At the time when this guide was written, January 2014, the price of one bitcoin stood at $913, down slightly after reaching an all-time high of over $1,200 earlier in December. The new cryptocurrency came a long way from trading below $4 just two years ago. Major online and offline retailers are starting to add the new currency as a payment method. But what exactly is bitcoin?

According to a recent Bloomberg poll, only 42 percent of Americans correctly identified bitcoin as a virtual currency. Six percent thought it was an iPhone app.

Bitcoin is a peer-to-peer digital currency launched in 2009 by ‘’Satoshi Nakamoto’’. Satoshi worked on the project alone for 2 years before releasing the code to the public. He disappeared shortly after creating the cryptocurrency, but before leaving he posted the now infamous quote:

‘’It might make sense just to get some in case it catches on’’

Satoshi Nakamoto, January 17th, 2009.

What’s so special about Bitcoin?

Bitcoin is a cryptocurrency and a new and unique financial vehicle, unlike anything the world has ever seen. It’s called a cryptocurrency because it uses cryptography to control the creation and transfer of money. Despite the name, there is no physical coin to speak of, Bitcoin is a completely electronic form of money.

Bitcoin solves the so called ‘’double spending problem’’ present with digital goods. For example, if I have an mp3 file or an ebook on my computer, I can freely copy that file a thousand times and send it to a thousand different people. For a digital currency, the possibility for unlimited copying would mean a quick hyperinflationary death. Bitcoin solves this by maintaining a peer to peer network and recording each transaction in a public ledger called the block chain. Say I send 1 bitcoin from my bitcoin address to my friend John. The bitcoin network records that transaction in the block chain and I no longer have possession of that bitcoin. The coin ‘’moved’’ from my bitcoin wallet to John’s wallet.

What’s so special about Bitcoin? There are many arguments on whether the new virtual currency will succeed or fail. We will not get into this nor discuss the politics behind the project. Our concern is strictly with the profit opportunities provided by this new payment phenomenon. In the next few pages on the new digital currency we will outline our thoughts from the perspective of a trader and a potential investor in this upcoming market.

Bitcoin Basics

Bitcoin is a peer-to-peer virtual currency. This means that in order for a transaction to occur, no middle men or central authority is needed. You can send any amount of bitcoins to anyone living anywhere in the world, completely eliminating the need for traditional third parties like banks or money transmitters. The cryptocurrency also allows the bypassing of capital and AML restrictions.

In order to send or receive bitcoins, all you need to have is a bitcoin address and internet access. You only need to be online long enough for the transaction to process. Similarly to traditional bank accounts, you can receive bitcoins to your bitcoin address even if you’re offline. When you want to ‘’collect’’ your coins however, you’ll have to find an internet connection.

How to get a bitcoin address

Like we mentioned previously, in order to send or receive bitcoins you will need to have a bitcoin address. You can get a bitcoin address either by downloading the bitcoin client or by getting an online wallet. The two most popular btc clients are Bitcoin-qt and Multibit. The main difference between these two clients is in the size of the block chain that needs to be downloaded. If you decide to go with Bitcoin-qt, have at least 10 Gigabytes free space on your hard drive for the block chain. As Bitcoin-qt is the ‘’official’’ bitcoin client, if you can spare 10 GB, go for this option. Here’s a page that has step by step instructions on installing Bitcoin-qt.

Multibit is a lightweight version of the bitcoin client. You can read more about it here.

Where are my bitcoins stored?

But where are the bitcoins actually stored? After you install one of the two clients above, you can find your bitcoins in a file called wallet.dat. If you use windows this file will be located in the application data section. If your computer gets stolen or lost and you haven’t made a copy of the wallet.dat file you will lose your bitcoins. It is always recommend to backup this file.

The bitcoins can also be stored in online wallets. There are specialized websites that offer bitcoin wallet services. However due to these sites being a frequent target for hackers, keeping bitcoins in online wallets is not recommended when you can easily store them offline on your computer. Wallets can be useful for storing small sums of bitcoins so that you can make quick online purchases. Some of the more popular wallet services are Blockchain and CoinKite.

Btc exchanges are a somewhat safer place for your bitcoins compared to online wallets because they keep most coins in what is known as ”cold storage”. Usually over 90% of the bitcoins deposited on an exchange are kept offline. A small 5 to 10% reserve is kept onsite for immediate redemption purposes. There are plenty of guides online on how to store/secure bitcoins, go over them. It’s always safer to take care of this process yourself then to trust a third party with a substantial amount of bitcoins.

