by Hazik Mohamed

PhD in Islamic Finance

Managing Director, Stellar Consulting Group (Singapore)

The main efforts in Islamic Finance so far has been to create new forms (Shari'ah-compliant standards) to operationalise Islamic values and ethics into the current conventional economic system and banking products.

While this is crucial to sustain the world as it is today, we also need to develop new strategies to cope with the next economy, which starts with a clear and deliverable vision of a new world economy. And the new vision of a new world economy will be driven by those who embrace innovation that will build the future.

Here we look at the main building block to enable trust in impersonal financial transactions in a highly globalized society. This innovation called the blockchain will play a crucial role in boosting the financial sector (banking, insurance, investment, etc.) including the Islamic Finance sector. Addressing the digital revolution that is happening right now will foster competitive advantage for the Islamic Finance industry.

It is clear that the digital revolution in financial services is under way, and digital disruption has the potential to shrink the role and relevance of today's banks, while simultaneously creating better, faster, cheaper services that will be an essential part of everyday life in the new economy.

Fintech Revolution

Over the last decade, disruptive innovation in financial services has emerged from financial technology (fintech) start-ups. These new firms have been quicker than banks to take advantage of advances in digital technology, developing banking products that are more user-friendly, cost less to deliver and are optimised for digital channels.

This relative success is unsurprising. These new players are less burdened by the demands of regulatory compliance which banks are subject to. They are unencumbered by complex and costly-to-maintain legacy systems. They can focus on creating single purpose solutions, designed to offer an improved experience within just one product or service.

They are more in tune with the peer-to-peer (P2P) culture engendered by the explosion of social media. And they are smaller organisations, designed for the purpose of innovation.

Also, much capital has flowed into the fintech sector: US$23.5 billion of venture capital investment in 2013/14, according to an analysis by Oliver Wyman.

Of this investment, 27% has been in consumer lending, 23% in payments and 16% in business lending. Fintech has two unique selling points: better use of data and frictionless customer experience. But to date these have been limited to relatively simple propositions such as e-wallets and P2P lending.

The conventional finance sector is already scrambling to cope with these digital disruptions in order to stay afloat and finding ways to embrace such disruptions in their respective sectors to stay relevant and retain market share.

Certain segments within Islamic finance has been too caught up in Shari'ah-compliance debate instead of recognizing that we are at the cusps of an economic evolution. The industry should also recognize that these technological advancements are essentially aligned to the principles of the Shari'ah that requires and upholds the values of trust, honesty and transparency.

In this article, we attempt to highlight the potency of the blockchain (the backbone to the cryptocurrency technology), and subsequently its potential applications as the technical experts unleash its capability and evolve its strength, very much like what happened for the internet in the late 1990s and 2000s.

“ This innovation called the blockchain will play a crucial role in boosting the financial sector (banking, insurance, investment, etc.) including the Islamic Finance sector. ”

What is the Blockchain?

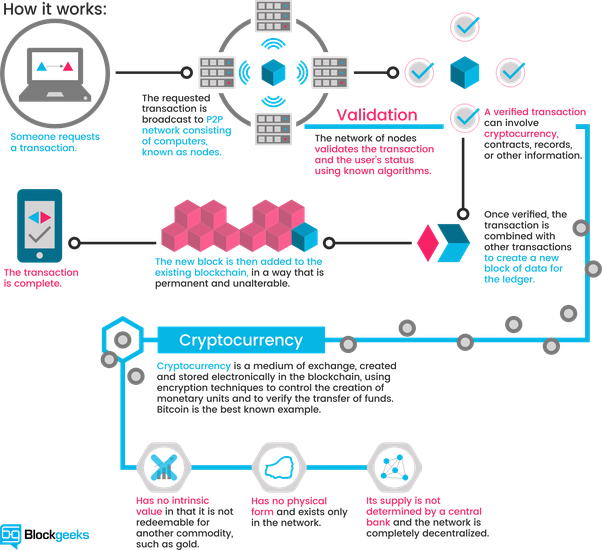

Blockchain is a peer-to-peer public ledger maintained by a distributed network of computers that requires no central authority or third party intermediaries. It consists of three key components: a transaction, a transaction record and a system that verifies and stores the transaction. The blocks are generated through open-source software and record the information about when and in what sequence the transaction took place.

This “block” chronologically stores information of all the transactions that have taken place in the chain, and therefore the name—blockchain. In other words, blockchain is a database of immutable time-stamped information of every transaction that is replicated on servers across the globe.

