, open political mindset, tax system and innovation power [10].

- What makes ICOs uncertain and volatile is due to the following facts [8] [7] [11]:

o Unregulated and the uncertainty about the regulatory measures coming*

o Lack of information and transparency

o False expectation created through hype

o Not backed by any assets

o No useable and scalable platform

1.2 Political

- The political and regulatory aspect of ICOs is substantial, focusing mostly on the difference and definition of what a utility or security token is.

- Utility tokens are about access to the platform and services. The security token on the other hand have share-like features with the right to profit.

- The communication of ICOs has become crucial, regardless if it is a utility or security token. The wording and communication method can also help in defining what token is behind an ICO and the project can be held liable for it [12] [13].

- Generating terms and conditions in a dedicated document becomes increasingly a good practice, doesn’t matter what type of token there is.

- Even when ICOs chooses to comply with local regulatory governments, what might be legal in one country can be illegal in others. Adding to the complexity of this, due to the complex nature of tokens and touching upon various regulatory frameworks, the issue is raised that there can be conflicting laws between the applied legal frameworks [14].

1.2.1 How Switzerland Approaches ICOs

- FINMA the Swiss government body responsible for financial regulation, welcomes and supports the development of the blockchain technology. But also stating clearly that it will seek out misuse and prosecute [15].

- FINMA published an ICO guideline with the attempt to distinguish between the token types and the regulatory framework behind them to adhere to [16].

- The Swiss State Secretariat for International Financial Matters (SIF) established a working group to review the legal framework for blockchain technology [17].

1.2.2 How other major countries approach ICOs

- USA: U.S. Securities and Exchange Commission (SEC) has brought out its stands on The DAO and how they went about to classify it as a security. The SEC has sent out many subpoenas to ICOs that might qualify as a security token. The Internal Revenue Service (IRS) states that it will handle virtual currencies as a property for US federal tax purposes. The U.S. Commodity Futures Trading Commission (CFTC) warns from pump-and-dump schemes and published a bounty on them. Wyoming is making headway and has passed five blockchain favorable legislations [19] - [24].

- Gibraltar: The Gibraltar Financial Services Commission (GFSC) brought out nine principles that blockchain technology should follow. Gibraltar is drafting up laws to regulate ICOs and could potentially become the first country to do so [21] [22].

- Japan: Bitcoin establish itself quite early in Japan and recognizes virtual currencies as a legal form of payment. It is required for an ICO if it has a security like token, to register according to the Financial Instruments and Exchange Act (FIEA) which is Japan’s security law [23] [24].

1.3 Economics

- Since ICOs create their own tokens which in turn creates an own ecosystem of supply and demand, creating the need for economic policies to sustain a fair balance to the ecosystem. The fiscal policy is the demand and needs to answer the benefit a token brings to the holder. The monetary policy defines the supply strategy of a token including the amount in circulation and distribution [13].

- Having the right mix of an fiscal and monetary policy is key, to ensure the right balance in the tokens ecosystem. If not considered the project of the ICO and its token holders are exposed to severe fluctuation of the token and eventual failure [13].

- The price fluctuation of an ICO token is also magnified by the fluctuation of the price in which the funds are raised, like ETH or BTC. Hedging this by selling of the funds can lead to greater risk by sending out the signal to the community that the ICO is selling off its funds, leading to a further price drop.

- The economic incentives given through a token can be revolutionary but also risky at the same time. Wrong incentives can quickly lead to wrong behavior and eventual failure of the project [24].

1.4 Social

- Another great benefit that comes through ICOs, is the creation of a worldwide community. Other startups first have to build a community towards a brand which can be very costly and time-consuming [25].

- The community is the engine of any blockchain startup and is, therefore, the key to establishing trust. But wrongly motivated communities can lead to more misleading or skewed information, hurting the future potential of the platform.

- The asymmetry of information existing within ICOs can lead to wrongly motivated communities lead by only few opinion makers hurting the long-term development of the project [7].

1.5 Technology

- Most ICOs take place on the Ethereum network, which brings the Ethereum network to its limits leading to some ICOs to move their fundraising dates. But there seems to be no other protocol as mature as the Ethereum network with smart contract functionality [26].

- The only other option an ICO would have is to run it on a private protocols like Hyperledger or BaaS. Both can offer also the smart contract functionality but might not be compatible with other open protocols.

- Hacking risk of ICOs are high and the vulnerability to be exploited are not only through the faulty code but also through social engineering.

- Creating a new token on the Ethereum network through ERC-20 is relativity easy and even for non-technical possible, but not recommendable due to security reasons. The Ethereum community has detail description of how to create a new token and has a library of code that can be used for it [27].