Bitcoin Advantages

Bitcoin has several advantages compared to traditional money transmitting services. We already mentioned two of these above, the elimination of the need for third parties and the bypassing of restrictions.

Another major plus of the new cryptocurrency is the very low cost for sending and receiving bitcoins. While it is possible to send transactions completely free of charge, it is recommended to pay the small fee in order to speed up the sending process.

The fee amount depends on the data size of the transaction. A typical transaction is 500 bytes and carries a fee of 0.0001 BTC. At current prices of $913 per bitcoin, this amounts to a charge of 9.13 cents.

Because the fee is completely dependent on a transaction’s data size and not on the number of bitcoins being sent, a $10 transfer will carry the same fee as a $10 Million transfer. The fee will take a 0.913% piece of a $10 transfer but that same fee will only take 0.000000913% of a 10 Million transfer.

Bitcoin offers benefits to merchants as well, as transactions that involve the digital currency are secure and irreversible. Without the risk of fraud or fraudulent chargebacks, merchants can offer their products at a discount thereby generating more sales or pocket the difference themselves. In addition, with card processors out of the picture, merchants can save on the percentage cut taken by Visa / MasterCard.

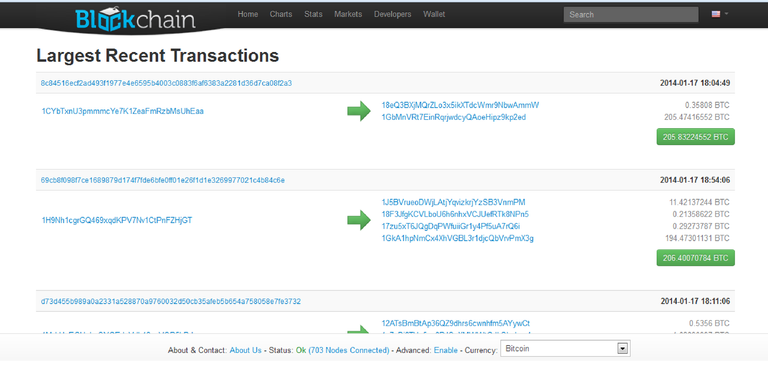

The picture above shows some of the recent large transactions recorded in the block chain. The first transaction is for 205 BTC, the equivalent of $187,165 at today’s prices. The long lines of letters and numbers you see in the pic are bitcoin addresses. A bitcoin address consists of 27-34 alphanumeric characters, beginning with the number 1 or 3. You can have as many addresses as you want, they’re free and easy to generate.

Notice that there is no name that goes along with the bitcoin address. This is what outside observers mean when they say ‘’ Bitcoin is anonymous’’. Bitcoin is in fact ‘’pseudo anonymous’’. While all bitcoin addresses and transactions are public, the holders of those addresses remain hidden.

The only thing that can be discerned by looking at the block chain is that address 1XXxxxXXXxxxxxxXX sent 100 Bitcoins to address 3XXxxxXXXxxXXxxXX at a certain time. Who sent the coins, the reason for sending, and the users location is not revealed.

However, keep in mind that as soon as you connect your bitcoin address to your real identity (for example, by purchasing bitcoins online or in a face to face meeting), the pseudo anonymity provided by bitcoin is lost. There are ways to regain the lost anonymity but that is beyond the scope of this introductory article.

Buying Your First Bitcoin

But how can you actually get a hold of a bitcoin? The easiest way to acquire bitcoins is to buy them at an online exchange. There are three major bitcoin exchanges, each of them with their own unique properties and a different fee structure.

Bitstamp.net

f you’re European, Bitstamp is your best bet to get some bitcoins at a low cost. The company is based in Slovenia, part of the EU. Deposits by SEPA are free, withdrawals are charged a fixed 0.90€ fee once the funds are converted to Euros. Because Bitstamp only offers trading in BTC/USD (Bitcoin versus the US Dollar) all Euro transfers are immediately converted to Dollars. If you want to withdraw by SEPA, you have to convert your funds back to Euros.

