The plan was to just see what they offer, out of curiosity.

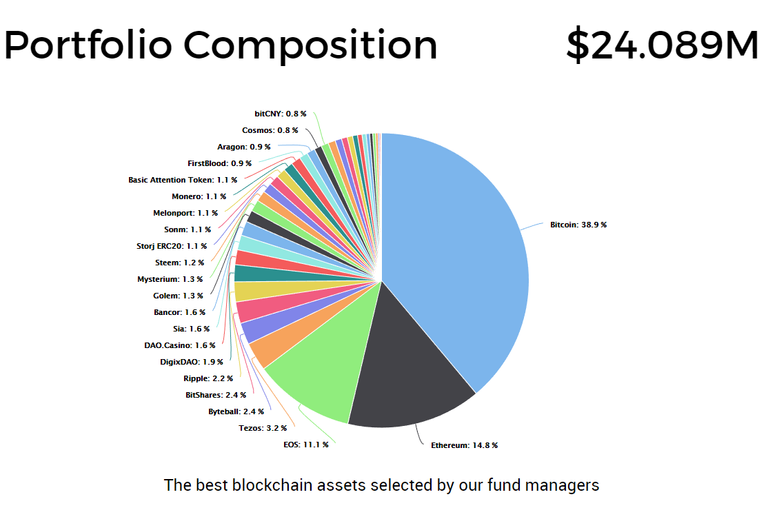

But then I learned that they offer the open end managed crypto fund ON BITSHARES

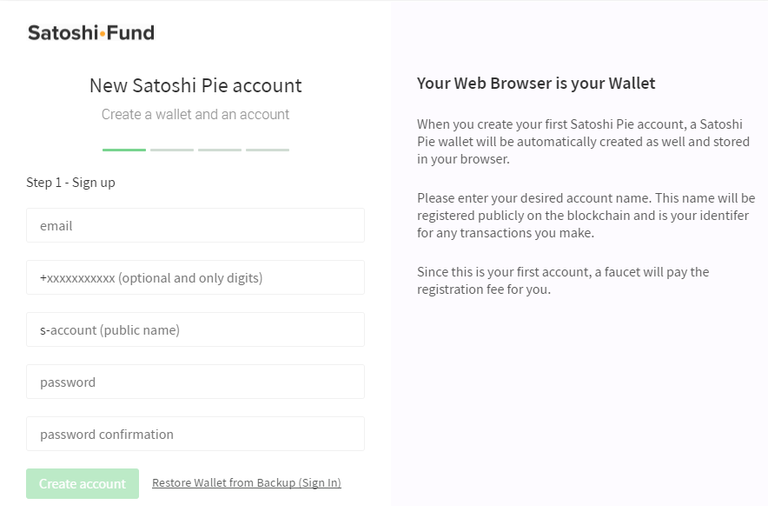

Sign-Up

Registration is as consumer friendly as it can be in current BitShares Wallet.

- Click Here to Sign-Up (

Invest Now) - Enter E-Mail, user name and Password

- Backup Brain Key (important)

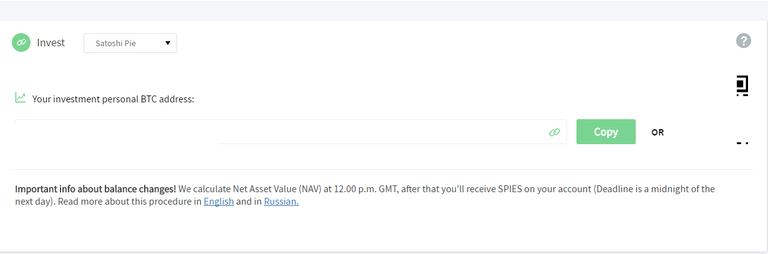

Investing

The GUI is so simple and amazingly end user friendly. You literally just need to send Bitcoin, and 24 hours later you will receive SPIES Shares based on Coinmarketcap NAV (Net Asset Value)

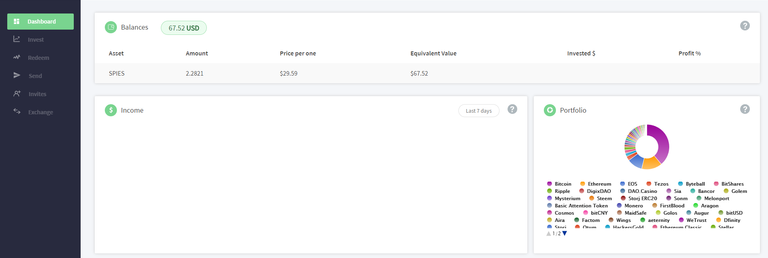

Dashboard

It's clean, and shows every data possible.

