What is BitShares?

BitShares (symbol BTS), formerly known as ProtoShares (PTS), is an industrial grade “crypto-equity”, peer to peer distributed ledger and network based on a Delegated Proof of Stake (DPS) algorithm. It was created in 2014 by visionary Dan Larimer (“Bytemaster”), co-founder of Steemit, EOS and Cryptonomex.

BitShares is based on Graphene, an open source C++ blockchain implementation, which acts as a consensus mechanism. Graphene is used by several other projects like Steemit.com (decentralized Reddit, blog platform), and PeerPlays.com (gaming site and token PPY) indicating real-world usage.

BitShares operates more as an equity rather than a purist “currency” since BTS tokens are used as collateral for a variety of decentralized financial services like smart contracts, decentralized exchanges, banking, derivative creation (of market pegged “bitAssets”) and currency rails.

BitShares Technical Details

Consensus algorithm: Delegated Proof of Stake DPOS

Block time: 1.5-second average, 3 sec max, ~1.5 sec latency for 99.9% irreversibility certainty

Block reward: 1 BTS (from Reserve Pool)

Irreversible blocks: (2 * BLOCK_INTERVAL * WITNESSES / 3) ~ 34s

Coins not in reserve fund: 2,599,900,000 BTS (2017 Sept 30)

Coins in reserve fund: 1,000,668,097 BTS (2017 Sept 30)

Maximum Coins: 3,600,570,502 (constant)

Maximum Transactions Per Second: 100,000+ potential (proven 3,400+ tx/s)

Noteworthy is the lightning fast blockchain with 1.5 second average block times and throughput potential of 100,000 transactions per second (which is more than all the credit card transactions worldwide combined).

BitShares management is controlled by a Decentralized Autonomous Company (DAC), a framework which allows BitShares holders to contribute and ultimately decide on the future direction of BTS. This DAC operates independently but in tandem with the original open source code base that is developed and tweaked continuously.

Your wallet address is your username

This is way better than long cumbersome strings of letters and numbers which is just asking for bad user experience and errors. Your username acts as your wallet address (like your social media or google login). It’s much easier to remember and type “john-smith” then 21x9d8sv37sd6m282u4j2hg9h4orbjht2u98f3.

BitShares Financial Service Offerings

BitShares competes with banks by issuing collateralizing market-pegged and stable bitAssets (also called smart coins)

This means crypto-based assets track real-world market assets like the US dollar denominated “bitAsset” known as bitUSD. This tracks the movements of the dollar by aggregating a variety of data sources that are maintained by the BitShares community.

This Smart Coin token always has at least 200% (or more) of its value backed by the BitShares core currency (BTS), to which it can be converted at any time, as collateral in a smart-contract based loan managed by the blockchain.

What makes this platform unique is that it’s free from counterparty risk yet still has a loan backed by collateral. This is achieved by allowing the network (and software protocol) to secure collateral and perform settlements.

The goal of price stable smart coins (bitAssets):

- A predictable stable price with reduced volatility

- A relatively reliable solution to predict the future value of a token

- A unit of account distinct from assets with capital gains or losses (which has increased tax liability)

- Hedging against volatile Cryptocurrency markets and price action

A BitShares market-pegged asset (MPA) can be viewed as a contract between an asset buyer seeking price stability and a short seller seeking greater exposure to BTS price movement.

BitShares as a Lender

BitShares offers the capability to loan your BTS holdings with customizable reserve levels (a minimum of 200%, reaching as high as 1000 or even 2000%+ reserves). BitShares integrates with any stock, commodity or currency pair provided there are price feeds available. In addition, bitAssets including bitGold, bitSilver, bitOil and other crypto focused commodity pairings can also exist in this construct.

It’s a working, dynamic “smart” economy which adjusts to the needs of the market. To help preserve price stability, large collateralized loans (10-20x) can be created allowing loans to last almost indefinitely.

Decentralized Exchanges (DEX)

Traditional exchanges create counterparty risk as receivers of fiat and issuers of IOUs

Typically with exchanges, there’s a clearinghouse required to facilitate buyers and sellers. While providing a needed service for the market, there is room for improvement as centralized management is a constant security risk.

Exchanges have withdrawal limits and other regulatory restrictions which can include furnishing various forms of identifications, utility bills and other documentation to be onboarded.

How Traditional Cryptocurrency Exchanges Operate:

- Receive cryptocurrency and fiat issuing IOUs in its place

- Redeem and allow exchange of IOUs

- Process the order book

Problems and Risks

Sounds great, but what about the downfalls? There’s always something…

The collateral risk of a “black swan event” (sudden crash in value)

Market pegged assets track the price of real assets through a crypto derivative that’s backed by collateral with established market value. Ultimately all bitAssets are denominated and collateralized by BitShares (BTS). This token is not immune from price action including drastic drops in value.

Although there’s a built-in construct to trigger margin calls (selling out positions to cover original principal), it’s isn’t foolproof. The biggest risk is the value drops too quickly and collateral can no longer purchase the asset. Sort of like if a home drops in value below the total loan due to a market downturn.

While the total market capitalization of Cryptocurrency has overwhelmingly increased exponentially to date, that has not been without a long bumpy ride. This Black Swan event would greatly erode confidence in the system and disrupt the ability to conduct a safe transaction (such as a loan), especially on a large scale.