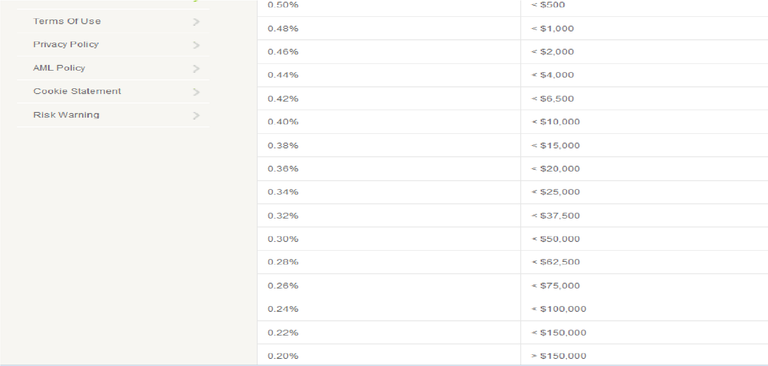

The fee structure favours big traders and market makers. The basic fee for new accounts starts at 0.5% and goes all the way down to 0.2% if you trade over $150,000 in one month.

Yes forex traders, you heard that right, the LOWEST fee structure is 0.2 percent. The 0.2% charge is per side, so you will get hit with this fee whenever you buy or sell bitcoins.

Luckily, the spread between the bid and the ask price is very low, most of the time ranging between 1 and 2 dollars. At a current bitcoin rate of $819, this amounts to an added cost of 0.1 to 0.25%. You only pay the spread if you want to enter a trade right away with a market order. If you placed a limit order to buy and you’re willing to wait until someone wants to sell, you can purchase your bitcoins at a small discount at the bid and later sell them at the ask, pocketing the spread in the process.

Bitstamp has largely avoided the deposit and withdrawal problems that plague many bitcoin exchanges. With a lack of regulation on the upcoming virtual currency and its checkered past, many financial institutions remain reluctant to get involved with processing bitcoin related transactions. You can deposit funds in USD, EUR, GBP and CHF. US clients are accepted.

Coinbase is probably the easiest and safest way to purchase bitcoins in the U.S. Unlike BitStamp, Coinbase is not an exchange. They act as a counter-party to all customer trades, you buy or sell your bitcoins directly to Coinbase. The buy/sell fee is 1% on top of the buy/sell spread. The bid/ask is usually close to BitStamp where the firm gets its liquidity from. For example, the current bid is at $635.48 and the current ask is $638.07. In addition to this, the firm has daily limits on the amount of bitcoins bought/sold. These limits are not applied on the individual level. Basically Coinbase has a set amount of bitcoins that it is willing to buy or sell every day. During times or high volatility, users may not be able to buy/sell bitcoins until Coinbase decides to ‘’refill’’ their stock. Here’s a good explanation on this issue from their Customer Support:

‘’The limit you’re seeing is Coinbase’s daily limit being reached, not your personal limit. Sometimes the Coinbase site itself will run into a daily rolling limit on purchases or sales if there is an exceptional amount of activity in the bitcoin markets. We put up this temporary pause to make sure that we have enough funds to accommodate the transfer orders being created. This should be a rare exception rather than the general rule however. There is no specific time of the day where this limit starts – it’s on a 24 hour rolling basis. It might be best to check in at 6am or 7am Eastern Standard Time tomorrow. Sorry for any inconvenience this has caused you – we know this can be frustrating. This is something we’re working on as we speak.’’

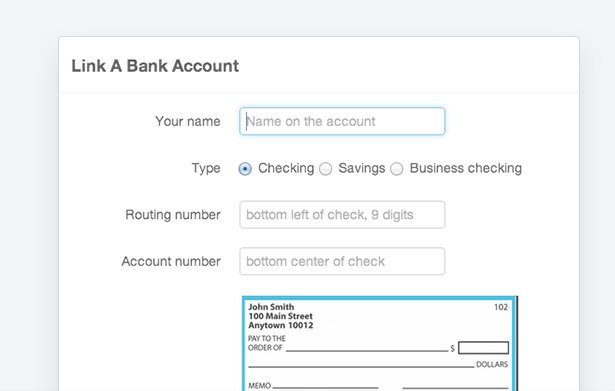

Coinbase claims that over 97% of all customer funds are stored offline in bank vaults to prevent theft or loss. If you live in the States, you can easily link your bank account to Coinbase to facilitate quick and easy bank transfers.

BTC-E.com

If you’re a forex trader, BTC-E is probably the easiest exchange to get into. The company offers its own MetaTrader platform. The instrument comes with a leverage of 3 to 1 and the ability to short bitcoin. Shorting is not an option at Bitstamp. You can still sell any bitcoins you already own at these exchanges but you won’t be able to short bitcoin outright.