2 Quantitative research

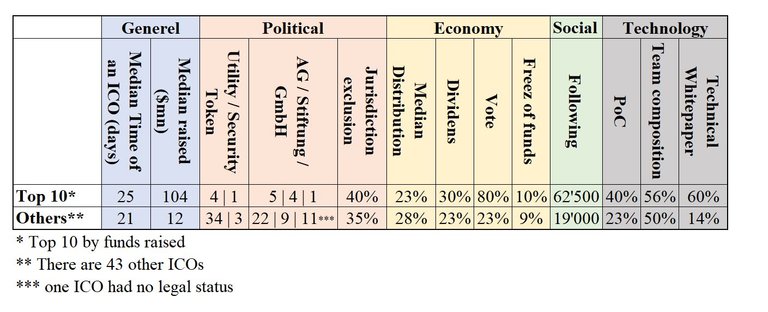

Here are the findings out of the quantitative part of the research paper. The approach was firstly find all ICOs that took place in Switzerland from 2016 until February 2018. With the help of various ICO rating platforms, 53 ICO could be found which closed their fundraising. The data points derivate mainly from main four categories (political, economic, social and technological).

2.1 General

The median time of an ICO is 22.8 days with the longest ICO taking place over 2 years and the shortest in 66 seconds. Of the 53 ICOs two occurred in 2016, 42 in 2017 and the 8 in the first two months of 2018. The total fund raised since 2016 until February 2018 are $1.78 billion with the median value at $15 million, the largest ICO raising $258 million, the smallest $0.9 million and the top 10 percentile raises above $100 million. Of the 52 ICO 33 successfully closed their fundraising by reaching their funding cap.

2.2 Political

Of the 53 ICOs 39 distributed utility tokens and 6 were security tokens. The rest were either cryptocurrencies or hybrid tokens. 17 of the ICO analyzed cannot be determined where the team is based out from due to the mix of nationalities in the team. 12 of the ICO had Swiss team members and 7 ICOs had a strong US presents. The rest had team bases from Russia, Israel, Hungary, Germany, France, Korea and Italy. The legal company status for ICOs was 27 AGs, 13 for Foundation and 13 GmbHs. 19 of the ICOs have chosen to have a jurisdiction exclusion of certain countries, this mostly included China, USA and South Korea.

2.3 Economy

The monetary policy is determined by the ICOs distribution strategy and dividends. All of the ICO published their token distribution strategy, with the median at 27% of token kept in the project and going as high as 85%. Promises of dividends were made by 13 ICOs and 18 gave the right to vote. There were 5 ICOs that froze their tokens after the fund raising with various ways to do it.

2.4 Social

A valuable part of an ICOs are the communities which are hard to measure in a quantitative measures. Also due to the fact that there are many channels through which ICO communicate with their communities. But the most popular once are twitter, telegram, and facebook. As a first step, the size of communities was measured through the following on the major social media platforms. The median following of ICOs combined of twitter, telegram and facebook are 21’100, with the largest following reaching as high as 145’400 followers.

2.5 Technology

14 of the 53 ICOs had a proof of concept. Looking at team composition it has been found that the median value of 57% has some sort of technical skill. A simple distinction has been used between whitepapers by looking at how technical and detailed the whitepaper was formulated. Out of the 53 ICOs, 12 had a more technical whitepaper.

Here is an attempt to compare the top 10 ICOs with the rest:

List of literature

[1] A. Banerjee, A. Belyaeva, C. Frankopan, M. Mersch, and R. Muirhead, “The State of the Token Market.”

[2] “Global IPO trends: Q3 2017.” Ernst & Young, 2017.

[3] “Q4 2017 Global Report: VC Sets Annual Records On Back Of Strong Late-Stage Results,” Crunchbase News. [Online]. Available: https://news.crunchbase.com/news/q4-2017-global-report-vc-sets-annual-records-back-strong-late-stage-results/. [Accessed: 17-Mar-2018].

[4] “ICO, Explained,” Cointelegraph. [Online]. Available: https://cointelegraph.com/explained/ico-explained. [Accessed: 17-Mar-2018].

[5] “CoinDesk ICO Tracker,” CoinDesk. [Online]. Available: https://www.coindesk.com/ico-tracker/. [Accessed: 14-Oct-2017].

[6] “Former Mozilla CEO raises $35M in under 30 seconds for his browser startup Brave,” TechCrunch, 01-Jun-2017. .

[7] M. Yadav, “Exploring Signals for Investing in an Initial Coin Offering (ICO),” Social Science Research Network, Rochester, NY, SSRN Scholarly Paper ID 3037106, Sep. 2017.

