This month, we saw bitcoin’s price hit a new all-time high of US$3,000, a whopping 400 percent jump from US$680 in June 2016. It is mainly due to an increase in media coverage that attracted new investors to enter the market and grew confidence in existing investors.

New money is flowing into the cryptocurrency market at an accelerated pace. In January 2017, the total market capitalization of all cryptocurrencies was US$17 billion, with a 24-hour trade volume of about US$120 million. Today, the figures have risen to US$112 billion and US$7.84 billion, respectively.

ICOs: The new devil

The rise in public awareness has proved to be highly beneficial for blockchain ventures who have held initial coin offerings (ICOs) recently. On June 13, blockchain project Bancor has successfully closed the largest ICO ever, raising about US$150 million in a matter of hours.

This came on a series of recently successful ICOs. Ventures like Gnosis and Brave had successfully raised US$12.5 million and US$35 million, respectively. While these fundraisers are beneficial in drawing media attention to the market, experts who are concerned that more and more investors are participating in recent ICOs to engage in speculative trading have raised their eyebrows.

These speculative traders would participate in ICOs to buy tokens at a rate fixed by the blockchain ventures, so when the ICO ends and the tokens begin trading at public exchanges, they can sell at a significant premium. It is certainly possible for speculative traders to profit from such ICOs without even understanding the technology, use cases, or the team behind the product.

This phenomenon is deeply troubling and disturbing. Without a regulatory authority to conduct proper due diligence on behalf of investors, scams and dubious ventures can easily enter the market and raise money with no legal repercussion.

The barrier to entry is surprisingly low. With a decent website, a whitepaper peppered with the latest buzzwords, and timely marketing, most of them can raise millions of dollars in minutes, if not hours. Even after the fundraiser, there is practically no pressure for founding teams to deliver their product according to their roadmap or whitepapers.

A million-dollar disaster waiting to happen

This cryptocurrency frenzy has, to some extent, desensitized many amateur investors. A tenfold or more investment return may be almost unheard of with traditional regulated financial investment instruments, but it is not the case with good, legitimate blockchain networks. Stories of scoring 10, 20, or even 100 multiple investment returns are common in industry forums and news sites. Bitcoin is a famous example.

This cultivates a “get rich quick” mentality among amateur investors. Because of the incredible speed at which these fundraisers and pump-and-dump schemes are happening, most investors have neither the luxury of time to conduct proper research and due diligence, nor the knowledge and expertise to understand market movements.

The product, its intended target market, and the technology behind it now becomes secondary; the money now lies in the peddling of speculations and the fear of missing out.

In this landscape, what will stop Ponzi schemes from starting an ICO and siphoning millions of dollars out of uninformed investors who are in it for a quick buck?

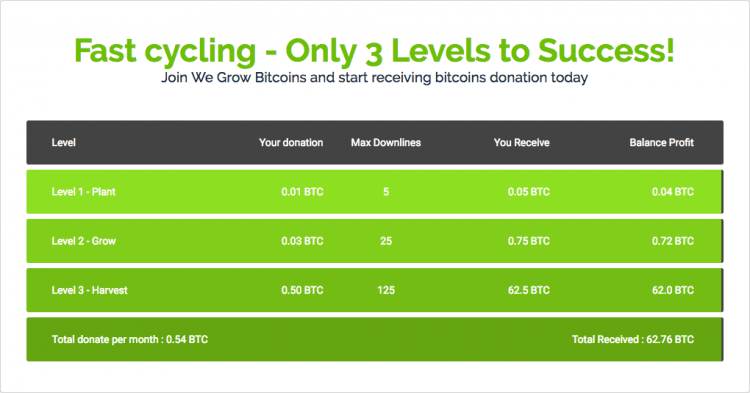

Wegrowbitcoins is a classic example of a Ponzi scheme. It works by requesting new users to first invest 0.01 bitcoins (about US$25) and then encourages them to refer five friends to the site. Once five friends have joined the site, the user will then be promoted to the next level, entitling them to receive more bitcoin payouts subsequently. The more people one can recruit to join the site, the more bitcoins will be given out as a reward.

While Ponzi schemes are relatively easy to spot, other scams might not be as obvious to an uninformed investor. Dubious syndicates can launch ventures with a promise to disrupt a billion-dollar industry with blockchain’s power, raise money through an ICO, cash out, and disappear from the face of the earth while the rest of optimistic investors continue to hold the tokens in hope, waiting for a rocket that will never arrive.

Blockchain ventures are startups after all

Most blockchain companies are still startups, even though many already have valuations of hundreds of millions of dollars. Many problems and troubles will await them as they scale, more so when they are building on a next-generation technology that is still maturing. And like most tech startups we have already seen, many of these blockchain ventures will crash and join the dead pool.

Whether you view this market like the gold rush of the old wild west, or a bubble like the dot-com bubble in the late 1990s, one thing is for sure: we will see millions of investment dollars lost, scams and scandals will be the talk of the town, and many rookie investors will burn their fingers.

In these times of uncertainty and panic, trust and confidence could be seriously undermined and budding ventures might be jeopardized. But it is for the good of the market that these terrible things happen.

We need scams and scandals to generate more public awareness in this industry. We need failures and burnt fingers so that investors will see the need to be educated and informed in their investment decisions. We need investors to stop trading based on fears, doubts, and uncertainties, which will help to stabilize this extremely volatile market.

More to do as the industry matures

There is a lot more to be done for the advancement of blockchain technology. Over time, we could witness the formation of a neutral blockchain regulatory board in the form of a large decentralized organization to govern and curate ICOs and to conduct due diligence on blockchain ventures. Such an organization could, in theory, be formed by randomly selecting numerous members of the blockchain community who could cast votes on key matters through the blockchain, which ensures votes will be kept completely anonymous and immutable.

In the short term, experienced members will need to come together in an altruistic effort to conduct due diligence and call out dubious projects so that investors can make sound decisions. These efforts are already propagating in forums and discussion boards as we speak, and it must be encouraged to continue. Investors themselves must, to a large extent, break out of the herd mentality and conduct their research to understand the technology and the products they are planning to invest in.

Just as the promise of the blockchain technology is to eventually decentralize the power and control of governments and institutions and distribute it to the people, the main challenge lies in how the blockchain community can govern themselves. Only when the community prove to be able to move forward in a truly independent, democratic and efficient manner can we see the technology truly flourish and fulfill its fullest potential.

Hello there! Thank you for reading this article. If you've enjoyed this article, please support me by upvoting and leaving a comment! I'd love to hear what you think about this topic!

I'm calling BitConnect to be a major scheme in the end. Hopefully not for the people invested...but looks to be set up that way.

Great article. Good points. Appreciate the effort put into this post!

Hi Lonnie! Yes, there are several dubious blockchain companies. But ultimately it is for the good of the industry. Thank you for supporting my article!

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.techinasia.com/talk/need-scams-failures-blockchain