The fees on MetaTrader are slightly higher, 0.3% per side compared to 0.2% if you used btc-e’s web interface. If you’re a forex trader btc-e might strike you as the best option of the three. But alas, nothing is as straightforward in bitcoin world.

No one knows who the real owners behind btc-e are. Apparently the headquarters of the company are in Bulgaria and the support staff is more familiar with Russian then with English, but the rest is a mystery. The company operates a complicated deposit and withdrawal process that relays the money through several banks and payment processors before depositing them to your account. If you plan to deposit on BTC-E, make sure to follow their deposit instructions to the letter. Because the deposits go through a web of banks, tracking down a lost deposit is near to impossible.

On the plus side, the company does offer deposit and withdrawal by several popular e-wallets like Webmoney, PerfectMoney, Ukash and Paypal (withdrawal only $500 minimum). According to user reviews, deposits and withdrawal by these methods are a lot faster and smoother compared to bank wires.

BTC-E does accept US clients. However, starting from the middle of December 2013, the company stopped processing US dollar wires or any wires connected to a US bank. Here is an email reply to a customer’s question on this: ‘’We don’t accept international wire transfers from US Citizens or from US Banks. All transfers from US Citizens or US Bank will be refused by bank.’’

Other ways to purchase bitcoins

Aside from the exchanges, you can also buy bitcoins on ebay and similar auction sites. Keep in mind that due to the possibility for chargebacks and fraud, bitcoin and other cryptocurrencies trade at a premium on ebay. Face to face meetups are another option to acquire bitcoins. Checklocalbitcoins.com for bitcoin sellers and buyers near your area. Always exercise caution when doing an offline exchange. Meet during the daytime and in places with a lot of people around. If possible, bring a friend.

We’ll leave the choice of where to buy your first bitcoin up to you, we hope that our presentation relayed enough information to help you make an informed decision. It all depends on your needs and requirements. Some exchanges are better for trading, others have superior banking relations with bankwire deposit and withdrawal options.

Leveraged Bitcoin Trading

In this section we’ll go over several options for trading bitcoin on margin. We’ll also outline the options to short the virtual currency. Before we go any further, a caution is in order. Bitcoin prices are highly volatile. Prices rose from a low of 195.50 on November 1st to a high of 1,090 by November 30th 2013. From here, the btc price crashed to a low of 420 on December 18th, only to go back up and retest the 1,000 level in January of this year. One bitcoin is currently worth 825.88 on btc-e. The chart below demonstrates this volatility.

Unlike major forex currency pairs which barely move 1 percent per day, bitcoin prices can rise or fall over 30 percent in a single day. If you know how to trade, you don’t really need any leverage to make money with bitcoin. With that caution out of the way, let’s get down to business and go over some of the options for leveraged btc trading.

We already wrote about one of the more competitive options for shorting bitcoin and leveraged trading, BTC-E. The Bulgarian exchange offers the popular MetaTrader platform with 3 to 1 leverage, shorting capability and a low fee of 0.3 percent per side.

AVA Trade

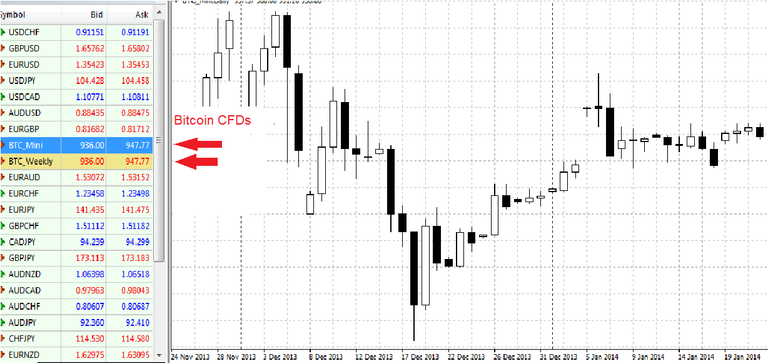

AVA Trade is a forex broker that offers bitcoin trading through a CFD. Two bitcoin CFDs are available, Bitcoin Mini and Bitcoin Weekly. The Bitcoin Weekly CFD has a 20 to 1 leverage and expires every Friday at 21:00 GMT. The Bitcoin Mini only has a 2 to 1 leverage but doesn’t expire. Both contracts are using data from BTC-E and AVA Trade adds around 10$ premium on top of the exchange spread. You can find more about the bitcoin trading conditions here. Here’s a snapshot of AvaTrade’s MT4.

