The stock-to-flow model models the supply side of Bitcoin. The demand side seems to have been seriously hammered by the Korona panic. I also think the stock market will continue to fall for quite some time. We haven't seen a recession since 2009. One was long overdue. The big ones come once every 18-19 years, though. But the market manipulations by central banks may have made this worse than it otherwise would've been.

I liquidated my entire stack before the big crash today morning (EET). If BTC goes through the 200 day MA at about $5000, I'll forget about the whole thing and accumulate cash until the bottom of the markets is found.

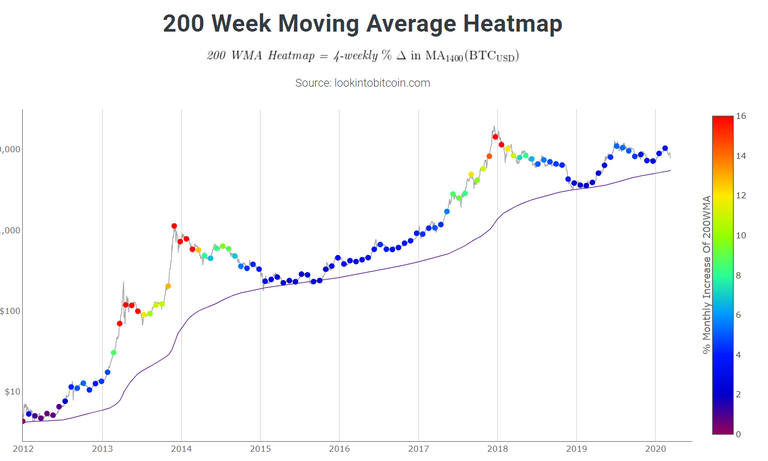

[Edit: Sorry, I meant the 200 WEEK MA of Bitcoin.]

The 200 week MA:

https://www.lookintobitcoin.com/charts/200-week-moving-average-heatmap/

May?

JFC. These markets have been completely manufactured by the incessant pumping of $T's into them - and the pockets of the investor class (all that pumped money is debt, for which government, and thus wage earners/taxpayers are on the hook in the future. This market has been the biggest theft in history). There is almost no correlation between price and value anymore. This is why Buffet is on the sidelines, and why everyone not all in on the VIX should be too.

Thanks!

Agreed. The Korona virus is the perfect scapegoat.

BTW, Austrian Korona's seem to be a fine investment presently. Just sayin'...

Most likely.