Blockchain is the base of wab 3.0 (decentralized web)? why blockchain is so important? how blockchain disturbed many industries ? blockchain eliminate all banks ?. Blockchain represents a dramatic improvement to the landscape of information collection, distribution, and governance.

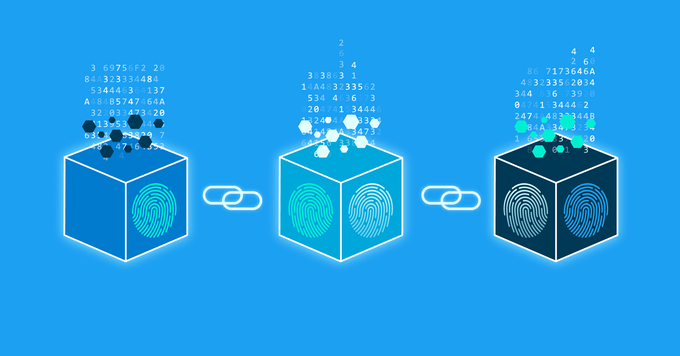

A blockchain is a database encompassing a physical chain of fixed-length blocks that include 1 to N transactions, where each transaction added to a new block is validated and then inserted into the block. When the block is completed. it is added tro the end of the existing chain of blocks.

- Add new and undeletable transactions and organize them into blocks.

- Cryptographically verify each transaction in the block.

- Append the new block to the end of the existing immutable blockchain.

A blockchain is also a distributed database that maintains a doubly linked list of ordered blocks. Each block averages 1 megabyte (see https:/blockchain info/ charts/avg-block-size) and contains control data of approximately 200 bytes, such as a timestamp, a link to a previous block.

The blocks once recorded are designed to be resistant to modification; the data in a block cannot be altered retroactively. Through the use of a peer-to-peer network and a distributed timestamping server, a public blockchain database is managed autonomously.

The ledger itself can also be programmed to trigger transactions automatically.

Blockchains are secure by design and an example of a distributed computing system with high byzantine fault tolerance.

The public blockchain is also a peer-to-peer program with one very important difference: not only does it move files (data) from peer to peer, it also ensures that all the peers have the same exact data. It enforces this. If the data changes on one machine, it changes on all the machines. There are rules specifying exactly how a change can be made, and if someone doesn’t follow them and modifies their copy illegally, they’re ignored.

As noted, the way current public blockchains like Bitcoin and Ethereum work is that instead of changing data within the dataset, new data is just appended onto the old. In other words, data is only written, never deleted. This is how it gets the name blockchain, because new data is added in batches, or blocks, and appended to the existing blocks, forming a chain of blocks. Not only does everyone have the same database (blockchain), but everyone gets a locker within the blockchain that only they can access.

A blockchain is a distributed ledger of transactions implemented as data batched into blocks that use cryptographic validation to link the blocks together. Each block references and identifies the previous block using a hashing function which forms an unbroken chain (i.e., blockchain).

A public blockchain is not stored in one central computer. Nor is it managed by any central entity. Instead, it is distributed and maintained by multiple computers or nodes that compete to validate the newest block entries before the other nodes to gain a reward for doing so.

From a technical point of view, the blockchain is a distributed, transparent, immutable, validated, secured, and pseudo-anonymous database existing as multiple nodes such that if 51 percent of the nodes agree then trust of the chain is guaranteed.

A lot has changed since blockchain first emerged as the technology underpinning the cryptocurrency Bitcoin as a distributed ledger of transactions and asset ownership that is maintained by a network of computers over the Internet. More proof of its ability to reduce costs and speed up post-trade processes has emerged in the past year.

A key factor to its rapid growth is the backdrop against which it has launched. Financial institutions and infrastructures are under pressure both to comply with regulation and to reduce cost. That pressure coincided with this technology coming into existence. It’s the intersection of requirement and opportunity that’s causing the rapid growth. The technology will make moves from “proof-of-concept” technology into production, especially in cross- border payments and trade finance.

Satoshi Nakamoto is the name used by the unknown person or persons who designed Bitcoin and created its original reference implementation, Bitcoin Core. As a part of the implementation, they also devised the first blockchain database and solved the double- spending problem for digital currency. They were active in the development of Bitcoin up until December 2010.

The narrative contrasts the differences between centralized banking systems and the public ledger at the heart of Bitcoin that removes the need for a central authority. It highlights Bitcoin’s power to reduce remittance fees, serve the two and a half billion people on the planet who remain unbanked, and put financial control back into the hands of the individual.

Nakamoto has claimed to be a man living in Japan, born in 1975. However, speculation about the true identity of Nakamoto has mostly focused on a number of cryptography and computer science experts of non-Japanese descent, living in the United States and Europe. It became a bit of “I’m Spartacus” as Australian programmer Craig Steven Wright has claimed to be Nakamoto, though he has not yet offered proof of this. As of February 2017, Nakamoto is believed to own up to roughly 1 million bitcoins (valued at about $4 billion USD) but has never spent even a single BTC.

Types of Blockchain

As people began to understand how blockchain works, they started using it for other purposes: as data storage for things of value, identities, agreements, property rights, and a host of other things. Ethereum, which will be one of the main focuses in this post, is to date the most comprehensive blockchain innovation after Bitcoin. Like cloud computing implementations, different types or categories of blockchain have emerged. Analogous to the cloud, you have public blockchains that everyone can access and update, you have private blockchains for just a limited group within an organization to be able to access and update, and you have a third kind, a consortium of blockchains that are used in collaboration with others. While working on Wall Street, we saw this consortium type of arrangement as very common between five of the larger investment banking firms. The consortium facilitated trades at an institutional level among the members, so it makes sense that blockchain as a financial technology tool would emerge in this way.