A major flaw of both contracts is the inability to trade them during the weekend. Bitcoin trading is completely decentralized and doesn’t rely on a network of banks for executing trades thus there is no set open and closing time. Unlike forex which trades 24/5, bitcoin trades 24/7 (except on AvaTrade). As can be seen on the chart, large gaps are frequent on AVA Trade’s Bitcoin CFD due to this policy. AvaTrade does not accept US clients at this time.

Etoro.com

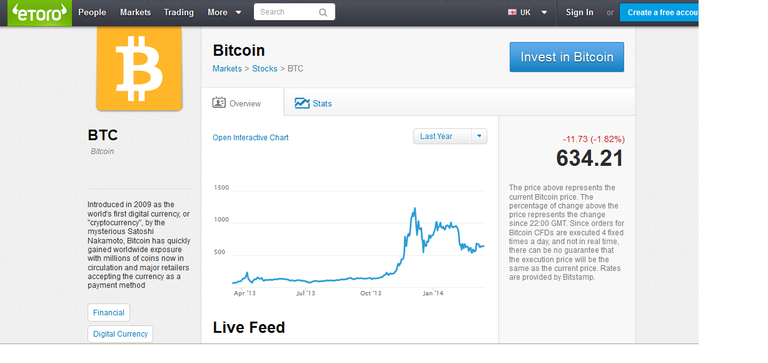

Etoro.com is one of the latest forex brokers to offer bitcoin trading. Unfortunately, the product is not very suitable for day trading as you can only enter and exit the market four times per day. It uses the BitStamp’s data feed as a price reference. You can read more about Etoro’s bitcoin offer here. Here’s a snapshot of their bitcoin CFD in action:

Unfortunately despite having a dedicated US part of the site (link to http://www.etoro.com/usa) , eToro doesn’t seem to accept US clients at this time. Here’s a part of the Q&A section that deals with this question: ‘’As part of our ongoing optimization process currently underway in the US, we have temporarily suspended our service. Therefore, at this time we will not be accepting new clients or funds from existing US customers. While you’re here, you are welcome to continue experiencing eToro through our practice mode, which will stay available and free to all.’’’

Btc.sx

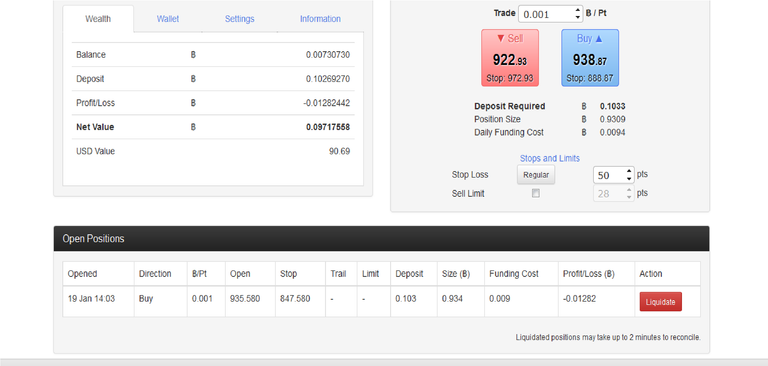

Btc.sx offers a 10 to 1 leveraged product based on BitStamp’s data feed. Similarly to Ava Trade, Btc.sx adds around 10$ to the spread at BitStamp. You will need a deposit of at least 0.01033 of a bitcoin in order to trade at Btc.sx. At current bitcoin prices of $638, this amounts to around 6.3$. Btc.sx is dually incorporated in England and Singapore. The exchange currently accepts only bitcoin deposits, no fiat currency deposits are allowed.

The pic above shows a bitcoin long position. Btc.sx has several restrictions that make trading with leverage problematic. The exchange doesn’t support moving the stoploss after entry. When contacted about this, their support team told us that ‘’this feature will be implemented in the next few months’’. Our question is why isn’t it already implemented?

As you can see on the picture, you can only set the stoploss as a distance from the current price (in the pic this is set as 50 points). The default is 88 points below entry. This is exactly where my stop was, 88 points below 935 at 847. There is a trailing stoploss option but despite my best efforts, I couldn’t make it work. So essentially, once you set your stoploss on Btc.sx, you’re stuck with it.

