Earlier today I was quite surprised to see my bitUSD margin was called. I was hoping we were near the bottom, so I created $2,000 worth of bitUSD using 400,000 BTS as collateral. I had more than 11x in value in my margin and the wallet UI said the price would have to go to $0.008 before I'd get called. I figured I was totally safe. I was surprised to find my margin closed:

luke-stokes changed bitUSD debt by 2,000.0000 bitUSD and collateral by 400,000.00000 BTS

luke-stokes bought 45,959.64665 BTS at 0.0532 bitUSD/BTS for order #250689428

luke-stokes sold 39,109.91958 BTS at 0.0511 bitUSD/BTS for order #105680

Clearly, $0.0511 is not $0.008. I was under the impression everyone with a worse margin would get liquidated long before I would. I jumped into a couple Telegram groups to see if I could figure out what happened and then learned something new: Global Settlements

I've read this post twice, and I'm still trying to wrap me head around it: How Global Settlements work.

I've been around BitShares for a while and I've posted about it multiple times, as you can see here:

- My Altcoin Investments: A Steemit Story

- Playing in the Margins: bitUSD and BitShares on Open Ledger

- Reading the BitShares Whitepaper

- Questions from a BitShares Newbie

- A Simple Example of Shorting the U.S. Dollar With BitShares

- 9 Day bitUSD Loan Result: 19,821 BitShares and 199 ZAPPL for Free

- Are you Shorting Fiat Currency yet?

- I Got Margin Called on HERO Today. Things Don't Always Go Up.

- Do Cryptocurrency Speculators Fear Utility?

I had no idea Global Settlements were a thing.

After discussing it a bit with Alex M - clockwork in Telegram, I've come to understand a Global Settlement is a rather rare black swan type event where the debt represented by the bitUSD asset is so under collateralized that the whole system hits a trigger point and essentially calls everyone at the same price. Those who over collateralized (as I did) get the extra back. Some, I imagine, lost it all.

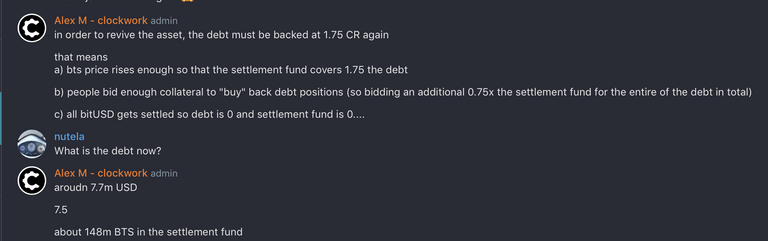

New bitUSD can't be created until the existing debt is backed by an appropriate value of BitShares as you can see in this message:

It seems this hasn't happed to the bitUSD asset since 2014. As I was digging around to try and learn more, including this idea of an auction that takes place on the remaining debt for the bitUSD still in circulation that is now controlled by the system... I noticed the staging wallet with the new auction feature I was looking at wasn't working anymore.

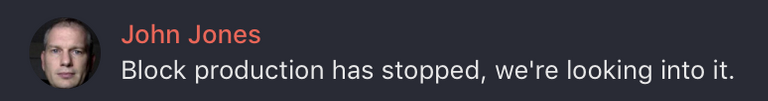

I started asking around and sure enough, the entire chain has frozen somewhere around block 32,599,932.

I don't have additional details at this time, but I did see this in the BitsharesDEX Telegram:

I don't know what that means, but instead of spreading FUD (Fear, Uncertainty, and Doubt), I wanted to put a quick post out there to say, yes, there was a very unlikely event known as a Global Settlement on the BitShares chain and, at this moment, the BitShares chain does appear to be down. The core developers are working on it, from what I understand.

As always, with stuff like this, I do not recommend making any trade moves. Wait and see what's going on before speculating one way or the other. BitShares is an amazing, pioneering platform way ahead of its time on many levels. Surely there will be growing pains and things will break and get fixed (as happened back in July 2017). I'll keep an eye on things and provide updates as I hear about them.

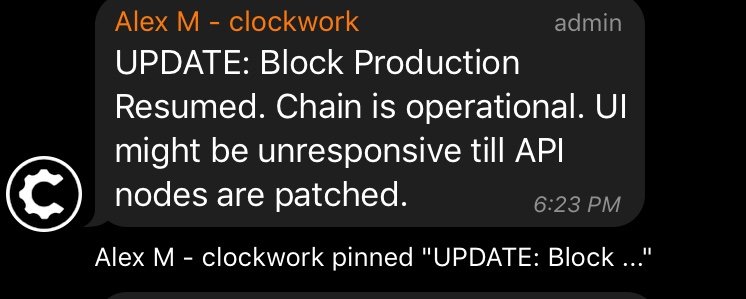

UPDATE: seems block production is back up, but api nodes are still being patched:

UPDATE 2: I was digging around for more information on how the Global Settlement works and how we can recover from it and found this post from 10 months ago by @haruka: Detailed mechanism of global settlement (black swan) and reviving of bitAssets

Luke Stokes is a father, husband, programmer, STEEM witness, DAC launcher, and voluntaryist who wants to help create a world we all want to live in. Learn about cryptocurrency at UnderstandingBlockchainFreedom.com

I've always thought the global settlement mechanism was flawed. Because those with the least collateral should be forced settled long before the responsible ones are at risk. And that clearly didn't happen.

To me, the trigger that brought the system down started many months ago when the bots took over the market.

For a long time I was wondering which person in their right mind would sell bts under the margin call price.

And it was true: no person did, only bots.

It was revealed in one of the new block explorers that only bots were trading at the ridiculous prices.

So with these new bots almost no margin calls were getting bought for many, many months.