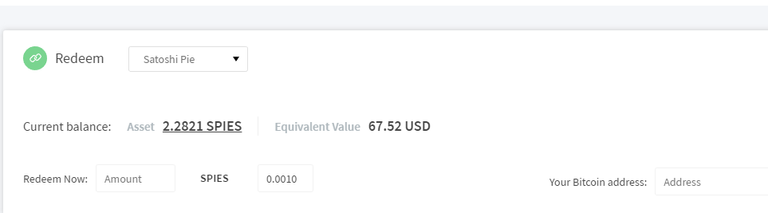

Exit

Just select Redeem and enter your Bitcoin address, you'll receive Bitcoin based on NAV (same as Investing).

You're free to move SPIES to your regular BitShares account, and you can trade them on their DEX Market, obviously.

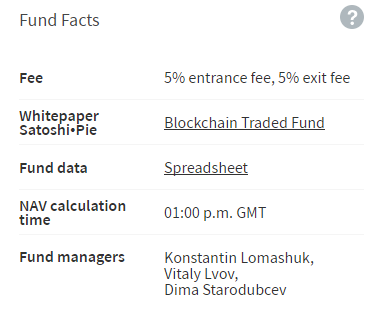

Fees

The slice of the pie comes at a price.

Entrance Fee: 5%

Exit Fee: 5%

so investing goal should be long term.

This may sound expensive, but it's still much cheaper than conventional Managed Funds or Prism.

Conclusion

This is the prime example for a specific and tailored product on BitShares DEX. It's very consumer friendly, and requires very limited knowledge of BitShares.

New users won't even notice the Blockchain!

Buy and Sell Steem & Steem Dollar at best rates!

Blog: FAVS dot PW

Contact: btsfav @ twitter

Steem: ash @ steem ─ Steemit How-To's

why should I trust my money with a fund that the only option it provides to withdraw the funds is through its frontend gui? What happens if that server is no longer online?

Do you keep or save the private keys?

then you can sell the shares on the market

How? If I can't access site and there is no other wallet that supports this token?

it's running on bitshares, you can just use the wallet seed you get on registration and restore account on any other available bitshares wallet

Thanks!

interesting fund. will check it out.

You could also check out the bittwenty asset by @estefantt

http://cryptofresh.com/a/BTWTY

No 2 x 5% fees but it is trading way above marketprice :/

Long term horizon needed

Major differences. Bit20 does not hold actual assets.

Thanks! BitShares - the sixth best blockchain asset in this portfolio...right? And EOS already on a 3th place.

Hmmm. 5% is way too much imo. Cool to know though.

I'll check this out. I hope I can understand a thing since I'm a newbie lol By the way I would highly appreciate If you can take time to visit my Introduction Looking Forward To Meeting New Friends Lemme know your thoughts. :)

Thank you so much for this great discovery. I will follow you because I like to discover new applications like this one.

It definitely looks like it's worth checking out. Thanks.

that does look interesting, checking it out. thanks! :)

Thanks for sharing. ...> followed n upvoted

Am definitely looking into this. Thank you for sharing.

Looks promising, might check it out.

Is it really so simple?

It's interesting, but as @unprovoked already stated 5% is too much, particularly since it's charged for both entry and exit. IMHO, there should be no entry fee as that will encourage investment, and even if that was the case 5% is still way too much for an exit fee.

My intuition leads me to the conclusion that a 0% entry fee and a lower exit fee would actually earn the fund operators more money through volume. Even if I was looking for a more conservative investment (if one can call any investment in cryptodom conservative), that fee structure would be an absolute deal-breaker.

Are there any performance or ongoing fees, or is the only way the fund makes money is on entry and exit fees?

If you buy the fund on market, would you avoid the entry and exit fees (since you are trading peer to peer, rather than with the fund?

none that I'm aware of. the fees are pretty clear

yes

I think the interests of investor and fund manager would be more closely aligned if the entry and exits fees were around the cost of the administration involved (and slippage caused by entries and exits), and the fund manager made money if they invested well.

I'm never a fan of percentage based fees on capital that are not linked to investment returns.

Thanks for sharing that information,very handy to know.

Prism eh what?