The high rollover cost also makes leveraged trading at Btc.sx problematic. The currency rollover cost for my position was 0.0094 of a bitcoin, that’s 8.8 US Dollars, far too high for a 1,000 usd position in my opinion. Because the company only allows deposits and withdrawals in bitcoin, it has largely avoided the US Dollar deposit/withdrawal issues encountered by other btc exchanges. Btc.sx does allow US clients.

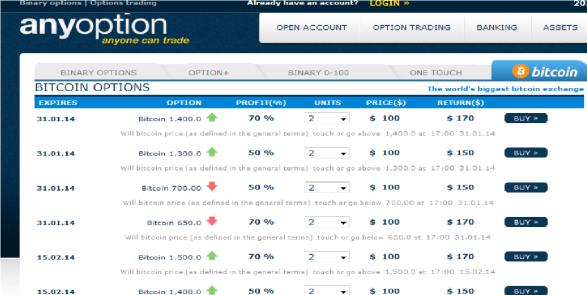

Bitcoin Options

Besides CFDs, the new cryptocurrency has also helped spawn a new options market. Currently several companies are in the business of offering Bitcoin options. Anyoption.com is one of the more established option houses that offers trading in the virtual currency. You can bet on rising or falling bitcoin prices. Anyoption.com is not an option for US clients, the company doesn’t accept USA traders at the moment. Here are some of the current btc options on offer.

Predictious

Predictious.com is a betting websites that matches buyers and sellers and doesn’t price the options themselves. Besides betting on bitcoin’s demise or rally, you can also try to predict the next winner of the Oscars or bet on which party win control the US Senate after the 2014 elections. Currently the site takes bitcoin deposits only. Predictious does accept US clients.

What Drives Bitcoin Prices?

Regulation

Regulation and other actions by government entities has one of the biggest impacts on the price of bitcoin. The US and Chinese governments are the ones to watch. Somewhat favorable comments by US lawmakers in November and December of last year underpinned the bitcoin rally.

At a Senate committee hearing last month a Justice Department official said that ‘’bitcoins can be a legal means of exchange’’. The new cryptocurrency can be exploited by ‘’malicious actors’’ and should be subject to ‘’rules to protect people’’, the agency added.

Increased bitcoin purchases from China and the adoption of the currency by Chinese online businesses were another driver that helped push the BTC/USD price from 195.5 at the start of November to a high of $1090 30 days later. Baidu, the biggest Chinese search engine started to offer payments in bitcoin. The chart below shows the remarkable November rally.

November rally

The silence of the Chinese authorities was seen as a subtle acceptance signal by market participants. The situation didn’t last long however. On December 7th, The People’s Bank of China barred financial institutions from buying or selling virtual currency or Bitcoin related products. The Bank also demanded that businesses stop with the practice of pricing their products in Bitcoins. BTC/USD opened the day at $906.50 on BTC-E. After the news hit the wires, bitcoin prices crashed from to a low of $551 in only 9 hours, a fall of 39%.

December 7th is marked with a yellow rectangle on the chart above. After a small dead cat bounce to $970 in the next few days, bitcoin prices resumed their decline. BTC/USD marked an interim low of $420 US dollars for one bitcoin on December 18th.

Increased Adoption and an Expanding Marketplace

At the start of 2012, one bitcoin was worth exactly $4.72. One year later a piece of the new currency could buy you a book on amazon ($13.51). On January 1st 2014, buying a single bitcoin would set you back $806.

With the 2008 financial crisis still fresh in people’s minds, most wrote off Bitcoin’s rising price as just another ‘’bubble’’. But what a lot of people failed to grasp is why the price is going up. While speculation and betting on higher prices certainly played their part in the process, a major reason behind the gains is very simple, increased adoption of the cryptocurrency.

According to BitPay, a Bitcoin Payment Service Provider, as of November 2013 there are over 14,000 merchants currently accepting bitcoins. Two years ago this number stood at few hundred. The number of transactions facilitated by Bitpay increased tenfold in 2014 and crossed the 50,000 mark in November. The payment processor said that 6,296 bitcoin transactions occurred on Black Friday last year, up from only 99 transactions the year prior.

Some of the notable adopters as of late include Richard Branson’s Virgin Galactic. You can now buy a private flight into space with your bitcoins. Zynga, the facebook games platform, offered the bitcoin payment option to players in “FarmVille 2”, “CastleVille” and other games. Major adult websites are also starting to accept the new currency as a means for payment.

All of these developments point to one thing. The Bitcoin marketplace is expanding at an astounding rate of growth. The businesses and individuals that embrace this new phenomenon will have a leg up over their competition going forward.