Public Blockchains

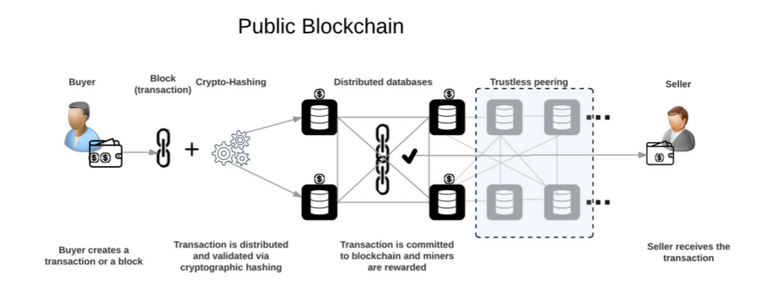

A public blockchain is one that initial creators envisioned as: a blockchain for all to be able to access and transact with; a blockchain where transactions are included if and only if they are valid; a blockchain where everyone can contribute to the consensus process. As discussed, the consensus process determines what blocks get added to the chain and what the current state is. On the public blockchain, instead of using a central server the blockchain is secured by cryptographic verification supported by incentives for the miners. Anyone can be a miner to aggregate and publish those transactions. In the public blockchain, because no user is implicitly trusted to verify transactions, all users follow an algorithm that verifies transactions by committing software and hardware resources to solving a problem by brute force (i.e., by solving the cryptographic puzzle). The miner who reaches the solution first is rewarded, and each new solution, along with the transactions that were used to verify it, forms the basis for the next problem to be solved. The verification concepts are proof-of-work or proof-of-stake.

Consortium Blockchains

A consortium blockchain such as R3 (www.r3cev.com) is a distributed ledger where the consensus process is controlled by a preselected set of nodes—for example, a consortium of nine financial institutions, each of which operates a node, and of which five (like the US Supreme Court) must sign every block in order for the block to be valid. The right to read the blockchain may be public or restricted to the participants, and there are also hybrid routes such as the root hashes of the blocks being public together with an API that allows members of the public to make a limited number of queries and get back cryptographic proofs of some parts of the blockchain state. These sort of blockchains are distributed ledgers that may be considered “partially decentralized.”

Private Blockchains

A fully private blockchain is a blockchain where write permissions are kept centralized to one organization. Read permissions may be public or restricted to an arbitrary extent. Likely applications include database management and auditing internal to a single company, so public readability may not be necessary in many cases at all, though in other cases public auditability is desired. Private blockchains could provide solutions to financial enterprise problems, including compliance agents for regulations such as the Health Insurance Portability and Accountability Act (HIPAA), anti–money laundering (AML), and know-your-customer (KYC) laws. The Hyperledger project from the Linux Foundation and the Gem Health network are private blockchain projects under development. See Chapter 8 for a detailed description of Hyperledger and other private and consortium blockchain technology.

Comparing Blockchains

The distinction between public, consortium, and private blockchains is important. Even for “old school” distributed ledger adopters who prefer a traditional centralized system, they still get the addition of cryptographic auditability attached. As compared to public blockchains, private blockchains have a number of advantages. The private blockchain operator can change the rules of a blockchain. If it is a blockchain among financial partners, then where errors are discovered they will be able to change transactions. Likewise, they will be able to modify balances and generally undo anything. That said, there is a trail. In some cases, this functionality is necessary, as with property registry if a mistaken transaction is issued or some nefarious type has gained access and made themselves the new owner. This is also true on a public blockchain if the government has backdoor access keys like they did in the Clinton era. On the private blockchain, transactions are less expensive, since they only need to be verified by a few nodes that can be trusted to have very high processing power. Public blockchains tend to have more expensive transaction fees, but this will change as scaling technologies emerge and bring public-blockchain costs down to create an efficient blockchain system.Nodes can be trusted to be very well connected, and faults can quickly be fixed by manual intervention, allowing the use of consensus algorithms that offer finality after much shorter block times. Improvements in public blockchain technology, such as Ethereum’s proof- of-stake, can bring public blockchains much closer to the “instant confirmation” ideal, but

private blockchains will always be faster, and the latency difference will never disappear as unfortunately the speed of light does not increase by 2x every two years like Moore’s law. If read permissions are restricted, private blockchains can provide a greater level of privacy.

Given all of this, it may seem like private blockchains are unquestionably a better choice for institutions. However, even in an institutional context, public blockchains still have a lot of value. In fact, this value lies to a substantial degree in the philosophical virtues that advocates of public blockchains have been promoting all along, among the chief of which are freedom, neutrality, and openness. The advantages of public blockchains generally fall into two major categories:

• Public blockchains provide a way to protect the users of an application from the developers, establishing that there are certain things that even the developers of an application have no authority to do.

• Public blockchains are open, and therefore used by many entities, This provides some networking effects. If we have asset-holding systems on a blockchain, and a currency on the same blockchain, then we can cut costs to near-zero with a smart contract: Party A can send the asset to a program which immediately sends it to Party B which sends the program money, and the program is trusted because it runs on a public blockchain. Note that in order for this to work efficiently, two completely heterogeneous asset classes from completely different industries must be on the same database. This can also be used by other asset holders such as land registries and title insurance.

Congratulations @blockchainindia! You have completed the following achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

SteemitBoard World Cup Contest - The results, the winners and the prizes

Congratulations @blockchainindia! You have completed the following achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

SteemitBoard World Cup Contest - The results, the winners and the prizes

Congratulations @blockchainindia! You have completed the following achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @blockchainindia! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!