Oh, How Things Have Evolved

As we begin toward closing out 2018, we find the cryptocurrency niche of the distributed ledger ecosystem in a very different place than the same time last year. Where December 2017 proved to be an all-time high for cryptocurrency since the dawn of its existence, 2018 has seen monthly successive degradation of currency value and investor hopes given the sustained devaluation from its former glory. Capitulation is the buzzword to describe the sentiment among many investors. Accompanying this monthly loss of value are the rise of enterprise entrants, celebrity profiles, and, of course, regulatory action. The overarching community of interested individuals and enthusiasts, previously gung-ho on the future expectations of public ledger cryptocurrency, have taken a step back from zealotry to re-evaluate where we stand now and what the future will hold.

Having myself been a part of this zealotry for some time, I can sympathize with many of the expectations. Decentralization sounds great on paper, and may exist in a future decades ahead in ways that will dramatically consolidate disparate daily functions and societal sectors. But the elephant in the room for the time being is that the only concrete usability happening in the space at the moment are the models which have public adoption stemming from (centralized) businesses taking responsibility for hosting a (centralized) platform on a centralized or federated blockchain network. While I’d like to discuss this in greater depth at some other point in time, the short of it is that we’re at the point in time now where individuals (with money) are willing to get on board with centralized blockchain solutions where market actors don’t determine one’s feasibility to transact seamlessly (see: CryptoKitties) and that the customers of blockchain solutions can still call up customer support and hold someone accountable for lack of meeting expectations (see: ICO scams, capital flight).

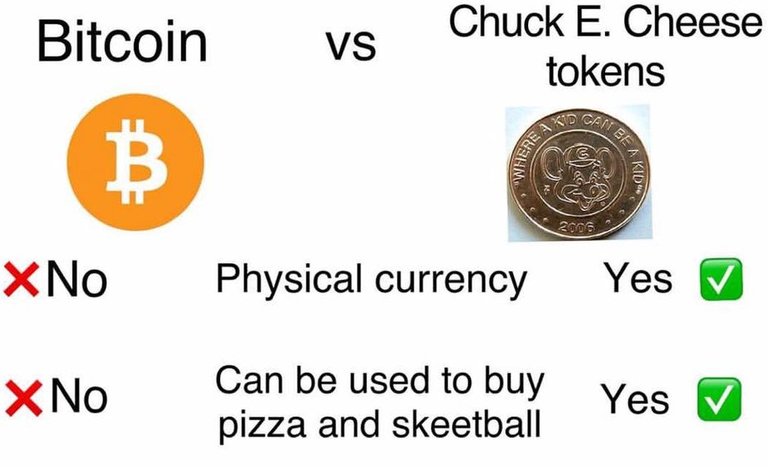

So this brings us to the crux of the article- what is the real value of a token?

Let’s make it easy and just stick to the things that will affect virtually all of the people here and now (we can play around with DRM, Intellectual Property, fungibility, divisibility, M2M micropayments another day).

Credit card fees replaced by fractional micropayments

Currency standardization and transaction ubiquity

Metadata for legal restrictability, accountability, and transparency

Credit Card Fees Replaced by Fractional Micropayments

In the current state of world B2B & B2C commerce, we use credit cards to buy things. Upon each purchase using a credit card, a 3% fee is incurred by the retailer which surely gets passed onto consumers in the price of the product. With a digital currency that uses computing power to uphold the network, incurring only the costs of servers (which are pennies on the dollar), the original fee is replaced by something exponentially more economical. The 3% paid for by the retailer/customer that had previously gone toward the parties’ trust in the infrastructure and security of credit card company, could now be instead saved by both parties that now have the infrastructure and security they need at a fraction of the cost. Absent viable current legitimate players in the space that have been able to convince retailers and consumers to transition to digital currency, and the likelihood that credit card companies will rain fire on anyone who infringes on their hegemony, we may be a few years out. But in theory, massive savings can be made for both consumers and retailers.

Currency Standardization and Transaction Ubiquity

International commerce is an interesting concept, and while I’m not going to pretend to know all of the ins-and-outs, I can speculate at what currencies underpin the majority of bulk orders. I imagine that mainly US Dollars are used to conduct trades, with Australian Dollars, Canadian Dollars, British Pounds, European Euros, Chinese Yuan, Japanese Yen, Russian Rubles, and Indian Rupees in the mix (probably some others as well). I imagine that it can be a chore for individuals involved in international commerce to constantly have to manually evaluate different national inflationary policies and pay the broker-dealer fees for transacting on the Forex markets when needing to obtain different currencies. In fact, even just for consumers heading to another country, there is a manual process (enshrouded with a fee) for going to exchange some of your currency for the national currency of the country that you are visiting.

So yet again while we’ll be a few years out, what if there were a method where anyone could see the immutable data stating the indisputable quantity of current national “dollars” in existence, rather than speculating and being subject to potential monetary supply manipulation deviously kept under wraps (looking at you Venezuela, Zimbabwe, China)?

In proliferation of such a system, people could purchase dollar tokens directly from the Federal Reserve (or its 3rd party affiliates) of a designated country straight from their computer and in a fashion where fees are minimized. As well, inflationary policy would be VERY above board, with anyone able to query how many dollars are in existence in South Africa, and knowing it to be indisputably true, while also being able to find press releases discussing South Africa’s push to inflate/deflate tokens for the quarter at a set rate that they have embedded in an algorithm underpinned by openly-reviewable code.

Metadata for Legal Restrictability, Accountability, and Transparency

One of biggest differentiators for those in favor of tokens over dollars, is that there is the ability to embed infrastructure in tokens that capture metadata over the course of the token’s chain-of-custody history in a way that does not exist with tangible dollars.

With the ability to attach metadata to tokens as they change hands, consumers and the government have greater access to more information about how dollars are being used. For consumers, it could be helpful to know that the dollars they receive are not ‘blood money’ or counterfeit dollars. On the governmental front, administrators may want know that the dollars spent are not laundered by criminal organizations or foreign spies. In addition to just watching the flow of dollars, with proper KYC and code backdoors, the government will be able to better identify bad actors and burn tokens/do force transfers away from criminal accounts. On top of all this, different municipalities, states, provinces, and federal governments can install their own rules in their own token in a way that benefits regional interest, standards, and laws (eg hold periods). There are some ethical implications here to all of this, but I’m not in the place where I’d like to tackle these at the moment.

In Sum

Despite what your snobby friend, neighbor, or acquaintance says, there are some long-term implications for tokens in the modern and futuristic society. Costs can be saved, oversight can be had, and discrepancies can be minimized. While the end of the “Year of the Regulatory Token” draws near and Crypto Winter continues its year-long stride, 2019 will provide another opportunity for legislatures and developers to play around with the ethical and practical challenges that exist in pervasive token utility and adoption.

…

While this article is posted here, it’s posted elsewhere as well. In an effort to create a cross-platform discussion, I invite you to expand on any thoughts you have here in the comments as well as over on treadie, which is very much a microcommunity twitter. The reason I use treadie is because (1) it’s free, signup only with Facebook or Twitter; (2) you don’t get the walled garden of only one platform comment section, instead combining everyone for discussion. Link: https://trvoat.treadie.com/