Cyber•Fund is introducing a series of publications that provide an overview of some of the best speaker topics we’ve hosted at our meetups. Dmitry Starodubcev spoke about smart contracts, tokens and gave a great Q&A session after his presentation.

Tokens

Image via Shuttershock

Many types of tokens currently exist. If you examine CoinMarketCap, you will find 100 different tokens available to be bought, sold and traded. They can be used as debts, event tickets, company shares or even as various forms of ownership. According to Starodubcev, Bitcoin, Ethereum and Ripple are all key to the consensus algorithm of the distributed network and database. Likewise, there are tokens released on top of the database such as Golem or Storj.

Tokens first started in 2013 with a colored coins movement. Bitcoin has the function OP_RETURN, which allows writing of 80 bytes of random information on the blockchain. With such a vast amount of opportunity that this particular function presents, individuals began to record information that someone released as tokens. The first functioned protocol for a token’s release appeared in the bitcoin network. This was followed shortly thereafter by the first-ever crowd sale of Mastercoin, which is now called Omni Layer and has a market capitalization of 37 million dollars.

All projects are allowed to launch tokens, however, the ICO is an expensive process. Subsequently, people began to seeks ways to reduce transaction costs and created new protocols for token releases. Starodubcev thinks that “the token is a very abstract thing. You need to program the token with certain properties to make it concrete.” The Ethereum protocol and BitShares were developed, and over the course of time an abundance of protocols have been developed for the release of tokens. Take Stellar for example, which focuses on debt assets.

Ripple, BitShares and Ethereum

Ripple is another great example of a token that focuses on debt assets. Since Ripple controls their entire network, they have their own procedure to include nodes in the transaction chain. They limit the frequency of entrance into the network and how many tokens can be created. On the other hand, the BitShares network is convenient, fast and simple; however, there is no way to customize and set properties for the tokens that are not provided for by the BitShares smart contract.

Ethereum is a great choice when an individual wants to issue tokens, but is unsure how to use them. Eventually you will be able to easily add smart contracts for these tokens, but it is important to note that the Ethereum network is expensive.

Centralized versus Decentralized

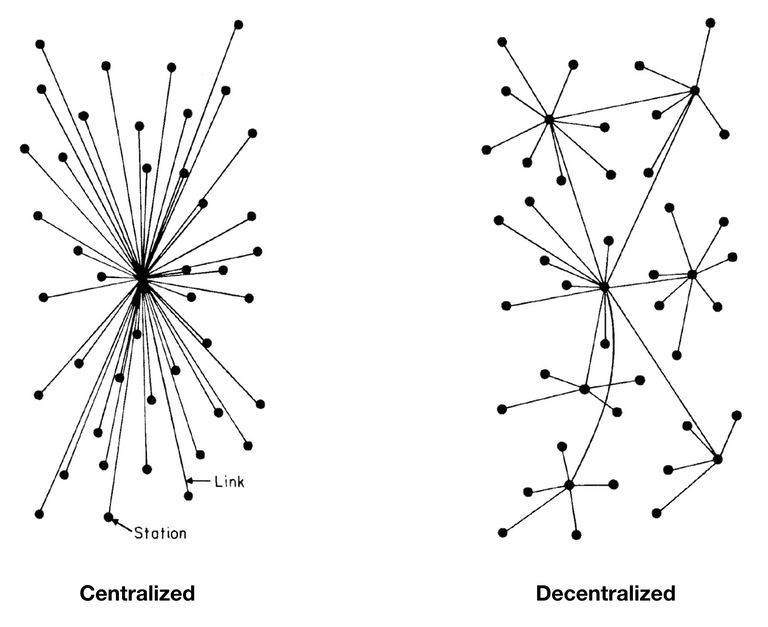

Centralized exchanges like Poloniex are essentially a bank where you can change dollars to rubles. They involve transferring an asset to an exchange account, but during this transfer you lose control over it. The asset is transformed into a debt of the exchange, or in other words the debt that the bank owes to you.

Put simply, during decentralized exchanges the asset belongs to you. Decentralized exchanges are more expensive and slow, and it takes time for these order books to be filled with liquidity. The chicken-and-egg dilemma arises with these new decentralized markets. BitShares is the perfect tool for utc-trading, but people don’t use it because there are no order books. In order to prove every transaction Poloniex can easily issue all the obligations they took in front of their customers on their private chain.

In Starodubcev’s opinion, “we should believe in Poloniex’s prices because there is no other way to make sure that trades we were informed of are really there.” Poloniex could move its’ operations to a high-performance private chain where decentralization is not required, and use it to prove all deposits and trades. Unfortunately, the market is not ready for this and customers do not demand such measures.

Smart Contracts

Image via Shuttershock

Smart contracts are suitable for all types of economic activity. As long as there is an existing need for accounting, such contracts will always be in demand. The only limiting factor in the use of smart contracts is the value of the planned transactions to be taken into account.

During dispute resolution when concluding smart contracts, the escrow method is used to guarantee certain transactions. We can take a third person as an arbitrator, add the condition to the blockchain, and the arbitrator will serve as a guarantee. This is the simplest example of automatization for the standard mechanism that currently exists between the escrow and agent. A smart contract is used to provide business workflow and ensure that neither the agent, nor the counterparty or arbitrator are deceived.

Q&A

After some general thoughts and comments, Starodubcev opened the forum for questions.

How can smart contracts be used by common users and what are their advantages?

The individual needs to learn how to use a smart contract before they can understand its’ real value.

When will there be software that allows any user the opportunity to benefit from all of this?

Currently there is no software program like Google for the Internet, where one program can do everything you need. Parity is close to achieving this, however, their only disadvantage is the performance of ether. Parity allows you to use applications, create contracts, make a will or even a marriage contract. It is the equivalent of a marketplace for smart contracts. Furthermore, if the BitShares network can provide you with 6 smart contracts, then Parity is a serious tool to allow the everyday user to do anything they imagine.

Just as Parity uses Ethereum, there are similar clients that use Ethereum Classic. Cyber•Fund is interested in investing in the existing ecosystem in order to create an infrastructure of fully decentralized computers. EOS, Dfinity and Aeternity are all projects competing for the main niche of turing completeness of centralized blockchains.

Are there a lot of different cryptocurrency projects, and how can we monitor the value of a particular project?

There is no particular way to monitor the value of a project. Instead, there are different stages of projects with their own specific criteria. When examining trade turnovers you need to keep in mind that it can be easily compromised. The main point of reference and the only way to benchmark a particular project should be based on transaction cost; if someone paid for the transaction, most likely it benefited someone.

Miners earn by mining directly or carrying out transactions. If I am a developer who wants to earn Ethereum by writing code, how do I do this?

Developers are able to earn a lot with smart contracts if they are able to help with verification. If there is an algorithm that proves anything from the real world, it can be easily monetized in Ether by using tokens: proof-of-birth or proof-of death. This often proves to be an interesting solution for other smart contracts that will most likely want to pay for it.

If Ethereum is just a large distributed computer, how can you directly use its’ power?

To put it frankly, nobody is quite sure how to use all these capacities.

Which of the existing consensuses does the cyber•Fund team consider to be relevant?

It is unlikely that something unique will be invented. Moreover, we consider proof-of-work and proof-of-stake will continue to develop. NEM is one of the best consensus protocols on the market. The distribution algorithm of the transaction fee on the basis of the significance indicator is a great feature that allows you to fairly pay the labor of those who are involved in economic activity with you.

For more information please contact: pr@cyberfund.io