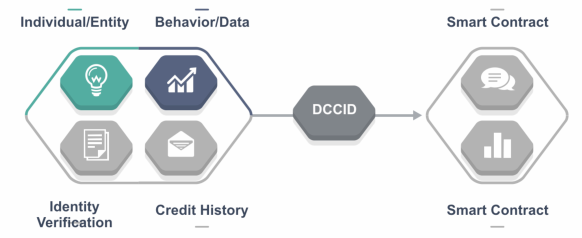

The Distributed Credit Chain, DCC is the blockchain network system pertaining the decentralization by the disintermediation breaking up original excessive by the premiums resulting in the information asymmetry among the intermediaries. This will have the return premiums for the ecosystem by the participation in achieving the redistribution of the ecosystem valuing the distribution participating through the digital consensus algorithm. The big data ultimately analysis the institutions by the regulatory bodies by the understanding respond to the industry risks for the blockchain analysis.

Gateway Service

The gateway service of DCC is a centralized system primarily. It serves the ecosystem participating without any ability directly with the access of DCC through RPC. This will have the access in DCC via open API through the gateway provided by the DCC. This will have greater reductions in the business by interfacing time. The DCC system also provides the SDK other access methods based on the Gateway Service facilitating the ecosystem by the expansion of providing an easy access to enjoy the credit services on DCC.

Open Platform

.png)

The Open Platform for the Distributed Credit Chain is in access to the centralized system and it will serve the data provider and market. This will serve the transaction market for data collaborating AI risk control algorithm by the providers, credit structuring institutions, and other institutional partners.

The platforms have the authority to check the institutional partners on screen, with contact and reach to the cooperation of partners based on the needs of DCC while using the service on DCC. The interface of the Open Platform contracts with the DCC market by the cooperating of institutions publishing the labor costs through the platform by the analysis to the processing of data to be sent to the users and institutions based on the service chosen by the needs.

It will make the process smoother in real-time through the exchange of information throughout the institutional service market. The platform also ensures the blockchain browser in view of all nodes for operating the block loan request for the transaction flow and other basic blockchain information on DCC.

Open Source Framework

The framework of DCDMF, DIV and SDV are operated through the open sources at GitHub given by the open source. The system welcomes the partners in modifying the frameworks for more customized services. It will have the involvement of users, Debit and Credit Sides App posses the numerical summary, conductive chain course referring to increasing material by the identification service supplier will receive endorse the application by conductive endorsing course.

This will have the identification for service user using conductive endorsement for test course. This will have the blockchain conductive service involves the query the order, application, pass, and refuse, an inquiry through the certification process by the requisition order in the conductive endorsement. The users will have debit and credit sides with App conducive chain course by the identification service supplier, receiving the applications by the download of increasing material for certification process internet-accessible.

The blockchain conducive service will have the application, pass, refuse, an inquiry by the certification process will be done through the requisition of order to make a conducive endorsement. The system also designed the domain model and SDV framework to emphasize the GitHub system of Distributed Banking system of Distributed Credit Chain blockchain network.

The regulation of records will register through the system of DCC blockchain will be tampered with enabling the regulators penetrating the underlying assets in real time.

Website : http://dcc.finance/

Whitepaper : http://dcc.finance/file/DCCwhitepaper.pdf

Twitter : https://twitter.com/DccOfficial2018/

Facebook : https://www.facebook.com/DccOfficial2018/

Telegram : https://t.me/DccOfficial