[8] W. A. Kaal and M. Dell’Erba, “Initial Coin Offerings: Emerging Practices, Risk Factors, and Red Flags,” Social Science Research Network, Rochester, NY, SSRN Scholarly Paper ID 3067615, Nov. 2017.

[9] S. Hazlegreaves, “Switzerland, blockchain’s spiritual home,” Open Access Government, 05-Jan-2018. .

[10] D. Diemers, “Initial Coin Offerings - A strategic perspective: Global and Switzerland,” PwC and Crypto Valley Association, Switzerland, Dec. 2017.

[11] “Only One in 10 Tokens Is In Use Following Initial Coin Offerings,” Bloomberg.com, 23-Oct-2017.

[12] T. Prof. Dr. Ankenbrand, A. Prof. Dr. Dietrich, and D. Bieri, “IFZ FinTech Study 2018,” Institute of Financial Services Zug IFZ.

[13] A. Sehra, P. Smith, and P. Gomes, “Economics of Initial Coin Offerings,” Nivaura, Aug. 2017.

[14] I. M. Barsan, “Legal Challenges of Initial Coin Offerings (ICO),” Social Science Research Network, Rochester, NY, SSRN Scholarly Paper ID 3064397, Nov. 2017.

[15] “FINMA Guidance 04/2017 - Regulatory treatment of initial coin offerings,” FINMA, Sep. 2017.

[16] E. F. FINMA, “FINMA publishes ICO guidelines,” Eidgenössische Finanzmarktaufsicht FINMA. [Online]. Available: https://www.finma.ch/en/news/2018/02/20180216-mm-ico-wegleitung/. [Accessed: 20-Mar-2018].

[17] “Blockchain/ICO working group established.” [Online]. Available: https://www.sif.admin.ch/sif/en/home/dokumentation/medienmitteilungen/medienmitteilungen.msg-id-69539.html. [Accessed: 20-Mar-2018].

[18] E. S. S and M. N.v, “Comparative Analysis of Legal Regulation of ICO in Selected Countries,” KnE Soc. Sci. Humanit., vol. 3, no. 2, pp. 77–84, Feb. 2018.

[19] “Subpoenas Signal S.E.C. Crackdown on Initial Coin Offerings - The New York Times.” [Online]. Available: https://mobile.nytimes.com/2018/02/28/technology/initial-coin-offerings-sec.html?referer=. [Accessed: 21-Mar-2018].

[20] “GFSC - Gibraltar Financial Services Commission - News.” [Online]. Available: http://www.fsc.gi/news/hm-government-of-gibraltar-and-the-gibraltar-financial-services-commission-announce-plans-for-token-legislation-272. [Accessed: 22-Mar-2018].

[21] “GFSC - Gibraltar Financial Services Commission - Distributed Ledger Technology.” [Online]. Available: http://www.fsc.gi/dlt. [Accessed: 22-Mar-2018].

[22] O. of Asia, “Japan: A Forward Thinking Bitcoin Nation,” Forbes. [Online]. Available: https://www.forbes.com/sites/outofasia/2017/11/02/japan-a-forward-thinking-bitcoin-nation/. [Accessed: 24-Mar-2018].

[23] J. D.-H. Ina and Y. Yoshida, “Japan’s FSA Clarifies Regulatory Position on Initial Coin Offerings, Warns of Risks | Lexology.” [Online]. Available: https://www.lexology.com/library/detail.aspx?g=86e04483-fd80-4a80-907d-4feb93e318ff. [Accessed: 24-Mar-2018].

[24] Y. Chen, “Blockchain Tokens and the Potential Democratization of Entrepreneurship and Innovation,” Social Science Research Network, Rochester, NY, SSRN Scholarly Paper ID 3059150, Oct. 2017.

[25] F. Montagnon, “Navigating the crypto market: When an ICO makes financial sense,” Bankless Times, 06-Mar-2018. [Online]. Available: https://www.banklesstimes.com/2018/03/06/navigating-crypto-market-ico-makes-financial-sense/. [Accessed: 24-Mar-2018].

[26] “Ethereum to ICOs: You’re Doing It Wrong,” CoinDesk, 10-Nov-2017. [Online]. Available: https://www.coindesk.com/ethereum-icos-youre-wrong/. [Accessed: 24-Mar-2018].

[27] H. Saeed, “What is ERC20 Token standard and why is it useful for your ICO? | Coinschedule Blog.” .

This research paper is a summary of the master thesis paper written at ZHAW School of Management and Law for Business Information System modul in Switzerland.

Congratulations @ephraim-ico! You received a personal award!

Click here to view your Board

Congratulations @ephraim-ico! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!