Usage in outlawed activities

The third biggest fundamental driver of bitcoin prices is the increased (or decreased) usage in activities outlawed by governments. Bitcoin’s pseudo anonymity has facilitated dealings in anything from the purchase of contraband like illegal drugs or weapons to bypassing capital and investment restrictions and tax avoidance. Government crackdown on these activities tends to suppress the price of bitcoin.

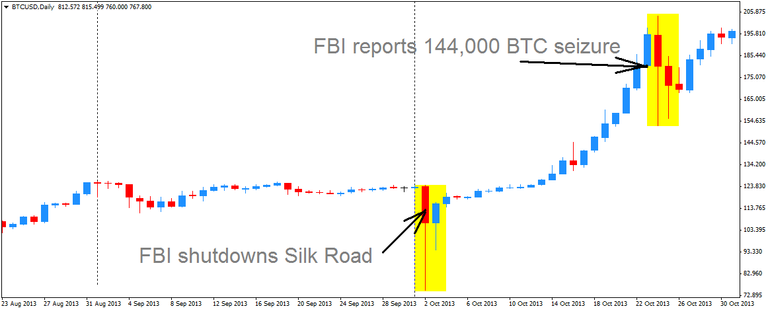

A notable example of this was FBI’s shutdown of the ‘’Silk Road’’ marketplace. The website had over 10,000 products for sale, 70% of which were drugs that are illegal in most countries. Around 340 different varieties of drugs were offered on the site. The site functioned as an ‘’Ebay for drugs’’, connecting buyers with sellers and not doing any dealing themselves.

The FBI shut down Silk Road on 2 October 2013. The alleged chief operator of the site, Ross William Ulbricht (also known as Dread Pirate Roberts) was charged with alleged murder for hire and narcotics trafficking violation. The agency confiscated over 26,000 bitcoins from different accounts on Silk Road, worth approximately 3.6 million US Dollars back then. Twenty days later, the FBI reported that they had seized 144,000 BTC thought to belong to Ulbricht.

The chart above shows the bitcoin market’s reaction to the website’s shutdown and the subsequent btc confiscation. Bitcoin prices plummeted from 123.95 to a low of 75.20 on the news. The market didn’t take long to recover however as most took the plunge as an opportunity to buy some cheap bitcoins. Prices were back to 118 two days later.

The second yellow rectangle on the charts marks the FBI’s announcement of the large btc confiscation. The prospect of an US law enforcement agency holding a large chunk of bitcoins spooked markets. The BTC/USD took a dive from 195.20 to a low of 152.49 on the news. But as can be seen on the chart, the spike lower was again used by investors to gabble up coins at a bargain.

It is interesting to note that a major bitcoin rally started right after the Silk Road shutdown, somewhat dispelling critics arguments that the virtual currency was mainly used as a tool for facilitating drug trafficking. In the months following the site’s closure, several major online and offline businesses started accepting bitcoins. These include major US retailers like Overstock.com and Tiger Direct. The CEO of Overstock.com reported that the company logged more than 800 purchases using Bitcoin on the first day they started offering the new payment solution, totalling $130,000. The company estimates that Bitcoin buyers have made $500,000 in purchases in the first 14 days since the new payment option was offered.

But what about the supply side?

Traders with experience in other commodity markets are probably asking themselves why the supply topic is placed last in an article that goes over the drivers of bitcoin prices. The reason is because when it comes to bitcoin, the supply doesn’t have much of an impact on the price. This is because the supply is constant and known beforehand and SHOULD therefore be already priced in. Situations like finding a huge oil field that significantly depresses oil prices is not possible with bitcoin. Let me explain.

The supply of bitcoins grows by the process called “mining” bitcoins. The supply is expected to increase by 10% in 2014 after going up 11.11% last year. The rate of block creation is 6 per hour with each block worth 25 bitcoins (around 25k USD). If more mining power goes online and the block generation increases to 7 blocks per hour for example, the so called “mining difficulty” will go up until the 6 blocks per hour average is reaffirmed. On the other hand if miners generate less coins then the difficulty will go down making it easier to generate new coins. You can read more about the supply of bitcoins here.

Wall Street Bitcoin Forecasts

With the mark of drug trafficking of the record, the new cryptocurrency was also starting to attract the attention of Wall Street. Wedbush Securities, a little known analyst firm put a forecast of around $98,500 on the price of one bitcoin. The analysts expect bitcoin to rise by 10 to 100 times its current value as the new technology partly replaces traditional payment processors and money transmitters. Bank of America Merrill Lynch wasn’t as optimistic in its forecasts. The Bank’s analysts predict a maximum ‘’fair’’ estimate of bitcoin of $1,300.