This technology is the foundation of cryptocurrencies such as the bitcoin. In fact, blockchain technology was first introduced in 2009 with Bitcoin, a crypto-currency based distributed payment protocol.

Blockchain's main innovation is a public transaction record of integrity without central authority. Blockchains are decentralised by nature that is shared by all nodes connected to a set network.

Blockchain technology offers everyone the opportunity to participate in secure contracts over time, with a secure record of what was agreed at that time. This innovation carries a significance stretching far beyond cryptocurrency.

The blockchain lets people who have no particular confidence in each other collaborate without having to go through a neutral central authority. Simply put, it is a mechanism for creating trust. Within this open ledger system, the blockchain offers an inherent level of trust for the user, eliminating the need for the middleman and mitigating the risk of human error.

Its publicly accessible log of transactions ensures that the data is protected against tampering and revision, and it is virtually impossible for individuals to modify or replace parts of the blockchain secretly.

A full copy of the blockchain contains every transaction ever executed, making information on the value belonging to every active address (account) accessible at any point in history. Every block contains a long reference number or hash of the previous block, thus creating a chain of blocks from the genesis block to the current block. Figure 1 illustrates how a transaction is recorded on the blockchain, based on the cryptocurrency protocol.

Validation is required for a new block to be added on to the blockchain. This validation process, also called mining, allows pending transactions to be confirmed; enforces a chronological order on the blockchain; protects the neutrality of the blockchain; and enables different computers (or nodes) to agree on the state of the system at any given time.

In traditional transactions such as money transfers or foreign currency, there is usually an intermediary or a centralized entity that records the transmission of money or currency that exist apart from it. In blockchain, the token or digital coin itself is what has value, which is determined by the market. This is what makes the system a truly decentralized exchange.

When people buy or sell bitcoins, a secret key or token is broadcast to the system. “Miners” use nodes, computers or devices linked to a network, to identify and validate the transaction using copies of all or some information of the blockchain which is accessible publicly. Before the transaction is accepted by the network, miners have to show 'proof of work' using a cryptographic hash function (a special algorithm) that aims to provide high levels of protection.

[Proof-of-Work (PoW) is a function that is hard to compute, but easy to verify, which serves as a probabilistic cryptographic proof of the quantity of computational resources controlled by a given node. Every block requires a PoW with a pre-specified difficulty level in order to be valid, and in the event of multiple competing blockchains the chain with the largest total quantity of PoW is considered to be valid].

As progress is made in the blockchain technology, its use will become more efficient and applicable in many ways, i.e. to transact anything of value, not just digitizing currency.

Evolution of the Blockchain

Not only is there the possibility that blockchain technology could reinvent every category of monetary markets, payments, and financial services but it might also offer similar reconfiguration possibilities to all industries within the economy, e.g. as registries for luxury goods (diamonds or works of art) and smart contracts for loans, wills and trusts, or intangible assets like patents, trademarks and copyrights. The blockchain is fundamentally a new paradigm for organizing activity with greater efficiency, and greater scale than current models.

We believe that the blockchain technology leverages on decentralization well and offers a truly global scope and scale that was previously impossible.

Limitations of the Blockchain

The blockchain industry is still in the early stages of development, and there are many kinds of limitations.

Ideally, the blockchain industry would develop similarly to the cloud-computing model, for which standard infrastructure components - like cloud servers and transport systems - were defined and implemented very quickly at the beginning to allow the industry to focus on the higher level of developing value-added services instead of the core infrastructure.

The current limitations are both internal and external, and include those related to technical issues with the underlying technology, public perception and government regulation.

Conclusion

The promise of the blockchain creates the possibility of coordinating our transactional activities within a strong mechanism of trust and transparency. This public ledger system of transparency and then making it available to anyone like the internet seems to be able to solve the coordination for the transactions that occurs within the now global economy.

Thus blockchain is the technology that will operationalize the mechanism of trust as we progress from personal exchange to impersonal exchange due to globalization. We suspect that this technological backbone will be commonplace in 6 to 8 years' time, through the advent of crypto-currencies, smart contracts, full-reserve lending platforms, multicurrency money transfers, etc.

Fintech using the blockchain technology will incorporate Islamic values (of trust, justice, equality and efficiency) into finance that embodies and promotes the spirit of the Sharia. In addition, the adoption of the blockchain technology will allow Islamic Finance to adapt to the changing landscape of modern economic transactions instead of playing catch-up by replicating soon-to-be outdated conventional practices.