Until suddenly some months ago somebody bought a huge chunk of bts and I finally got margin called at 0.12usd. I was quite sad but now it almost feels lucky.

Because after that the bots rushed in and drove the price down even further.

So I think it's important to rethink the whole global settlement mechanism to protect against bot speculation.

Because it also makes the system vulnerable if somebody intentionally wanted to crash the price of bts.

Anyway I'm sorry for all the responsible investors who lost money. I still believe in bitshares and hope the system recovers strongly from this.

Interesting point, thank you. I’ve yet to see a way to effectively remove bots. They are a part of our ecosystem, regardless of how we feel about them. Also, one of BitShares biggest adoption challenges is lack of liquidity. If bots can bring that, that’s a good thing. Maybe we just need smarter bots.

I agree, bots are not necessarily bad. I just noticed the pattern that they weren't really market making.

They just kept underbidding each other and everyone else no matter the price. So I've tried to tell all the bot makers on steemit to take that into consideration when programming. Because obviously market makers are great for liquidity as you mention.

I also got settled on my BitUSD yesterday. Although my collateral ratio was much lower, but I had just paid on the debt to keep it above 2.25... Disappointing. Hopefully with prices seeming to stabilize we can move on and grow from this. Still hurts though :(

Yeah, definitely still hurts. I wonder if/when it will be active again. And even then, I wonder who will trust it. If my margin can get called by other reckless speculators, no matter what my own capitalization is... well, that's pretty crappy.

At the same time, I understand the need to prevent black swan events that could otherwise crash the value of the whole system.

take a look at my posts since January..sorry I didn't save you from a horrible mistake and listening to horrible advice. I might be able to help in the future.

I think that is a typical risk of the DPos system where you have the main currency BTS as a collateral to create Debt like BitUSD. With Steem we had the same issue with SBD two weeks ago when the Peg to 1$ broke. And now the debt ratio between BTS and BitUSD is broken because the price of BTS went to fast down and on the way down was too much Debt BitUSD created.

The Global Settlement is also new to me and sounds pretty scary...what does it mean all collateral positions got closed??? I guess a lot of Users will have closed them with huge losses in this market. It almost sounds like a catastrophic event for anyone who was leveraged in this market.

Looking forward to further News on this!

Yeah, all positions got closed and now there's $7.5M worth of debt controlled by the system and locked at the $0.0511 conversion rate. If the value of BTS goes back up, it may turn on again, but for now there's no way to create more bitUSD.

At least the blockchain is back up and running again.

Ouch, at least you got something back. I suggest those interested in stablecoins to look at Maker and dai, it operates on ethereum and has been stable through this whole bear market, working smoothly the whole time.

Yeah, I should give it another look. I’m spoiled now though. I don’t like using chains which may get overloaded or whose mining fees may go through the roof.

That I understand, usually eth transactions go through in few mins though at max and considering the amounts you're dealing with, I'd prefer the safety of the system over little waiting and a small fee over a surprise like this (global settlement).

This bear market has been a perfect battle test for stablecoins, and Dai has proven itself in the harshest of conditions, as the system came online just before the end of bull market and eth has seen 90% drop in price since, that's why I'm recommending it for anyone wanting to have some and it's also decentralized which is a big plus for many.

But currently you can only use eth as collateral, that will change over time though. The system itself is simple for the end user, you just need to make sure your collateral value stays over 150% of Dai drawn at all times. If it goes lower, the system will automatically take its cut and return the remaining collateral back to you.

There's currently 60 million of Dai in existence but since it's still in beta, it's not on any major exchanges, that'll change in about 4 months.

Cool. Thanks for the detailed response. Definitely worth checking out.

Good to see that you only paid the 100% value of the $2000 bitUSD instead of throwing 1100% into the settlement pool though, plus those who lost it all are those who undercollateralized bitUSD itself plus they didn't lose any more than you did. Right?

I think I lost about $75 but that has more to do with the prices I bought and sold at. But yes, the goal with force settlement as far as I understand it is for everyone to pay the same price.

Crazy the whole chain in down, I was wondering why I couldn’t log into BitShares just now. Thanks for the info

I think it's back up now.

yeah it's back online, fast response from the devs, block producers and full node operators 👍

I don't really understand ... Weird

Highly rEsteemed!

Yep...an unwelcomed surprise for sure. Am slightly concerned the blockchain isn't working.

It's back up now.

Will be interesting to see how and if this will impact the prices further once it is up and working again which would be interrsting given how intriguing the price is already. This is the risk of leveraging up any asset although it seems that collateral should have been enough to support the asset.

Posted using Partiko iOS

Yeah, should have been is the key. From what I understand, the system triggers this black swan response when the price drops so quickly that there's a risk of the value in collateral not matching what is created as debt. That would be a real problem so to prevent then, everyone gets liquidated and all the debt is locked into one place at a set price.

Thanks for the update!

So sad the market advice of a professional was not heeded in January. Anything parabolic will ultimately come down as hard as it went up. You haven't a clue where the bottom is no more than understanding a "top". It is the knowledge of sentiment and "mass psychology". A tough lesson to learn learn indeed....you must KNOW market history.

While I agree, the same patterns happened many times before, like when BTC goes from $0.01 to $1.00 or from $1 to $30 or $130, etc, etc.

No one has a clue, but everyone's guesses eventually turn into reality.

I’m also curious about where they are auctioning the debted bitUSD. I was searching on the DEX but can’t find where you mentioned they are auctioning it.

I saw it in the chat and on a staging version of the DEX. You can do it from the command line interface as well.

Good advice that reaches beyond the scope of this post. Glad to hear voices that are tuned into reason and far-focus instead of FUD.