The Winklevoss twins told CNBC that a $400 Billion market cap for BTC would be a “small bull case scenario’’. With around 12 Million bitcoins currently in circulation, to reach that market cap one bitcoin has to be worth a fantastic $40,000. The brothers are major investors in bitcoin after getting rich from an early investment in Facebook.

The largest potential for ‘’disruption’’ to the current status quo lies in taking a chunk out of the payment processors market. Visa and MasterCard are estimated to take a 2 to 3 percent cut of every card transaction. By using bitcoin instead, merchants stand to improve their bottom line by at least 2 percent. In addition, because bitcoin transactions are irreversible, there is no possibility for chargebacks and fraud. This reduces the costs of operation by another several percentage points.

Another area ‘’ripe’’ for disruption is the money transfer market. The market is currently dominated by large players like Western Union and MoneyGram, WU for example can earn upwards of 10 percent per transaction on international remittances. By comparison, a bitcoin transaction shouldn’t cost more than 5 percent even after accounting for all exchange and bank wire fees for both the buyer and the seller on each side of the remittance. If no fiat currency is involved, sending and receiving bitcoins is almost free and costs 0.0001 btc regardless of the amount. This is around 9 cents at current btc prices.

Additional Bitcoin Resources

There are plenty of resources online where you can learn more about bitcoin and its unique properties. Here are some of the major websites that can help you speed up the learning process.

Weusecoins.com Provides simple instructions for setting up your first bitcoin wallet and purchasing bitcoins.

The Bitcoin Wiki. Plenty of articles on any bitcoin related topic that range from securing your wallet, dealing with scams, mining bitcoins, to a list of online and offline businesses that accept the new currency.

Bitcointalk.org The main bitcoin forum. Use it only after you’ve got the basics down by following the previous two links. Use this resource to ask questions about more advanced topics.

Bitcoincharts is the most popular website for following the current bitcoin price. The site provides a rundown of all major btc exchanges by volume. You can also arrange the markets to only display the Euro or the Japanese Yen versus bitcoin on the different exchanges. Like the name says, the website also offers charts with several popular technical indicators. The choice of timeframes ranges from 1 minute all the way to the Weekly TF. Plus, you get to see the current market depth at the different exchanges.

Bitcoinity.org Another popular charting resource, very similar to Bitcoincharts. Recently switched to mBTC pricing, 1 mBTC = 0.001 BTC. They still offer the option to display prices in BTC instead.

CoinDesk.com Coindesk provides daily news on bitcoin and other cryptocurrencies.

DC Magnates focuses on news about different digital currencies including bitcoin. It was launched by the same team from Forex Magnates, a popular forex industry news website that many of our forex readers are probably familiar with.

Places to spend your bitcoins

The following three sites provide an interactive map of bitcoin merchants near your area.

http://bitcoin.travel/

http://www.bitcoinmaps.org/

http://coinmap.org/

https://en.bitcoin.it/wiki/Trade Provides a long list of bitcoin merchants. The wiki page showcases different categories of businesses. You can find anything from major retailers like Overstock and Target to forex brokers accepting bitcoin deposits and bitcoin specific stock and options markets.

https://en.bitcoin.it/wiki/Category:Games Bitcoin’s pseudo anonymity helped trigger a revival in the games of chance industry. This wiki page provides a selection of places where you can gamble away your bitcoins. Includes card games, dice rolls, poker sites and online casinos.

Bitcoinstore.com One of the first websites to offer bitcoin purchases.

Gyft.com By using bitcoins to buy gift cards from Gyft.com you can get 3% back. The selection of gift cards incudes major retailers like Amazon, GameStop, Target, Wholefoods and a lot more.

Good article

Source: http://www.forexnews.com/bitcoin-trading/

Not indicating that the content you copy/paste is not your original work could be seen as plagiarism.

Some tips to share content and add value:

Repeated plagiarized posts are considered spam. Spam is discouraged by the community, and may result in action from the cheetah bot.

Creative Commons: If you are posting content under a Creative Commons license, please attribute and link according to the specific license. If you are posting content under CC0 or Public Domain please consider noting that at the end of your post.

If you are actually the original author, please do reply to let us know!

Thank You!