Know Your Customer (KYC) is a contentious issue in the world of cryptocurrency. In the mainstream world of finance and business, KYC is a commonplace process that protects an organisation against exposure to violations under Anti Money Laundering (AML) and/or Counter Terrorism Financing (CTF) legislation or regulations.

The original crypto-movement was very much antiestablishment in nature, and that mindset has prevailed in the crypto-sphere over the last nine years that cryptocurrencies have existed. Perusal of KYC-related threads in BitcoinTalk.org forum and other crypto-sites indicates many in the world of cryptocurrency are very much on the “No KYC” side of the ledger, either:

(a) because of the potential for their personal details to be misused (particularly with the current prevalence of scam ICOs), or

(b) simply because they want to remain anonymous and/or keep their crypto assets away from prying eyes.

The problem for the second group is the potential exploitation of the system by the criminal element in our society, who are always eager to find new and safer ways to launder their dirty money or fund terrorism activities. It is this sector of the crypto-community that regulators and law enforcement agencies are keen to minimise, or ideally, eliminate. The upside for all law-abiding crypto-investors is that adoption of safe and secure KYC systems will minimise exposure to reason (a), while reason (b) will remain a contentious issue.

However, as cryptocurrency proceeds ever closer to mass/mainstream adoption, many new projects are no longer simply a non-fiat currency alternative, but are in actuality related to new or pre-existing businesses, who have adopted some form of crypto-tokenisation model for their company.

These companies have certain compliance requirements to ensure they keep on the correct side of the financial rules and regulations for the country in which they’re based, or in which they hope to do business.

But many of these new adoptees of cryptocurrency have been blasé about their KYC compliance requirements, and there are several reasons why this has been the case:

- Mistakenly believing that anonymity in the crypto-world is more important that regulatory compliance;

- Inexperienced personnel and/or insufficient funds allocated to construct a foolproof KYC process; and

- Avoidance of the KYC process because of the perceived financial costs that KYC entails.

Only by mitigating or eliminating the perceived problems will we get these companies eager to embrace the implementation of safe and secure KYC processes, and thus bridge the gap between old-world finance sectors and the new crypto markets.

Not surprisingly, the answer to addressing these problems will use the very technology they’re looking to safeguard: the immutability of the blockchain.

Enter traceto.io…

traceto.io is a subsidiary of Singapore-based Cynopsis Solutions Pte Ltd, who are specialists in regulatory compliance for AML, CTF and other KYC-related procedures. Cynopsis have already provided KYC/AML/CTF services to over 200 crypto/ICO/blockchain clients.

traceto.io will leverage the five decades of knowledge and skills, along with the processes and procedures already used at Cynopsis, as they create an inclusive KYC solution on the blockchain, by fusing Artificial Intelligence (AI) with Smart Contract technologies.

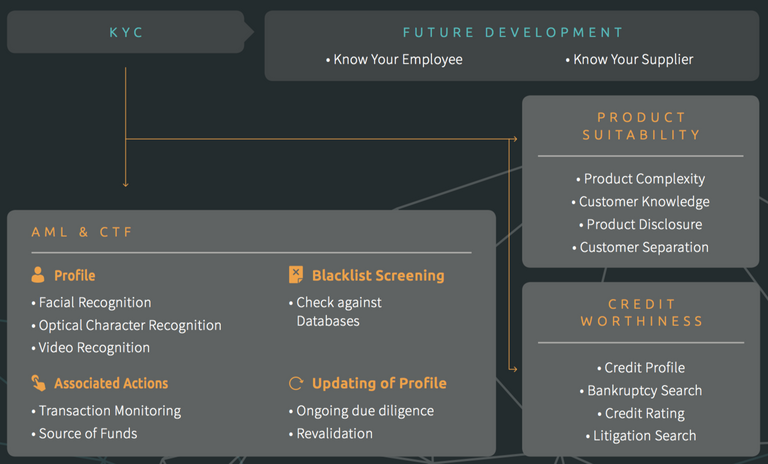

In the short-term, the focus will be on creating a KYC process that addresses AML and CTF problems. This will include:

- Person Profiling

- Associated Actions

- Blacklist screening

- Updating of Profile

Once that system is in place and functional, the team plan to expand into:

- Product Suitability

- Credit Worthiness

- Know Your Employee (KYE)

- Know Your Supplier (KYS)

The ecosystem being built by traceto.io will be decentralised, privacy preserving, and self-sustaining. Bringing the KYC process onto the blockchain, and standardising it, will negate many of the inefficiencies of the current manual and analog processes. The traceto token (T2T) will be an ERC20 Utility Token and will address a myriad of problems that currently exist in traditional KYC systems:

- data security

- privacy issues

- inefficient practices

- data siloing

- unstable KYC outcomes

- ‘social engineering’ vulnerability

- KYC not reusable

How the traceto.io Network Works

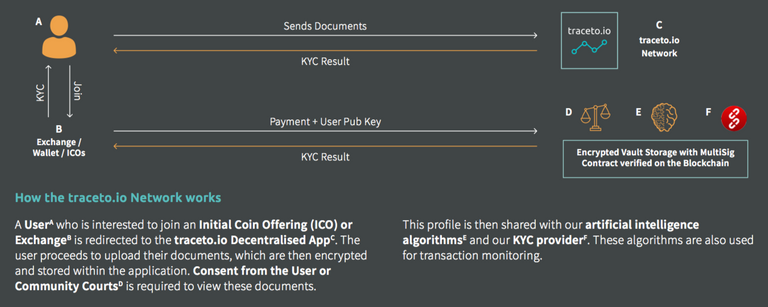

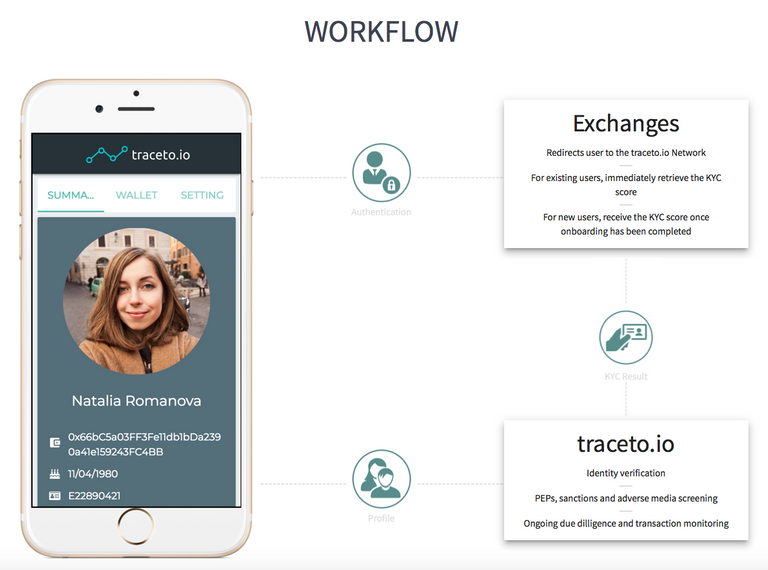

When the basic traceto.io KYC system is implemented, it will comprise the following participant entities:

- User: any individual who is the subject of a KYC process. (A in the image below)

- Corporate Requester: the entity requiring KYC services. (B)

- Verifier: a trusted User who stakes T2T Tokens and performs KYC-related tasks to earn more tokens (Part of C)

The data gets stored in a secure, encrypted vault on the traceto.io dApp with a MultiSig Contract that is verified on the blockchain. The data can then only be decrypted by:

- the User

- a Community Court (quorum of Verifiers and requesters) (D)

and is shared with:

- AI algorithms (E)

- the KYC Provider (F)

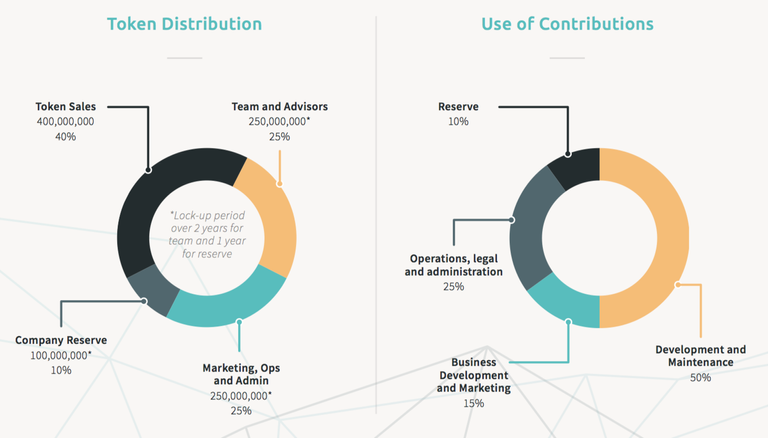

Tokenomics

- Token symbol: T2T

- Token type: ERC20 Ethereum-based

- Total supply: 1,000,000,000

- Available for Sale: 400,000,000

- Token Price: 0.0000875 ETH = 1 T2T

- Token Fractions: 18 decimal places

- Accepted Payment Methods: Ethereum

- Total Token Sale: 35,000 ETH

- Private Sale: in Progress.

- Early Access Sale: commences 21 May 2018.

- Public Sale: commences 8 June 2018.

Relevant Links

Website: https://traceto.io

Telegram: https://t.me/tracetoio

ANN: https://bitcointalk.org/index.php?topic=2911588.msg29949476#msg29949476

Bounty: https://bitcointalk.org/index.php?topic=3439768.msg35858902#msg35858902

Twitter: https://twitter.com/tracetoio

Facebook: https://www.facebook.com/traceto.io

Medium: https://medium.com/traceto-io

LinkedIn: https://www.linkedin.com/company/traceto-io-pte-ltd/

White Paper: https://traceto.io/static/wp/traceto_Whitepaper_v1_34_11052018.pdf

For Whitelisting, go to: https://platform.gbx.gi/register

I am not a financial analyst. The above information should not be construed as financial advice and is not intended as financial advice. Always do your own research before investing in anything. The price of tokens may be volatile once listed on any exchange, and purchasing cryptocurrencies can be a high risk activity.

If you’re looking for other article reviews by this author, please check out this Telegram channel https://t.me/aussiesloth_ico

Proof of article ownership - ETH address: 0xcE497066921f8aE00d1128d8B9cA105f025DF210