People and businesses (banks even more so) are sensitive about their money so it must work flawlessly. This is still all very experimental technology, which is probably scary for “big money people”.

Final Thoughts

Ultimately, BitShares leads the pack with exemplary thinking and architecture

Just to recap the main ideas covered:

BitShares is a decentralized network, protocol and industrial grade platform – Based on a Delegated Proof of Stake (DPoS) algorithm and Graphene (Steemit’s backend engine) with the potential to handle 100,000+ transactions per second.

BitShares offers a variety of decentralized financial services – Issuing smart coin bitAssets including Market Pegged Assets (MPA) and other crypto derived pairs from recognized commoditized assets (e.g. Gold, Oil, S&P 500)

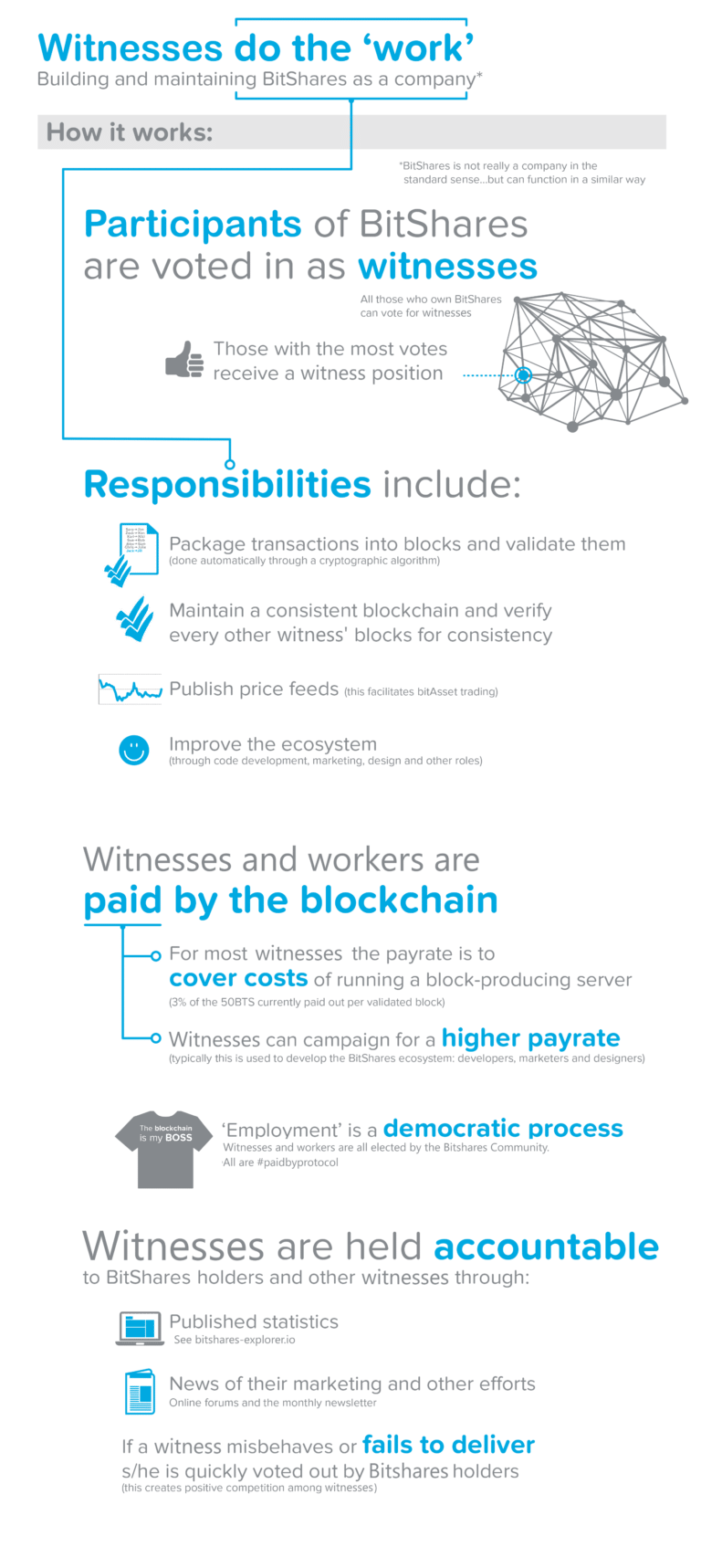

The Delegated Proof of Stake (DPoS) algorithm adds a governance layer – Building on the traditional Proof of Stake model which increases and produces coins based on holding.

Source Link: https://coincentral.com/what-is-bitshares/

Copying/Pasting full texts without adding anything original is frowned upon by the community.

Some tips to share content and add value:

Repeated copy/paste posts could be considered spam. Spam is discouraged by the community, and may result in action from the cheetah bot.

If you are actually the original author, please do reply to let us know!

Thank You!

More Info: Abuse Guide - 2017.

Hi man... Interesting article... I have been Wonder inglés if you could upvote my article as well... Thanks

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://coincentral.com/what-is-bitshares/

Hi ~ I'm a robot of Januschoi.I just upvoted your post!

Please also help upvote my post here: https://steemit.com/cn/@januschoi/6jlsyu

Thanks so much~!!

This excellent post truly has all of the info I wanted concerning this subject and didn’t know who to ask. There's definately a lot to know about this issue. I really like all the points you made.

Good write up. Thanks for helping spread the word!