BitShares-Based SEC-Compliant Token & Exchange

@stan addressed concerns by the USG's SEC regarding how certain tokens may be obtained and traded. These include:

• Delist tokens deemed unregistered securities.

• Don’t charge fees for trading without a broker/dealer license.

• Don’t charge fees for ICOs based on a percentage of what is raised, equity in the company or any success fee without a broker/dealer license or working as an agent for a broker/dealer.

• Don’t allow trading of security tokens without an SEC exchange license.

• Complete KYC/AML on all members for anti-money laundering.

• Provide auditable transparency – Each exchange must be audited.

• Provide educational material on a regular basis in a clear, visible place on any exchange or ICO website or related app explaining the risks of trading tokens and the possibilities of fraud and loss of funds.

• Provide clear guidelines to members on best practices for avoiding & reporting theft or fraud.

• Provide member wallets and trading with a technically secure exchange.

"Embracing the TXSRB and SEC rules, regulations & laws will make the Stokens Exchange (powered by the BitShares Network) the first and most legally compliant way for a company to successfully secure funding without the chance of a shutdown, lawsuit or investigation. The Stokens Exchange is the future of crypto and it will be built on the BitShares blockchain.

"The new exchange licensed by Stokens, Inc. and called the Stokens Exchange (Stokens.com), will require KYC/AML for membership and only list tokens deemed legal by the SEC and other related global regulating bodies where members reside.

BitShares was designed to support this from the beginning. It must be the responsibility of the individual token issuers and exchanges that build on top of the BitShares platform to ensure that they are fully compliant."

Related Articles

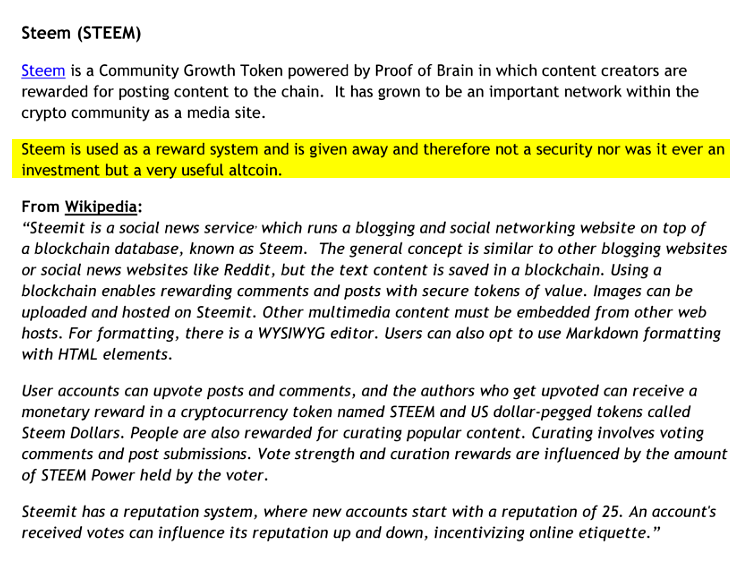

I am interested in hearing more of a discussion on this and how the SEC and government regulators plan on upsetting the balance in crypto - how they will determine an investment asset vs non - and what this means for people holding STEEM, SBD, BTS, EOS, and other UIA.

This is from page 22 of the Whitepaper

https://docsend.com/view/fz9txes